Returning to India? How to Handle 401(k), IRA & US Accounts the Right Way

This guide explores tax-efficient strategies to minimize lifetime taxes, maximize post-tax returns, and navigate US estate tax rules.

This guide explores tax-efficient strategies to minimize lifetime taxes, maximize post-tax returns, and navigate US estate tax rules.

🔥 Tip: Port your mobile number to Google Voice

Apart from these, we will also explore the options of dealing with Social Security and Real Estate when returning to India.

We will measure the effect of these accounts on the following considerations:

In the absence of a crystal ball, we need to set up some thumb rules based on what we know today and extend that based on reasonable expectations based on past trends.

The cornerstone of minimising taxes on future US and Indian income is the India-U.S. DTAA.

📕 What is Double Taxation Avoidance Agreement (DTAA)?

The next input on understanding taxes is future tax slabs and rates at the time of withdrawal in either country. In general,

Currently, capital gains are taxed at 12.5% and onwards in India and are generally favourable to normal income tax rates for investors in the highest slab rates (30% or more). However, the New Tax Regime in India allows tax-free income up to ₹12 lakhs (for non-salaried) which implies that even ordinary incomes, say via FD interest and dividends can be tax-free for significant capital amounts.

Given that tax rates in the US are progressive, future withdrawals from say a 401k can happen at lower rates vs current slab rates at the point of returning to India. While we don’t know what the tax rates will be in the future in either country, these are reasonable assumptions based on what we know today. That being said, the current tax laws in the US state that for non-resident aliens, 401k withdrawals are considered as fixed, Determinable, Annual, or Periodical (FDAP) income, not Effectively Connected Income (ECI) which means that the tax is a flat 30% (plus 10% penalty if any) and not a progressive rate.

We will cover these three main groups:

Here is a calculator that shows your US tax-residency based on the SPT:

Learn more about the SPT from the IRS website.

Here it is important to understand the nuance of domicile vs residency.

Domicile status depends on factors such as the amount of time spent in the US vs elsewhere, intentions regarding staying in the US vs leaving and other factors.

| Threshold | U.S. Citizen (Yes) | U.S. Citizen (No) |

|---|---|---|

| U.S. Domiciliary | $15.0 mn | $15.0 mn |

| Non-U.S. Domiciliary | $15.0 mn | $60,000 |

An NRI who has come back to India has to apply the above table to their circumstances to understand the estate tax applicable to them. The calculator below shows the effect of the federal estate tax on your US-situs assets.

How to use the US Federal Estate Tax Calculator?

The calculator requires you to enter your total value of US-situs assets and your tax residency status:

Now click the Calculate Tax button to get the result.

1.00 Cr

Apart from the tax considerations discussed so far, there is also the question of the impact of currency movements on the returns on various investments based on their location.

For example, from 2005 to 2025, the Indian Rupee has gone from ₹43/$ to ₹86/$ or around 3.6% depreciation per year. If we assume even half that depreciation rate on an average, the rupee will reach around ₹100+/$ in another ten years.

For all things remaining equal, every additional $1,000 deferred while bringing back to India is therefore worth more in rupees. We cannot assume that returns in the US in different asset classes will be comparable to the same asset classes in India. Even if we assume that the stock market in India gives higher returns than that in the US, after factoring in the rupee depreciation, the returns will be lower than expected.

| 10Y CAGR | India | US |

|---|---|---|

| Equities | 12.39% | 11.07% |

| Debt | 7.83% | -0.35% |

| Gold | 10.17% | 8.15% |

| Real Estate | 3.62% | 6.90% |

Rupee depreciation over this period is around 3.07% a year on an average.

These are point-to-point average returns from 2015-2024 for:

We need to keep in mind that these are average returns. There will always be pockets (e.g. in Real Estate) where returns will be dramatically higher (or lower). But if you aggregate the returns from say 10,000 investors, they will converge to the numbers above.

Equities have been a clear winner in India at an asset class level. The case for equity investments in India using mutual funds is extremely straight-forward in India as shown below for SIP investments:

| Category | Any 5Y SIP | Any 10Y SIP |

|---|---|---|

| Equity: Large Cap | 14.11% | 14.21% |

| Equity: Mid Cap | 19.87% | 19.11% |

| Equity: Small Cap | 21.41% | 19.76% |

It is important to correctly plan withdrawals from your US accounts not only to minimise taxes but also to know how much assets exist in India vs. outside India so that you can plan your investments in India as per that. Here is a case study for such a returning NRI: Barista FIRE Calculator for NRI Returning to India: Can $1 million be enough for this NRI returning to India in 5 years for early-retirement?

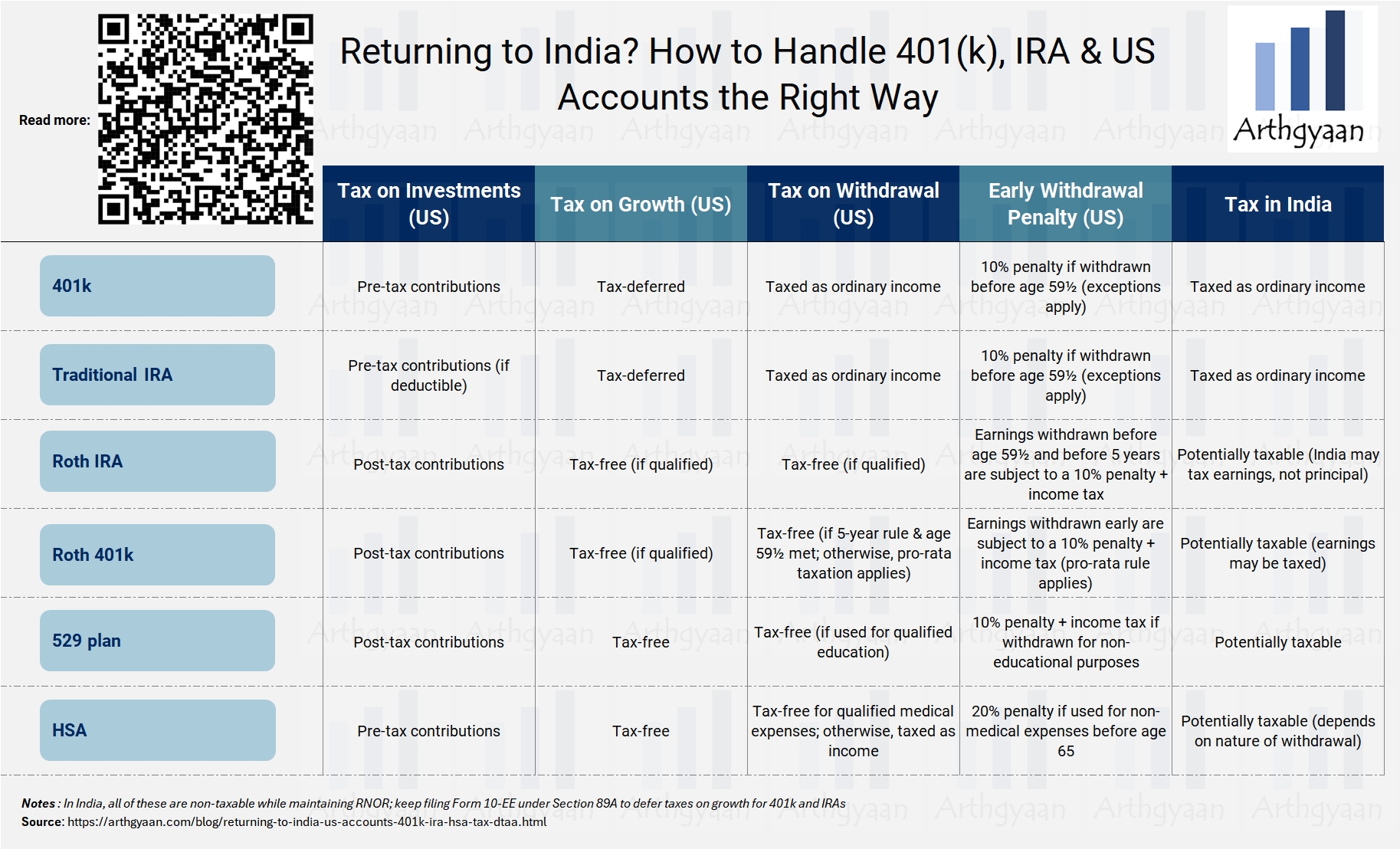

| Account Type | Tax on Investments | Tax on Growth | Tax on Withdrawal |

|---|---|---|---|

| 401k | Pre-tax contributions | Tax-deferred | Taxed as ordinary income |

| Traditional IRA | Pre-tax contributions (if deductible) | Tax-deferred | Taxed as ordinary income |

| Roth IRA | Post-tax contributions | Tax-free (if qualified) | Tax-free (if qualified) |

| Roth 401(k) | Post-tax contributions | Tax-free (if qualified) | Tax-free (if qualified) if 5-year rule & age 59½ met; otherwise, pro-rata taxation applies |

Remember:

India starts taxing worldwide income as soon as your status changes from Resident but Not Ordinarily Resident (RNOR) to Resident and Ordinarily Resident (ROR)

There are three options for dealing with a 401k:

Note: Monthly pension after 59½ is taxed in the US first with a foreign tax credit available under DTAA when filing ITR in India. Be wary of estate tax whenever leaving large amounts behind in the US.

You can use this decision-matrix to decide what to do with your 401(k):

You can also listen to this AI-generated podcast which talks you through all the scenarios:

When dealing with Roth IRAs, which don’t get the tax-free status in India, remember the twin 5-year rules:

You can only withdraw the Roth-IRA contributions tax-free (in both US and India) if you withdraw before moving to India. Earnings are taxed and penalized (10%) if withdrawn before age 59½ and before 5 years. If you withdraw after moving to India from your Roth, then you do pay tax in the US but none in India only if you strategically complete the withdrawal in the RNOR stage. When you are ROR in India, at least the income part of the Roth will be taxable in India when you withdraw.

🔥 Tip: Resetting the cost basis on your Traditional IRA

| Account Type | Tax on Withdrawal (India, RNOR Status) | Tax on Withdrawal (India, ROR Status) |

|---|---|---|

| 401(k) | Not taxable (Foreign passive income is exempt for RNOR) |

Taxed as ordinary income |

| Traditional IRA | Not taxable (Foreign passive income is exempt for RNOR) |

Taxed as ordinary income |

| Roth IRA | Not taxable (Foreign passive income is exempt for RNOR) |

Potentially taxable (India may not recognize U.S. tax-free treatment) |

| Roth 401(k) | Not taxable (Foreign passive income is exempt for RNOR) |

Potentially taxable (India may not recognize U.S. tax-free treatment) |

For a Traditional IRA, keeping it intact until 59½ to avoid the 10% penalty, resetting the basis for India on the date of RNOR to ROR conversion in India and filing Form 10-EE under Section 89A can be a good option to maximise the benefits from this account and minimising the tax. For this it is best if the IRA funds are in not in dividend paying funds since the value of growth or accumulating funds will be higher than distributing funds thereby reaching a higher value at the time of the reset of basis.

If you have a Roth 401(k), then it has pro-rata taxation before 59½ for withdrawals. You should get that rolled into a Roth before your status changes to ROR in India.

Let's say you have a Roth 401(k) with the following balance:

Now, if you withdraw $10,000 before age 59½, the IRS requires you to withdraw a pro-rata portion of contributions and earnings.

Thus, from the $10,000 withdrawal:

If you are prioritising contributions to these accounts with an eventual view to return to India, then contributions should go to your 401k (up to the employer match) and then to taxable brokerage accounts first. Adding money to a Roth leads to unnecessary complications for withdrawal-related taxation that a brokerage account will not have. Similarly, if you are following the Backdoor Roth IRA & Mega Backdoor Roth 401(k) strategies, you should stop if you plan to leave the US.

Unless you plan to sell off all the contents in your brokerage account and pay the requisite tax, you can keep some of the contents.

Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding - IRS website.

Once you leave the US, it is important to inform your broker about the change in your residency status via Form W-8 BEN and provide your new India address. As the IRS website quote says, this requirement for W-8 BEN is only for those who are foreign persons i.e. not US Citizens/Green Card holders.

Some brokers do not support foreign nationals to hold a US brokerage account while those like Fidelity, Interactive Brokers and Schwab do allow (it is a good idea to check with customer support of these brokerages first). Here you can use Automated Customer Account Transfer Service (ACATS) transfer to move these securities to the new account.

⚡ Tip: How to Reduce holdings in US-domiciled funds/ETFs?

Rotate from US-situs ETFs/MFs (e.g VT) to non-US domiciled accumulating (i.e. non-dividend paying growth funds) European SICAV/UCITS funds (e.g. VWRA) to reduce exposure to IRS estate taxes. Do this once you are back in India since US taxes will be low (no US income) and no taxes in India (if done in the RNOR window)

If you are selling off some of the stocks, it is important to sell off any positions with losses and offset those against profitable positions. This strategy is called tax harvesting.

If you are choosing between a investing in a brokerage account and a Roth IRA, the brokerage is better from a return-to-India view.

It is possible for Indian citizens with the required accumulated 40 credits to get Social Security sitting out of India. You can create an account on the SSA website to check your eligibility. You can choose to defer payouts until age 70 to get the maximum benefits.

| Account Type | Tax on Investments | Tax on Growth | Tax on Withdrawal |

|---|---|---|---|

| 529 plan | Post-tax contributions | Tax-free | Tax-free (if qualified) |

| HSA (only if HDHP is in place) | Pre-tax contributions | Tax-free | Tax-free (if qualified) |

529 plans are tax-free as long as they can be used for qualifying educational expenses either in the US or in eligible foreign institutions (which participate in US Federal Aid programs). Also, money in 529 plans do not count towards the estate of the investor and therefore reduces estate tax liability.

However, if used for purposes apart from college expenses might lead to the removal of tax benefits with a 10% additional penalty. If there are any plans for children going for higher education in the US, then 529 plans should be left as is. If not, there is a high chance of the withdrawal being treated as non-qualifying and requiring the tax plus 10% penalty.

If you are starting a 529 plan and have plans to return to India in the near future, then remember that withdrawals from a traditional IRA for qualifying educational expenses do not trigger tax and penalty.

HSAs exist when your insurance premiums are so high that you are forced to take up High Deductible Health Plan (HDHP) and then can save for future medical expenses in the HSA to fund that high deductible.

Just like the 529 plan, HSAs can be used tax-free if a withdrawal is needed to fund a qualified medical expense even when outside the US. It is just that you can no longer contribute if you are no longer in the HDHP plan which would be the case when you leave your US employment. Early withdrawals are taxed as ordinary income in the US with a 20% penalty.

If you are planning to return to India, you should lower your HSA contributions unless you have found a qualified hospital in India for HSA-eligible expenses.

Note: All the tax discussion so far is about Federal taxes in the US. Some US states might have their own taxes on withdrawal which would vary from state to state.

It is easier to keep on bank account in the US if you plan to receive dividends from brokerage accounts, rental income or pension payments. You need to of course fund a low-cost bank which supports non-resident customers and online transactions. Any US bank accounts must of course be reported both in your US and Indian tax returns.

Being legal obligations, you cannot walk away from loans. Therefore, you need to either pay them off before leaving the US. This might require finding a bank in India which allows you to negotiate foreign exchange rates for such recurring payments.

We will cover both types of life insurance: term and non-term with cash value:

Death benefits are tax-free while the cash value on maturity might be taxable in the US (including estate tax) and in India for ROR.

NRIs who have been in the US for sometime are very likely to have a primary residence along with investment properties given attractive rental yields. There are three cases here:

If you have either a Green Card or hold US Citizenship, then you might have to pay exit-tax, called Expatriation tax, when leaving the US permanently. Exit tax applies to the following assets:

| Asset Type | Exit Tax? | Key Tax Treatment |

|---|---|---|

| Stocks, ETFs, Mutual Funds | ✅ Yes | Mark-to-market, capital gains tax |

| Real Estate (Primary Home) | ✅ Yes | $250K exclusion, capital gains tax |

| 401(k), Traditional IRA | ✅ Yes | Fully taxed as ordinary income |

| Roth IRA | ✅ Yes (only earnings) |

Tax-free if held 5+ years & >59.5 |

| Employer Pension (🇺🇸) | ❌ No | Taxed when received |

| Employer Pension (Foreign) | ✅ Yes | Deemed distributed & taxed |

| Trust Beneficiary | ❌ No | But 30% withholding on future distributions |

| LLC, Private Business Ownership | ✅ Yes | Valued at FMV & taxed as capital gain |

| Cryptocurrency | ✅ Yes | Mark-to-market, capital gains tax |

US Exit tax rules can be complicated. Use our simple calculator to estimate how much exit tax might be due when you leave the US:

No exit tax applies unless substantial presence is met.

Applicable if you held a Green Card for at least 8 of the last 15 years

Failure to disclose foreign assets and income can attract stringent penalties and prosecutions under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

Source: https://www.incometax.gov.in/iec/foportal/sites/default/files/2024-11/Enhancing%20Tax%20Transparency%20on%20Foreign%20Assets%20and%20Income.pdf

While NRIs can hold foreign assets when they are back in India, without RBI permission in general, it is important to declare these holding while filing tax return in India in their Income Tax Return (ITR) in India:

Under FATCA and CRS, foreign countries share information on assets held there to India. Not disclosing these assets in the ITR can lead to a ₹10 lakh fine or even jail-time. If you have missed reporting these details in your ITR, then you can either rectify or file a belated return by 31st December.

As per Finance Act 2021, Section 89A offers tax exemption and relief for NRIs who have come back from the US, Canada and UK who need to file Form 10-EE (under rule 21AAA) in India while filing income tax return.

A good example for using 89A exemption is deferring the yearly tax due in India on 401k accounts and making the tax treatment the same as the tax-deferral offered in the US for these accounts. 89A benefits are not applicable to 529 plans and their annual growth, on MTM or accrual basis, is taxable in India.

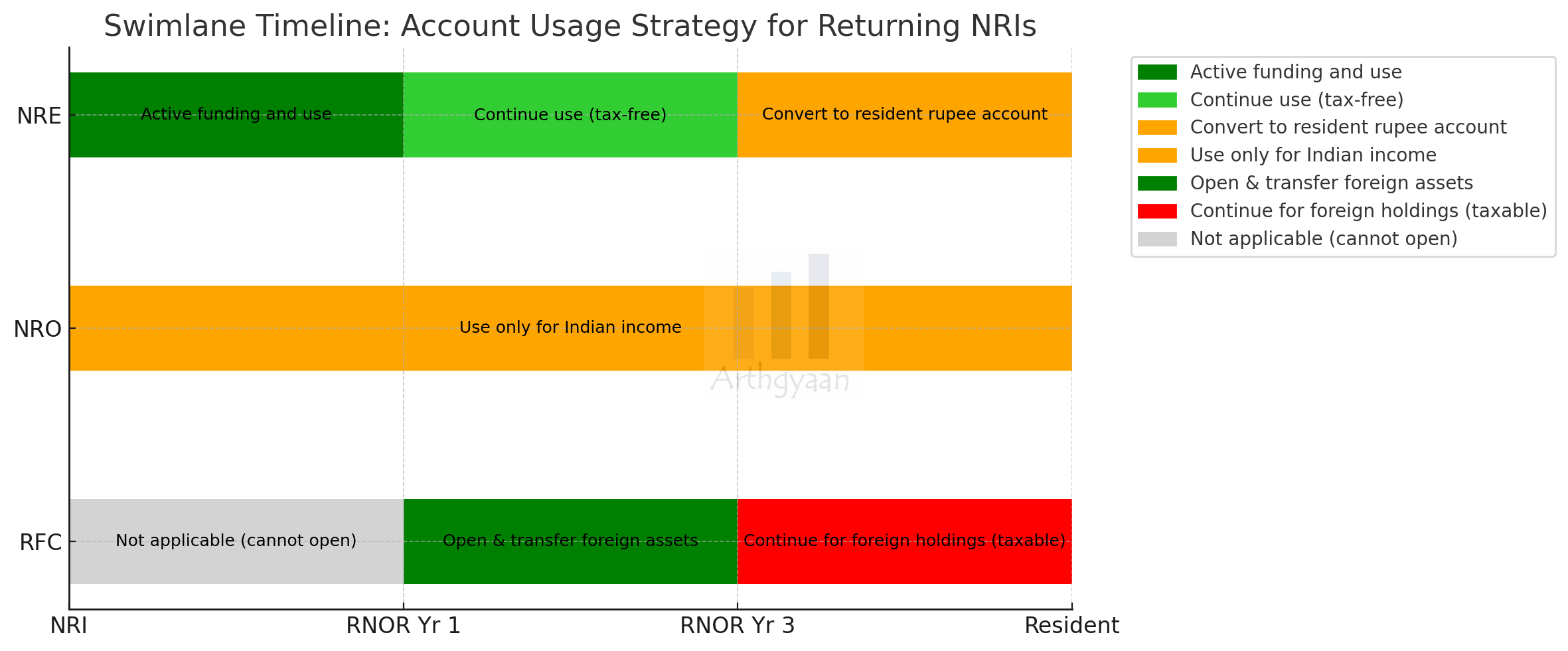

Timeline: Pre-Return ➝ RNOR ➝ Resident

| Step | Time frame | Action |

|---|---|---|

| 1 | Immediately on return | Inform bank of change in residential status; retain NRE/NRO status until reclassified |

| 2 | Month 1 | Open RFC Account; transfer any foreign assets (cash, deposits, pensions, matured policies abroad) into RFC |

| 3 | Ongoing | Keep using NRE for foreign remittances ➝ tax-free interest; do not route foreign funds via NRO in-case you want to go back |

| 4 | During RNOR | Consider prepaying Indian liabilities or investing from RFC to avoid eventual taxation post-RNOR |

| 5 | End of RNOR (~Year 3) | Plan for any large outbound remittances or currency hedging from RFC before losing repatriability or tax-free status |

Notes:

| Step | Time-frame | Action |

|---|---|---|

| 1 | ROR stage | NRE account (if still active) must be converted to Resident Rupee account |

| 2 | ROR stage | RFC continues but interest is now taxable; consider merging or converting depending on currency needs |

| 3 | Ongoing | All interest income (RFC) now taxable |

| 4 | If planning to emigrate again | Do not transfer foreign funds to ₹ accounts; use RFC to preserve currency denomination and repatriability |

If RNOR is not applicable, as per the classification rules (see this RNOR status calculator), the returning NRI directly becomes ROR status holder.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Returning to India? How to Handle 401(k), IRA & US Accounts the Right Way first appeared on 08 Mar 2025 at https://arthgyaan.com