How can NRIs easily manage their parents' finances in India?

This article shows the steps NRIs can take to easily manage their family’s finances in India.

This article shows the steps NRIs can take to easily manage their family’s finances in India.

This article will cover cases where NRIs can ensure that their parents in India have regular income with the least possible setup and maintenance hassles, simple taxation and low to no activities needed in the physical world by focusing on online transactions that can be managed from overseas.

We will focus on simplicity, ease of maintenance and safety for these investments. We will avoid situations that involve running around by elders like:

We will explore the following options:

To gift by NRI to a resident of India, we must distinguish between relatives and non-relatives. Gifts to relatives are tax-free, and for non-relatives, there will be gift tax. The following are considered relatives relative to the individual NRI who is gifting the assets, while anyone not covered below are non-relatives:

To avoid hassles and maintain a clear record for tax purposes, please create a gift deed for gifts exceeding ₹50,000 in value to both relatives and non-relatives. If the items being gifted are shares or mutual funds, or anything that has a purchase date and price, include those details in the deed for making it easy to calculate capital gains in the future.

Read more: How much money can NRIs in the US gift to their parents in India without paying tax?

NRIs need one or more Non-Resident Ordinary (NRO) bank accounts to be set up. This account is used for any income and investments in India. The features and uses are:

In this case, set up the NRO account(s) jointly with your parents for them to receive the money you plan to send them for their expenses. Alternatively, since there is no gift tax for transferring to parents, you can transfer money to the resident accounts of the parents as well.

We prefer the joint account approach since the NRI is the primary holder:

We cannot change the situation if the parents already have a government pension or the assets that they manage themselves. We are also not advocating that the parents transfer any assets to the NRI children just for simplicity of managing.

Before creating a retirement corpus ensure that these are in place:

We will give some examples for managing existing assets in India in a simple way that reduces the effort needed in India to maintain them:

The purpose of making these investments is only to take care of parents and their expenses in India. These investments are not for the NRI’s own goals like retirement or children’s education.

Priority: High

Direct remittance to the NRE account is the standard practice of sending money to India. You may hold NRE accounts jointly with a resident relative but only in former or survivor mode. You can set up a standing instruction to transfer funds from our foreign account to your Indian NRE account to fund it regularly. You should transfer what is needed every quarter or six months.

The issue with this approach is exchange rate fluctuations will make it difficult to predict how much will end up in the target account in INR for future transactions. Generally the more the number of remittances you make, there will more charges. Bank account to bank account transfers are low cost while if you pay via a credit or debit card, the fees will be higher.

Since regular remittance has a dependency on having an active income, we will also explore options that are more fit-and-forget in line with the theme of this article.

Priority: Very high

NRIs have an option of buying an RBI issued long term bond that pays half-yearly coupons and gives back the principal at the end of the period. This is via RBI’s Retail Direct Scheme or via brokers like Zerodha. You can think of this as a very long term FD with interest payments every six months. These bonds are available with maturities from 91 days to 40 years and investments may range from ₹10,000 to ₹2 crores per PAN.

The biggest benefit of this scheme is that due to the government of India guarantee on coupon payments and return of principal, there is no dependency on the NRI child’s own finances after the bond is purchased. In case there is a disruption of income due to health issues, immigration or job loss, your parent’s income will continue. The interest payments that they will receive are fixed and will not increase over time with inflation.

It will be prudent to hold these bonds in a joint mode with your parents so that transmission, in case of their demise, is hassle-free.

NRIs will have to use their NRO account for investing in and for receiving interest from RBI/Gilt bonds.

For example, if you buy a 2062, 7% coupon bond at ₹106 by investing ₹50 lakhs, then you get:

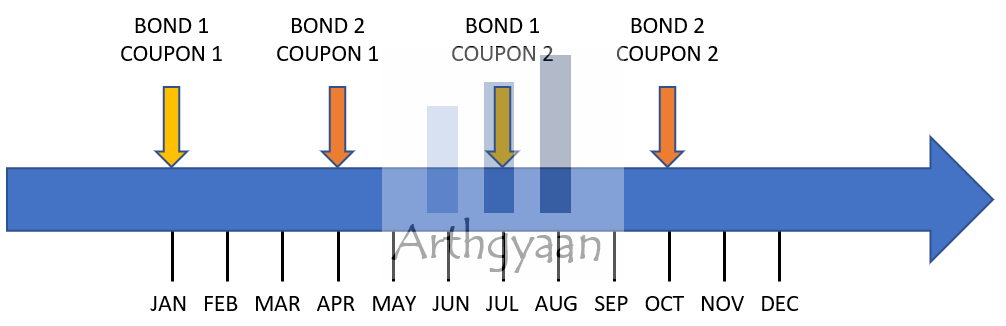

You can spread out buying the bond over a few months to allow income every few months like this:

The example above shows two bonds purchased three months apart, allowing interest payments every three months.

You can use this formula to calculate monthly income from bond price and coupon rate:

Monthly income = 100 * Coupon * Investment / Price / 12 * (1 - TaxRate)

Here, investment = 50 lakhs, price = 106, tax = 30%, coupon = 7% and hence the monthly income = 100 * 0.07 * 50,00,000 / 106 / 12 * (1 - 0.3) = ₹19,250

Steps to follow:

The concept of RBI bonds is explained in detail here: How to use the RBI Retail Direct Scheme to get guaranteed income?

Priority: Medium

Pension plans that generate a fixed income for life may be an option for someone looking for an excellent fit-and-forget solution. You can gift the money to your parents and let them take a pension plan in their name. The annuity rate should be compared with the RBI bond return before purchasing.

There are a few problems:

Priority: Medium

Unlike NRO FDs, which have 30% TDS, the interest on NRE FDs are tax free and can be used to generate an income for parents. The issue with this approach vs buying RBI bonds, is two-fold:

More on NRE FDs: Frequently asked questions on NRE Fixed Deposits (NRE FD): the complete guide

Note: NRE FDs may give a lot lower return even after paying zero tax in India when repatriated: Should NRIs invest in India for higher returns and later repatriate?.

Priority: Low

NRIs should not invest in mutual funds in India solely for the purpose of income generation for parents. Mutual funds require a degree of active management that may not be possible all the time sitting in a foreign country. If active maintenance is possible, a combination of equity and debt funds, as per this post on choosing mutual funds, may be followed. If active management is not possible, then mutual funds should be avoided.

Priority: Very low

We do not recommend that NRIs invest in direct stocks in India due to the research and tracking overhead involved. However, since stock dividends have the potential for providing inflation-indexed returns, NRIs may consider if they are comfortable with the extra effort needed.

Read more here on choosing dividend-paying stocks: How to plan for retirement/FIRE using dividend income?

Priority: Avoid

These options should be avoided at all costs:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How can NRIs easily manage their parents' finances in India? first appeared on 07 Apr 2022 at https://arthgyaan.com