India vs. US: Where Should NRIs Invest for Maximum Returns?

This article compares 10-year CAGR returns across asset classes, explains the impact of taxation, and provides a capital allocation framework for NRIs.

This article compares 10-year CAGR returns across asset classes, explains the impact of taxation, and provides a capital allocation framework for NRIs.

The short answer is “Yes, in many cases”. The slightly longer answer requires an understanding of USD/INR exchange rate movements, cross-border taxation and investor residency status.

What is the Best Investment Destination for NRIs?

For NRIs, choosing between India and the US depends on multiple factors. Historically, Indian equities have outperformed US stocks in CAGR terms. Taxation plays a crucial role, with PFIC rules affecting Indian mutual funds held by NRIs in the US. Additionally, rupee depreciation impacts overall returns. The optimal strategy is to allocate capital based on where it will be spent - keeping short-term expenses in USD while directing long-term investments to India to take advantage of higher-growth opportunities.

We will first deal with averages across four asset classes (equity, debt, gold and real estate) and also look at the effect of rupee depreciation vs. the US Dollar and the impact of taxes, specifically PFIC taxation.

| 10Y CAGR | India | US |

|---|---|---|

| Equities | 12.39% | 11.07% |

| Debt | 7.83% | -0.35% |

| Gold | 10.17% | 8.15% |

| Real Estate | 3.62% | 6.90% |

Rupee depreciation over this period is around 3.07% a year on an average.

These are point-to-point average returns from 2015-2024 for:

We need to keep in mind that these are average returns. There will always be pockets (e.g. in Real Estate) where returns will be dramatically higher (or lower). But if you aggregate the returns from say 10,000 investors, they will converge to the numbers above. Also, unless you invest in REITs, which do not exist in India in the same way they do in the US, your real estate returns will be based on the actual house or land holdings you have.

For NRIs looking at investing in real estate in India, here is a comprehensive guide:

The answer, unfortunately, starts with tax.

The US has a very simple taxation concept: you will always be taxed on everything you have and every cent/paisa of returns that you make:

The only silver lining in this gloomy story is India’s DTAA with the US.

📕 What is Double Taxation Avoidance Agreement (DTAA)?

Indian taxation laws are definitely better in this respect:

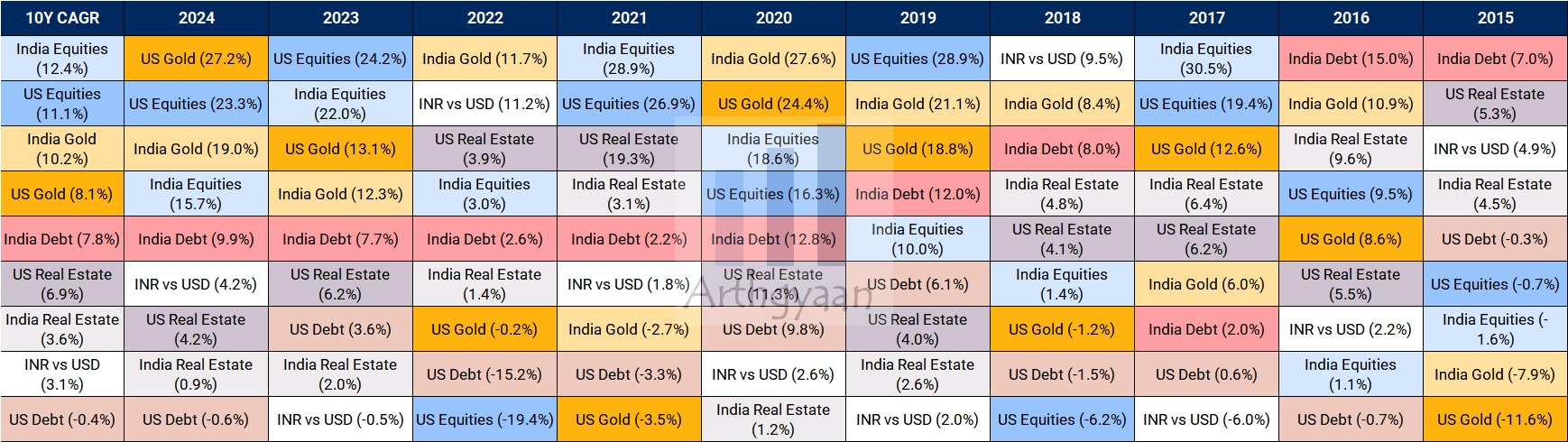

The chart below shows that there is no reasonable pattern between these asset classes over the years:

However, if you are willing to withstand some amount of volatility, e.g. 2018, then there was a good amount of money that was made in Indian mutual funds as per historical data:

| Returns | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|

| Equity: Large Cap | 16.12% | 24.94% | 2.91% | 26.78% | 14.38% | 11.78% | -0.57% | 31.74% | 4.34% | 0.61% |

| Equity: Mid Cap | 29.22% | 39.15% | 4.67% | 45.18% | 25.37% | 4.02% | -10.13% | 42.59% | 5.1% | 8.84% |

| Equity: Small Cap | 27.04% | 43.43% | 2.61% | 64.8% | 33.08% | -0.84% | -16.94% | 47.78% | 7.25% | 11.34% |

To understand which mutual funds can be suitable for wealth creation:

Given the complexities of taxation and capital withdrawal in the US, it will be prudent to allocate capital as per these thumb rules:

If you have plans to send your children to colleges in the US (or Canada/UK, Europe/Australia etc.), this amount should be invested in the US, maybe in 529 plans for US college admission.

Similarly, mortgage payments for primary residence and real estate investments in the US will come from current income in the US.

If you have an iota of doubt that you will not settle permanently in the US, then India is the next best option for the rest of your capital.

The case for equity investments in India using mutual funds is extremely straight-forward as we can see below for SIP investments:

| Category | Any 5Y SIP | Any 10Y SIP |

|---|---|---|

| Equity: Large Cap | 14.11% | 14.21% |

| Equity: Mid Cap | 19.87% | 19.11% |

| Equity: Small Cap | 21.41% | 19.76% |

Here is the same view for lump sum investments:

| Category | Any 5Y | Any 10Y |

|---|---|---|

| Equity: Large Cap | 14.32% | 14.18% |

| Equity: Mid Cap | 20.71% | 17.84% |

| Equity: Small Cap | 23.67% | 17.89% |

The Indian real estate market is also seeing a boom in the major Top 7 or Top 10 cities with rupee depreciation making payments for under-construction properties becoming cheaper with time. Here is an example for NRIs looking to invest in real estate in India:

If you are funding current expenses for parents in India, you can get both an inflation-indexed income stream and capital appreciation by investing in dividend-paying stocks in India as we show in the video below:

You can transfer capital to parents and family members in India to invest for them.

USD 19,000 per person is the annual Gift Tax Exemption amount for 2026 as notified by the IRS.

This amount is offset against the lifetime Gift and Estate Tax Exemption limit. This limit is currently at $15.0 million in 2026 (up from $13.99 million in 2025). If you exceed the annual exemption amount, then you need to fill Form 709 while filing your tax returns.

Read more here: How much money can NRIs in the US gift to their parents in India without paying tax?

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled India vs. US: Where Should NRIs Invest for Maximum Returns? first appeared on 28 Feb 2025 at https://arthgyaan.com