Asset allocation by age: How much equity should you have at various ages?

This post will answer the frequently asked question for many investors regarding the proportion of equity they need to hold as per age.

This post will answer the frequently asked question for many investors regarding the proportion of equity they need to hold as per age.

Age vs equity percentage in the portfolio is a common question because as age increases, retirement comes closer, and risk-taking ability reduces. But, like all generalisations, this requires careful understanding of when it is accurate and when it is not.

If we flip the question and ask if equity is necessary for retirement, we will conclude (see this post for details) that you need a very high corpus and relatively low cost of living to live off retirement using only debt investments.

This post will check the efficacy of the 100-age thumb rule and determine if it is usable for investors. The law says that asset allocation of the investor’s portfolio should depend on the investor’s age, and equity proportion should be 100-age in percentage terms.

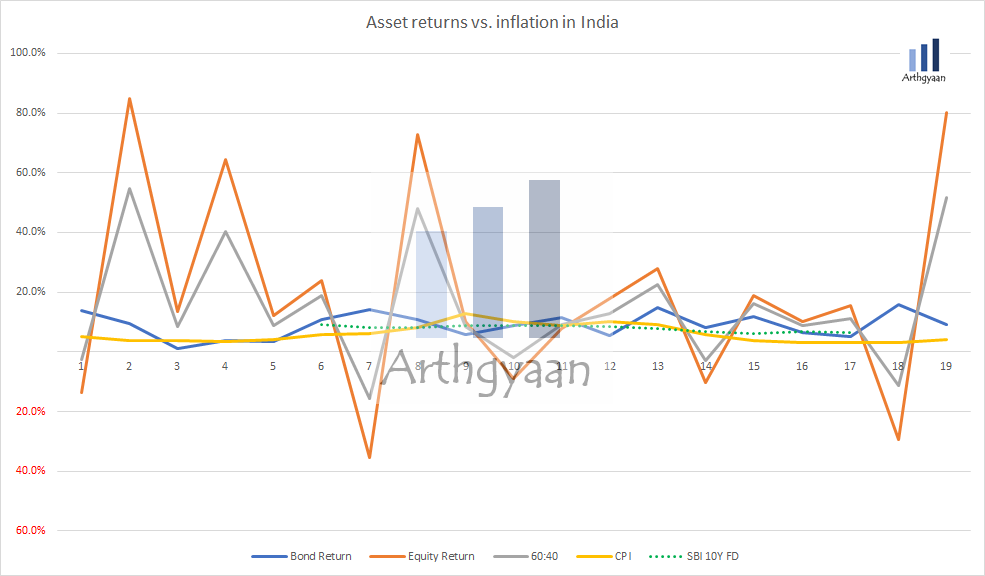

Using data from 2002, we see that while equity and debt returns fluctuate a lot, a 60:40 ratio of equity and debt has beaten inflation historically in India. As India matures as an economy, both interest rates and inflation is expected to reduce. However, the relationship between inflation and equity or debt returns is likely to remain as:

Inflation: the impact on your goals and how to choose assets that beat it

These two conservative assumptions will set a lower bound on the portfolio returns assumed for all goals. If the market gives higher returns, especially for the debt component, the investor will benefit without depending on the high returns assumption in the beginning.

We will make the case here as to why you need equity in the first place in the portfolio for a long term goal. Examples of long term goals:

The last example needs a bit of clarification. Say you retire at 55, and your longevity is up to the age of 90. Money that you need from age 70 to 90 are goals that are 15 to 35 years away, making them long term goals. Beating inflation is the reason even a retirement portfolio needs equity allocation. We have covered retirement portfolio construction in this post.

The rationale of including equity in the portfolio is to support withdrawals in the period when income is not there. Therefore, the percentage allocation to equity will depend on the number of years in retirement and the lifestyle that needs to be supported. In the pre-retirement stage, the percentage depends on the accumulated corpus and the investible surplus available every month.

The asset allocation of a goal depends on

The asset allocation for retirement goals depends on

The thumb rule is a piece of general advice available almost everywhere. It requires that as you age, your portfolio needs to become more and more conservative. This advice is straightforward to implement. For example, a 30-year-old should have a 70% equity allocation while a 60-year-old should have 40% equity and so on. Of the assumptions in the previous sections (goal amount, horizon, current savings etc.), we use only one variable, i.e. age, to determine the asset allocation. This formulation obviously oversimplifies the calculation, and we will see below if that is good enough.

The rule is better than the extreme cases where investors have investments either mostly in debt (since they are not investing as per goals) or near to 100% in equity (typically during a bull run).

The rule has built-in rebalancing since every year, as age increases, the portfolio becomes more and more conservative as the equity allocation reduces.

Since there is a single portfolio for all the goals, this is an example of a unified portfolio. Readers should read about unified portfolios in more detail in this post. 100 - age is a particular case of “Case 1: Simple unified portfolio with fixed asset allocation” where instead of keeping the allocation fixed, we reduce it over time. For example, for a 45-year-old, the portfolio has 55% in equity and 45% in debt assets. This allocation implies that the same risk profile is associated with each year in retirement, whether at the beginning, middle, or end.

We will follow the same methodology as our post on unified portfolios and the same data set for comparing the results. We calculate for the following four cases:

We have chosen cases 3 and 4 based on recent modifications to the rule based on rising life expectancies.

In each case, we will rebalance yearly. The 30-year-old investor will be investing ₹ 3.5 lakhs/year for 30 years with a 10% increase in investments every year. After 30 years, new cash investments will stop, and they will draw down the portfolio for a retirement period of 40 years. The lifestyle in retirement will be the same as five lakhs/year in today’s money and will be adjusted by inflation at 7% throughout 70 years.

We define the following parameters to compare the results:

The ideal risk-management approach combines a high success rate with a not very low value of the worst 5% metric with a non-negative median of ending portfolio value. A non-negative median implies at least half the ending values are more than 0, i.e. success rate is more than 50%.

| Cases | Success | Median | Worst 5% |

|---|---|---|---|

| Case 1: Rebalanced/Simple 60:40 | 73% | 9,942 | -14,177 |

| Case 2: Rebalanced/100-age | 19% | -4,006 | -11,251 |

| Case 3: Rebalanced/110-age | 50% | -121 | -11,359 |

| Case 4: Rebalanced/120-age | 70% | 5,138 | -11,421 |

As we see above, the first case is terrible in the 27% cases it fails to last through retirement with a high worst-case loss figure. We see that the results become progressively better (see Success column) as the overall allocation to equity increases since 120-age always allocates 20% more in equity than 100-age. However, the increase in equity allocation is a double-edged sword since both risks of loss and the potential for higher returns increases. Additionally, the worst 5% cases are marginally better but uniformly abysmal irrespective of the starting allocation chosen.

These results show that 100-age and its variations are unsuitable. The alternative for retirement portfolio construction is discussed here.

Given the performance of the 100-age rule for retirement, we will see if you can use the rule for other goals like children’s education/marriage or house purchase.

Imagine two families with the same age of the investor with two very different sets of non-retirement goals:

The 100-age rule requires both portfolios to have the same asset allocation, which does not make sense given the timing of the goals. Suppose non-retirement goals are also managed using the same portfolio. In that case, we need to be mindful of the situations like this: imagine a goal like a college admission payment coming due, and a market crash (like March 2020 due to COVID) happens when the portfolio is supposed to be 50% in equity. Since you cannot miss the goal, the required money comes

Instead, investors should use the complete goal-based investing calculator for all goals. The Excel sheet will output a portfolio level asset allocation and SIP that can be followed. Overall asset allocation for all goals, on which the Excel planner is based, is covered in this post.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Asset allocation by age: How much equity should you have at various ages? first appeared on 19 Oct 2021 at https://arthgyaan.com