Should NRIs invest in India for higher returns and later repatriate?

This article shows what returns NRIs should expect if they invest in India and later repatriate that corpus to their current country of residence.

This article shows what returns NRIs should expect if they invest in India and later repatriate that corpus to their current country of residence.

NRE FDs and Indian stock markets are standard options for NRIs who invest in India, apart from the perennial favourites of gold and real estate. It is common knowledge that interest rates in India are higher than that of developed nations, and some investments like NRE FDs are tax-free in India. Indian stock markets, in Rupee terms, have also given higher returns in the recent past than many developed nations.

More on NRE FDs: Frequently asked questions on NRE Fixed Deposits (NRE FD): the complete guide

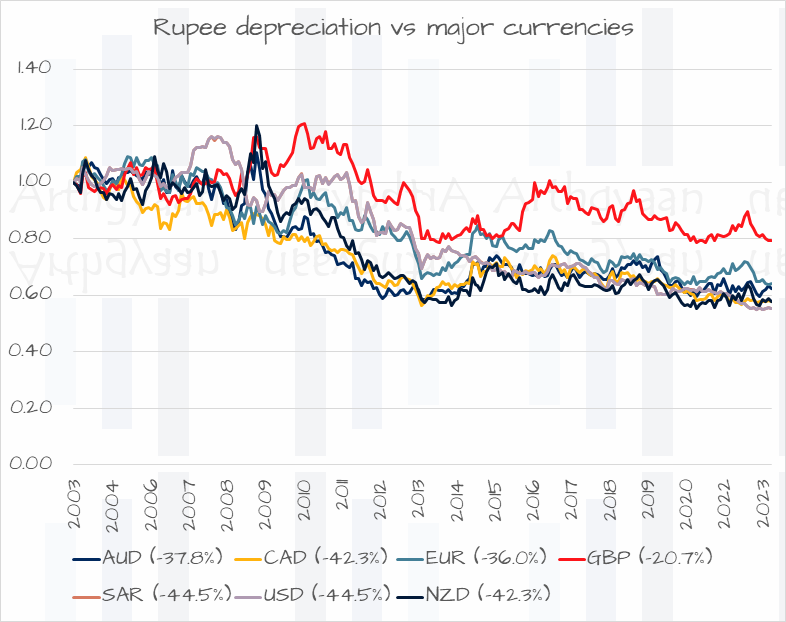

For an NRI investing in Indian FDs or stocks, there is a problem if they decide to repatriate that money back to their current country of residence. This issue happens due to the rupee’s movement against their home currencies.

We assume the NRI is in the US, and the current USD/INR FX rate is ₹40 to $1. They invest $1000, i.e. the equivalent of ₹40,000 in India, in a 10-year 10% FD. In 10 years,

The NRI now has ₹104,000/60 = $1733 for repatriation, pre-tax. So in USD terms, their return is 1733/1000 ^ (1/10) = 5.6% only. This is the problem if the rupee depreciates against the USD. If the rupee appreciates instead, the return will be higher than 10%.

As per Google Bard, NRIs repatriate money from India to a variety of countries, but the top 5 destinations are:

1. United States of America

2. United Kingdom

3. Canada

4. Australia

5. New Zealand

Also, as per Bard again,The top 5 countries that NRIs remit the most to India are:

1. United States of America

2. Saudi Arabia

3. United Arab Emirates

4. United Kingdom

5. Canada

Therefore we are showing the following 7 currencies in our analysis: AUD, CAD, EUR, GBP, SAR, USD and NZD to cover most of the use cases of NRIs investing and later repatriating the corpus.

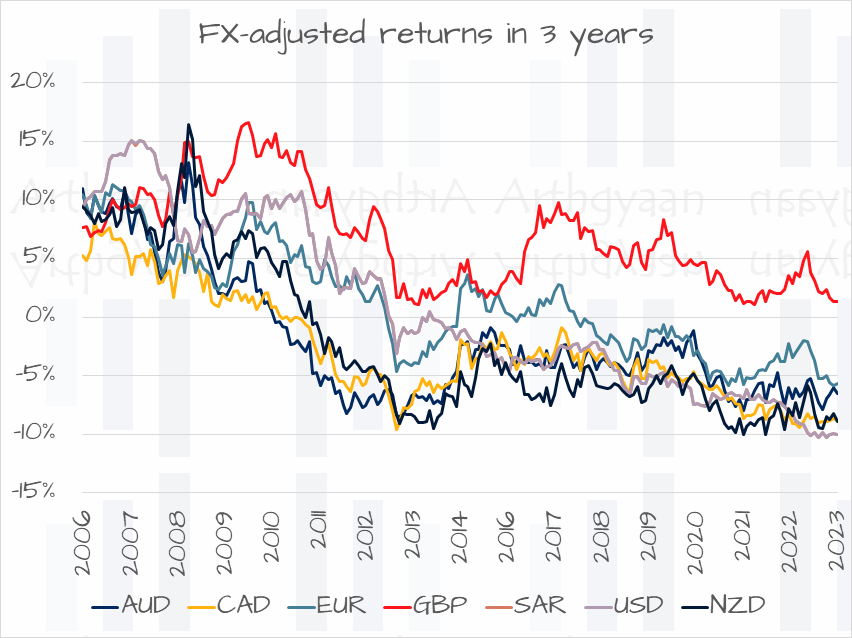

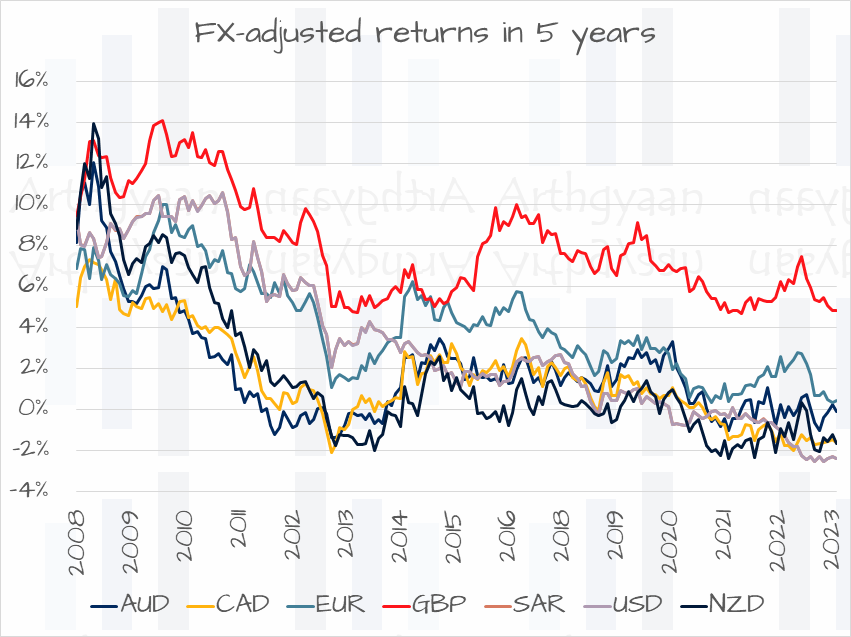

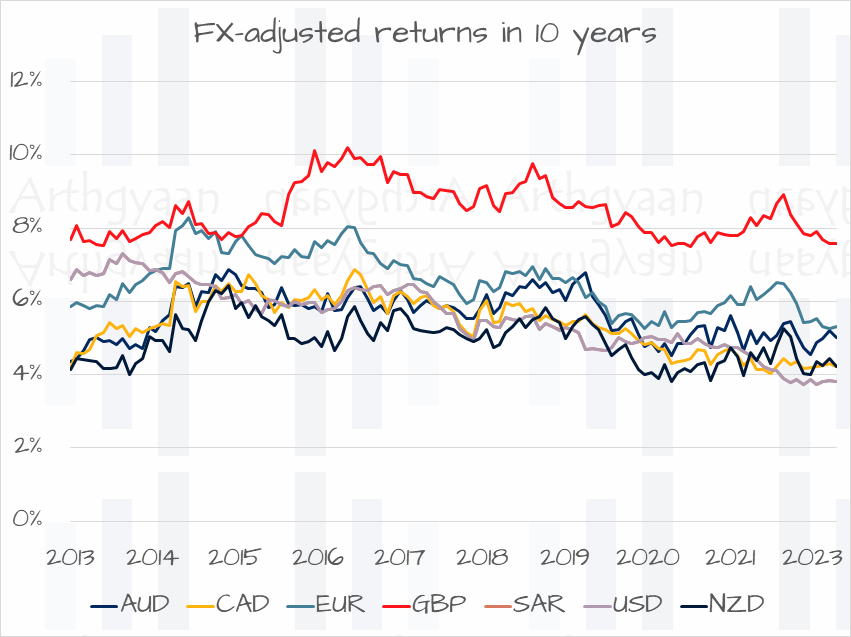

In the examples below, we assume a 10%/year pre-tax investment. The FX rate data is from 2003. In each of the cases we show investment returns, adjusted against rupee movement, for a 3,5 or 10 year holding period. These are rolling returns i.e. each dot in the chart is a separate investment period. Using the 3-year case, these investment periods are:

As the 3 charts show above, in most cases, the realised return, once repatriated, is much lower than the expected 10%. Such investments may be made as long as this fact is incorporated while investing in India for repatriation later. But, of course, suppose the amount will be spent in India later. In that case, the return is not impacted by currency movements.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should NRIs invest in India for higher returns and later repatriate? first appeared on 21 May 2023 at https://arthgyaan.com