How to go for a foreign vacation every 3 years?

Walk-through: Get the SIP amount for recurring goals like a dream vacation every few years

Walk-through: Get the SIP amount for recurring goals like a dream vacation every few years

We have already covered

This post will deal with a recurring goal like going for a foreign vacation every three years throughout your life (for the next 30 years).

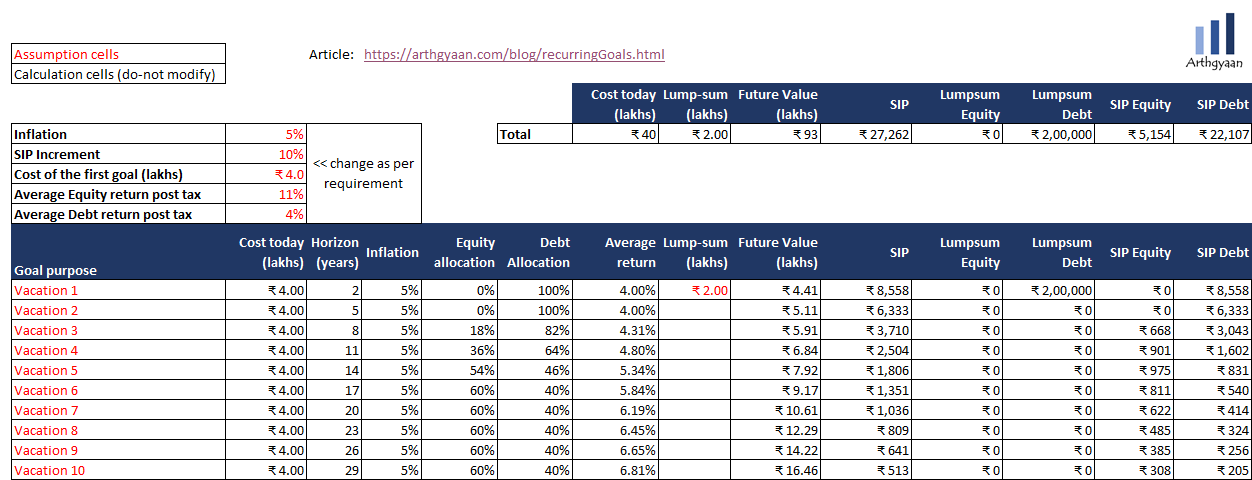

Assume that the goal amount is 4 lakhs (as per today’s cost) every 3 years for the next 30 years starting 2 years from now. So this is a plan for 10 vacations using the same framework followed for multiple goals with constant inflation of say 5%. We should keep in mind that inflation for vacations can be unpredictable due to how fuel prices, demand at various tourism locations and other factors play out.

Assume 2 lakhs is available today which is allocated to the first year’s vacation.

These are essentially 10 single payment goals:

Using the single goal model the following SIP amounts are determined and the totals are added up as shown:

The 40 lakhs initial cost of the 10 trips are expected to be around 93 lakhs over the next 30 years. The initial lump sum amount is allocated to the first trip since that will happen first. A single set of SIPs are created: equity 5154 and debt 22107 along with one lump sum investment in debt of 2 lakhs as per asset allocation. Refer to these posts for investing in equity and debt funds.

These calculations are explained in this Google Sheets workbook.

The following needs to be done in this order:

See this detailed post for the process for reviewing.

At all times ensure that you have the following in place

Please see below:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to go for a foreign vacation every 3 years? first appeared on 26 Jun 2021 at https://arthgyaan.com