Stock Market Crash 2025: How Much Has the Nifty Fallen & What Should Investors Do?

This article explores how to manage SIP investments, allocate fresh capital during a downturn, and assess bottom-fishing opportunities.

This article explores how to manage SIP investments, allocate fresh capital during a downturn, and assess bottom-fishing opportunities.

Around 14% from the level of 26,277.35 (26-Sep-2024) for the Nifty 50 index.

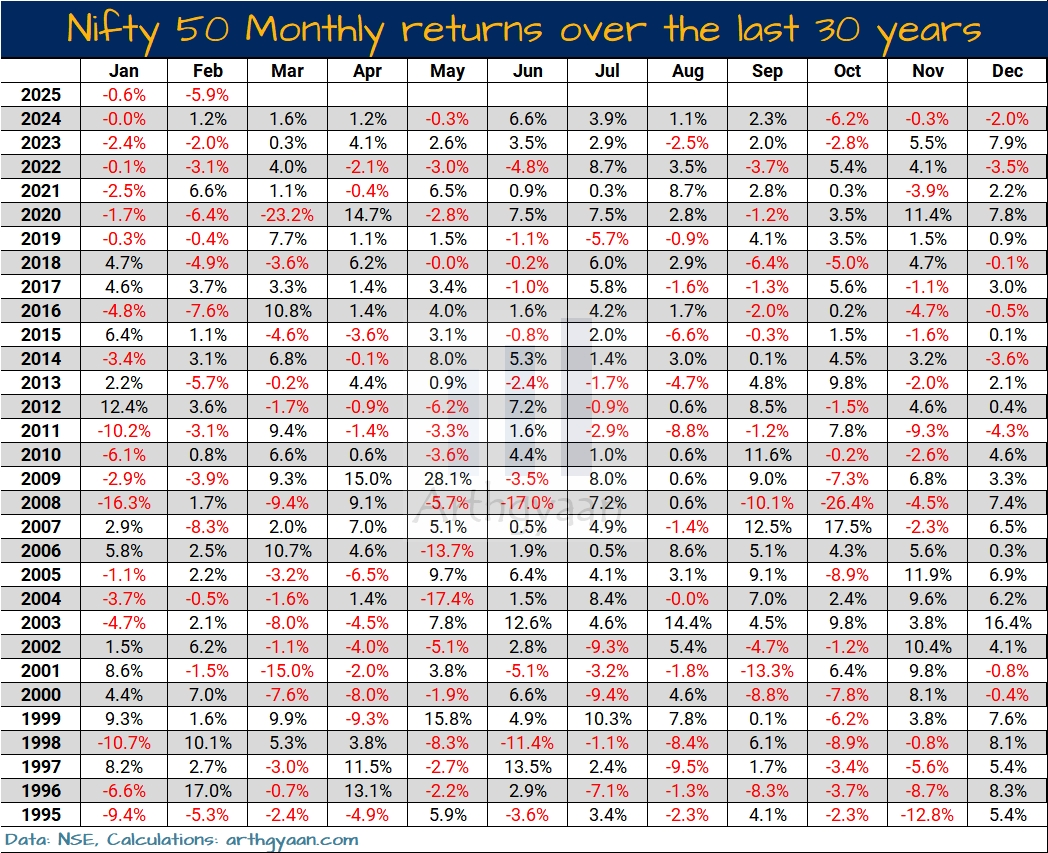

The Nifty 50 is experiencing its longest monthly losing streak in 30 years:

In this article, we will tackle the question: What should mutual fund investors do in such a situation?

The latest values of most short-term SIPs are currently negative:

| Category | Any 1Y SIP |

|---|---|

| Equity: Large Cap | 11.48% |

| Equity: Mid Cap | 10.81% |

| Equity: Small Cap | 2.94% |

This is normal given the market correction we are seeing. However, for many investors who have started investing recently, this can be a matter of concern. But we urge such investors not to panic but instead focus on implementing the steps in this article.

A market correction is the time of reality check for those investors who believe that the stock market goes up by 15% every year like a super-charged FD.

As we have said many times before, money that is due to be spent in the next five years should not be in equity at all.

| Category | Any 5Y SIP | Any 10Y SIP |

|---|---|---|

| Equity: Large Cap | 14.41% | 14.92% |

| Equity: Mid Cap | 19.63% | 19.27% |

| Equity: Small Cap | 18.22% | 19.58% |

But beyond that period, equity can be slowly added as per your risk profile following a chart like this:

To do this in practice refer to this guide: Which are the Best Mutual Fund Categories for every Investment Horizon?

A lump sum is a large chunk of money, relative to the size of your portfolio, that you need to invest.

Typical examples of lump sum amounts come from bonuses, real estate sales or other such transactions. In addition, suppose you are doing a portfolio rebalancing exercise or exiting investments that no longer meets your objectives. In those cases as well, you will also end up with a lump sum cash amount.

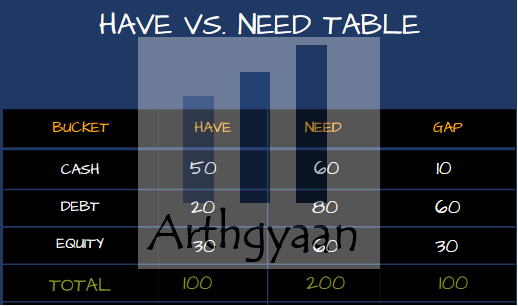

We will use the bucket theory of portfolio creation, also called the Arthgyaan Have-vs-need (HvN) framework for investing a lump sum amount.

We extend the concept of the bucket theory of portfolio construction to create a framework to be used in the accumulation, i.e. the pre-retirement stage when the investor has active income and is investing for future goals.

The Arthgyaan Have vs Needs framework (HvN) is a simple tool to tell you how much money you need to invest:

We will now break this down in simple terms. There are two important questions that investors who are investing for their goals ask:

The Arthgyaan HvN framework needs you to make a very 4x4 simple table with three asset class buckets and for each bucket asks you to calculate three numbers: the amount you already have (the HAVE column), the amount you need to reach your goals (the NEED column) and the difference between the two (the GAP column).

The three buckets are:

The columns are:

We also have a TOTALs row to give a high-level view of the portfolio.

To see worked-out examples for this framework, see How to invest a lump sum amount for your goals?

Investopedia defines bottom fishing as looking for bargains among stocks whose prices have recently dropped dramatically.

If you are an investor with some cash available, whether money is set aside for this purpose or from a recent windfall like a bonus, temporary market declines can present excellent bottom-fishing opportunities.

We have a daily-updated list of funds that have fallen recently here: Bottom fishing tracker: which mutual funds have fallen the most?

| Category | Any 1Y SIP |

|---|---|

| Hybrid: Aggressive | 9.56% |

| Equity: Large Cap | 11.48% |

Hybrid funds which mix equity and debt inside the same fund offer automated tax-free rebalancing without behavioural biases from the investor and can be more resilient during market corrections. Hybrid funds should be a core component of your portfolio. Don’t add 5-10% of your portfolio to hybrid funds and then expect resiliency since the debt allocation will be too low.

At Arthgyaan, we provide a free mutual fund portfolio review service available to all investors like you looking for a portfolio review for your mutual funds.

The Arthgyaan Mutual Fund Portfolio service will allow you to evaluate your mutual funds and give you mutual fund portfolio insights via an easy-to-understand report.

Please follow this guide to get a review completed: Analyse Your Mutual Fund Portfolio for Free with Arthgyaan’s Mutual Fund Review Service

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Stock Market Crash 2025: How Much Has the Nifty Fallen & What Should Investors Do? first appeared on 09 Mar 2025 at https://arthgyaan.com