How much equity should you have in your retirement portfolio?

This article shows you an easy way to calculate the equity allocation for your retirement corpus.

This article shows you an easy way to calculate the equity allocation for your retirement corpus.

“nastiest, hardest problem in finance.” - William Sharpe, Nobel Prize winner, regarding the withdrawal stage of retirement

If you have spent some time in mutual fund portals trying to screen funds, you would have come across the Sharpe ratio. Likewise, if you have spent time analysing the returns expected from a stock or a mutual fund, you would have come across the Capital Asset Pricing Model (CAPM). Both of these are contributions of Professor Sharpe to the field of finance and investment management.

Professor Sharpe’s quote above emphasises the difficulty of constructing a retirement portfolio. This is due to the following risks:

Secure your own oxygen mask first before assisting others - Flight attendants everywhere

We will get this out of the way first. Many parents will exhaust their life savings in providing the best possible college education and marriage expenses for their children. While the intentions here are faultless, this also means that once retirement starts, these same parents decide or end up in a situation where they are heavily dependent financially on their children. While children voluntarily taking care of their parents is highly desirable, you should not expect that since you spent your retirement corpus giving them an expensive education, they better take care of you financially post-retirement.

Expensive marriage ceremonies that take a large chunk out of retirement savings is again not prudent. We have dealt with a few alternatives in the past in this post: Do you need to pay for children’s education or marriage?.

A lot of ink, spreadsheets and sweat/tears has gone into constructing Safe Withdrawal Rate (SWR) models for retirement.

SWR = the percentage of your portfolio that you withdraw in Year 1 of retirement and then increase that amount by inflation every year

The retiree hopes that while doing this, paired with annual portfolio rebalancing, the assets will last throughout retirement.

A well-known example of SWR is the 4% rule which says that if you have a corpus of 25x your target year one annual expense as retirement corpus, then you can expect the corpus to last for 30 years.

An example to make this clear is shown below.

Once you figure out your expenses in retirement/FIRE and say that comes to ₹6L/year or ₹50,000/month, you can retire if you have 25 * 6 = 1.5 crores as retirement corpus. Since 4% of 1.5 crores = 6L, that’s how the name comes. Adherents of the 4% rule should keep in mind that:

Famous financial author Willian Bernstein in his 2009 book “The Investor’s Manifesto” talks about the following modifications to the 4% rule:

However, you will not reach this state of targeting a lower than 4% SWR unless you start investing without delay, stay on track in your 30s, 40s and 50s and have the proper asset allocation for your retirement portfolio. We tackle the second point, the right asset-allocationn for your retirement portfolio, in the rest of this post.

The above sections should give the reader an overview of the complexities, sensitivities, and native urgency required to get started with the right kind of assets in the right proportion and amount for the retirement portfolio. This urgency is warranted, especially due to the number of myths and thumb rules like equity allocation should be 100-age rampant in the retirement planning community.

A typical retirement myth that we wish to debunk early is that the proportion of equity as an asset class should be low in retirement. This misconception comes from the belief that since equity is risky and retirees cannot take too much risk, the proportion of equity in the retirement portfolio should reduce as retirement comes close and should not increase. However, as we see below, the proportion of equity in the retirement portfolio behaves differently compared to intuition.

There is nothing special or must-have as far as equity is concerned for a retirement portfolio. You can retire without having any equity exposure at all, but the lifestyle may not be what you are expecting to have: Can you retire by keeping money only in FD or pension?

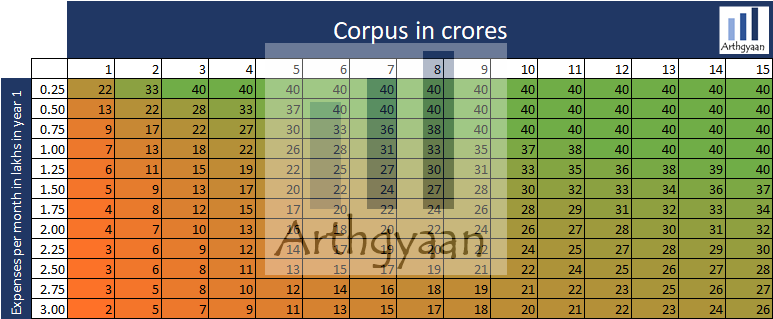

Here are some sensitivities between corpus in crores and the number of years in retirement it can support with multiple levels of monthly income with 100% in debt investments:

The table shows that a debt portfolio of 3 crores will last just 18 years or less (i.e. till mid-70s starting at 58) if required to support a lifestyle of ₹1 lakh/month, growing with inflation. If you need the portfolio to last longer, you need equity allocation. This is due to inflation.

At just 7% inflation, the cost of goods and services doubles in 10 years and quadruples in 20. If you have a pension scheme that gives you ₹1 lakh/month today, you will be able to buy only ₹50,000/month worth of stuff after ten years and ₹25,000 worth in 20. Many retirees have no option but to shift in with their children in their 70s due to this issue.

A caveat: there is no guarantee that equity allocation in a retirement portfolio will give the desired returns. It is just that based on historical data, equity is one of the asset classes, along with managed real estate, to produce inflation-beating returns.

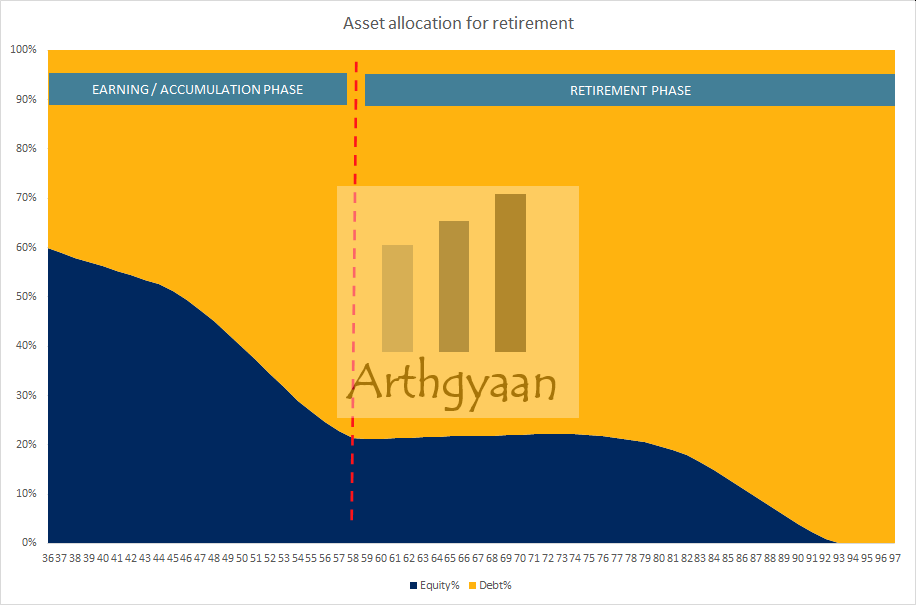

The diagram shows the asset allocation over time for a hypothetical portfolio of a 36-year-old retiring at the age of 58. The portfolio is constructed as per the steps in this post: How do you get the SIP amount for retirement?.

We can see that the allocation to equity drops steadily over time as retirement approaches. However, as soon as retirement starts, it remains steady and even goes up for some time. This observation, which is counterintuitive, is due to the requirement of beating the sequence of returns risk. The reason the glide path of the equity is increasing in retirement is that the further years are being funded by higher equity allocation (or conversely the closer years have a higher debt allocation) as described in this post: How does the sequence of return risk affect your goals?.

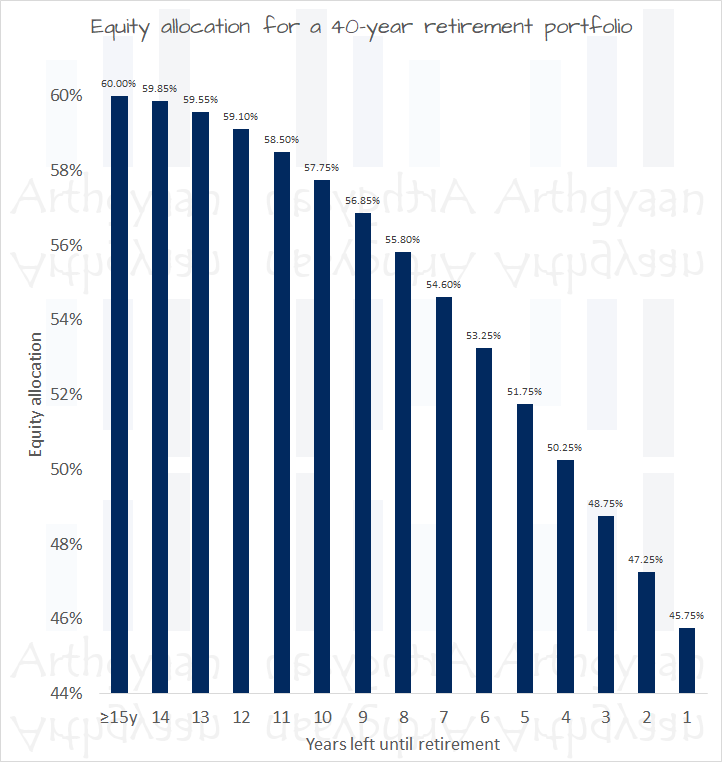

This chart shows the sample asset allocation based on time left in retirement plotted against the equity allocation of the portfolio. We have assumed that each year in retirement is modeled as a 60:40 portfolio as explained here: How do you get the SIP amount for retirement?.

This article will show you various return-vs-risk tradeoffs of model portfolios in the Indian market: Portfolio allocation models for Indian investors.

Estimating the lifetime real returns from the retirement corpus is a tricky concept. We need to model the expected returns from both equity and debt over multiple decades. The return is estimated over the entire investing period for retirement, i.e. the accumulation stage to the drawdown stage during retirement.

If you construct the retirement portfolio based on the concept of goal-based investing, the real return for the portfolio will be zero or slightly negative. Read more: How much returns should you expect from your retirement portfolio?

The entire retirement corpus is not spent in the first year of retirement. Don’t create your portfolio as if it is - Author

This quote is the fundamental basis of retirement portfolio construction. The actual asset allocation will depend on a case-to-case basis and there are no generalized formulas to know it before hand. To know your equity allocation for retirement as of this moment, please follow as per the cases below.

We model each year’s expense in retirement as a single goal as apply goal-based investing principles to it. For example, if you are planning a 40-year retirement, you will have 40 such goals, one of each year in retirement. Each goal will have its own asset allocation, rebalancing plan and glide-path. While this sounds complex, investors may use either the simple goal-based calculator or the more comprehensive Google sheets based tool to manage their retirement portfolio easily.

Read more here: How do you get the SIP amount for retirement?

We are not a proponent of the Safe Withdrawal Rate (SWR) approach for managing the retirement corpus. We believe that SWR leaves too many things to chance and cannot be demonstrated to work for India for long durations due to a lack of data.

Instead, we use a modified version of the bucket theory of portfolio construction by creating 3 buckets: cash, debt and equity for each year in the retirement stage. We believe that applying goal-based investing and risk management via an appropriate glide-path per goal of yearly expenses maximises the chances of completing the retirement stage.

You can follow the steps in this article to construct your post-retirement portfolio: How to plan for retirement using the bucket approach?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much equity should you have in your retirement portfolio? first appeared on 10 Apr 2022 at https://arthgyaan.com