Which are the Best Mutual Fund Categories for every Investment Horizon?

This article breaks down mutual fund categories based on your investment horizon-whether it’s 5, 10, or 15 years away.

This article breaks down mutual fund categories based on your investment horizon-whether it’s 5, 10, or 15 years away.

Disclaimer: This article does not have a list of best mutual funds. This article talks about mutual fund categories based on your goal and risk profile and how far your goal is.

The whole idea of goal-based investing relies on being able to access the target amount of your goal on the day it is due. For example, if you plan to pay ₹10 lakhs as fees for your child’s higher education and have invested for that goal, the money should be available on the admission date. To ensure this, the ₹10 lakh amount should not be invested, just before the payment is due, in any investment that carries risk, such as stocks, equity mutual funds, or certain debt funds whose value fluctuates daily or could suddenly fall.

On this basis, we have divided your entire goal horizon into five-year groups and allocated mutual fund categories according to the associated risk:

We will categorise the investor population into three risk-based categories:

Here is a detailed post on how to determine your risk profile for any goal. Based on that, you can proceed with choosing mutual funds.

| Target allocation | Years 5 or less | Years 5 to 10 | Years 10 to 15 | Years > 15 |

|---|---|---|---|---|

| Equity | N/A | Large-Cap | Large-Cap | Large-Cap |

| Debt | N/A | Arbitrage | Money Market | Short-term Gilt |

| Cash | Liquid | N/A | N/A | N/A |

| Target allocation | Years 5 or less | Years 5 to 10 | Years 10 to 15 | Years > 15 |

|---|---|---|---|---|

| Equity | N/A | Large-Cap | Large-Cap | Mid-Cap |

| Debt | N/A | Money Market | Short-term Gilt | Long-term Gilt |

| Cash | Arbitrage | N/A | N/A | N/A |

| Target allocation | Years 5 or less | Years 5 to 10 | Years 10 to 15 | Years > 15 |

|---|---|---|---|---|

| Equity | N/A | Large-Cap | Mid-Cap | Small-Cap |

| Debt | N/A | Short-term Gilt | Long-term Gilt | Long-term Gilt |

| Cash | Money Market | N/A | N/A | N/A |

Depending on your understanding of risk/return potential, other fund categories like international stocks, gold, or other debt fund categories can be added to the appropriate bucket.

To understand which mutual funds are the best in their category:

We need a method to divide your entire portfolio into these 12 categories (3 buckets: equity/debt/cash and 4 time-based groups) and allocate the correct amount of mutual funds to each.

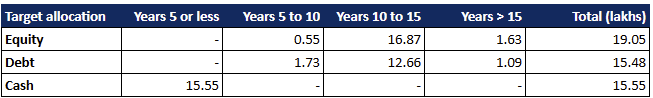

The Arthgyaan goal-based investing calculator shows you how to do this by making it easy to see how much of your existing portfolio should go into each bucket and year-based cell as shown in the image above. The detailed concept is explained here: Which are the Best Mutual Fund Categories for every Investment Horizon?

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

This table is in the “goals” tab on the right.

For example, based on the above, the category-wise allocations will be:

| MF Category | Low | Medium | High |

|---|---|---|---|

| Large-Cap | 19.05 | 17.46 | 0.55 |

| Mid-Cap | 0.00 | 1.58 | 16.92 |

| Small-Cap | 0.00 | 0.00 | 1.58 |

| Liquid | 15.55 | 0.00 | 0.00 |

| Arbitrage | 1.73 | 15.55 | 0.00 |

| Money Market | 12.62 | 1.73 | 15.55 |

| Short-term Gilt | 1.06 | 12.62 | 1.73 |

| Long-term Gilt | 0.00 | 1.06 | 13.68 |

| Total | 50.00 | 50.00 | 50.00 |

After a year, three things happen that you need to track as part of your annual portfolio review:

As a result, the values in each cell above will change, and you will need to review and rebalance the portfolio.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which are the Best Mutual Fund Categories for every Investment Horizon? first appeared on 21 Aug 2024 at https://arthgyaan.com