What should new investors do during a stock market correction?

This guide explains why new investors should focus on asset allocation more than fund selection, how to balance risk, and what steps to take based on your investment timeline.

This guide explains why new investors should focus on asset allocation more than fund selection, how to balance risk, and what steps to take based on your investment timeline.

We will consider any investor who has started investing since April 2020 as a new investor.

The logic of choosing this period is not based on the time that passed since then but on having the experience of market cycles.

Since April 2020, after the COVID-19-induced market bottom of March 2020, the stock market surged, with some funds delivering up to 5x returns in 5 years.

As a result, all investors who have started a SIP or invested a lump sum in mutual funds have not felt the pain of a correction until the period post-September 2024.

Any piece on market correction and equity investing is incomplete without asserting the nature of long-term returns in the equity market.

It is a fact that stock markets are volatile in the short term. It is also true that stocks have historically given positive returns in the long term.

The above two sentences are the bedrock of any investment plan involving the stock market.

But it is not that easy. Astute readers will notice that while stocks give good returns in the long term, money gets spent in the short term.

For example, you start your first job at 23, invest for 35 years in mutual funds, and then retire at 58. The first year of retirement, when you started investing was 35 years away i.e. was in the long term. But once you retire, the first year’s expense is now squarely in the short term.

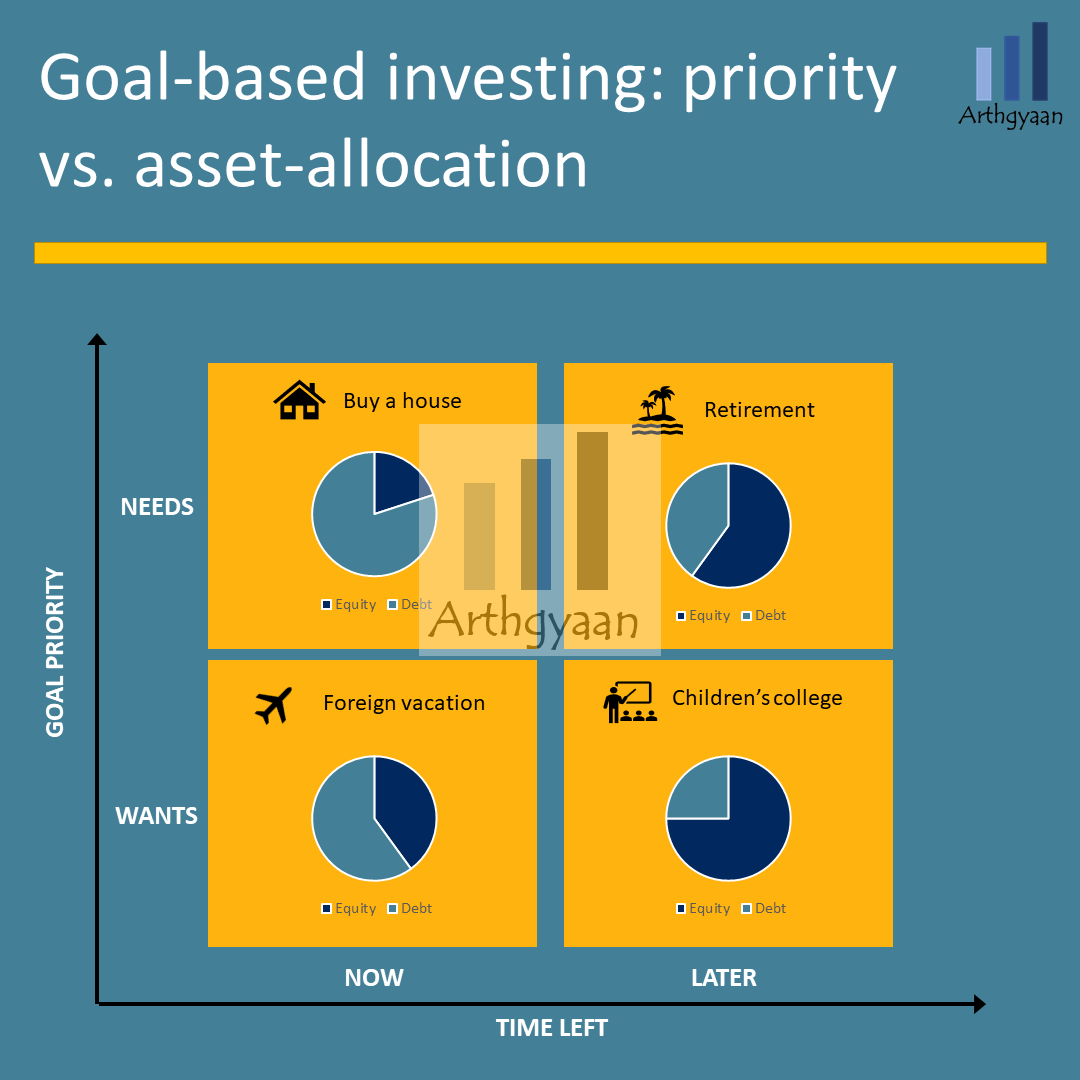

The solution to this fallacy is in asset allocation or the mix of risky and non-risky assets in the portfolio to fund a particular amount on a known future date. As the spending date comes closer, the asset allocation changes via rebalancing to make the allocation less risky.

The above table shows an example of what asset allocation looks like based on when you are spending your money.

Choice of funds is immaterial to long-term portfolio returns. Asset allocation is more important.

There are around 10,000 different mutual fund plans in the market today. Switching funds will not help if you switch from one type of fund to a similar fund:

If you plan to spend the money in the next five years, you should not have that in equity mutual funds. If you still have time left for the goal, start a SIP in a safer fund today to cover the goal. As the table below shows, lowest SIP returns can be pretty bad in the short-term in equity.

| Category | Any 1Y SIP | Any 2Y SIP | Any 5Y SIP | Any 7Y SIP | Any 10Y SIP |

|---|---|---|---|---|---|

| Equity: Large Cap | -24.9% | -3.65% | 4.8% | 10.89% | 13.38% |

| Equity: Mid Cap | -26.73% | 2.34% | 6.86% | 19.47% | 18.49% |

| Equity: Small Cap | -30.13% | 0.46% | 5.11% | 20.72% | 19.1% |

Otherwise, it falls into long-term investing and therefore equity can be a part of your portfolio.

Long-term investing is something most of us don’t understand. If you expect a normal lifespan in India, you will be around till your 80s at least. Depending on your age today, that will be a few decades away. You will be invested in equity throughout this period, except maybe for the last five years or so.

There will be at least 3-4 corrections like this per decade. Therefore, it is a good time to take stock of your investments by making a plan first and then implementing that instead.

You can look at Arthgyaan Packages for making your retirement planning simpler. Each Arthgyaan Package is a structured investment plan for retirement, ensuring financial security in later years through systematic wealth accumulation tagged to a particular retirement year. A package encapsulates the portfolio creation assumptions (equity / debt / cash asset returns, inflation, longevity and rebalancing plan) and creates a mutual fund (and EPF, PPF and NPS if applicable) portfolio. Choose the year closest to your desired retirement year to get started:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What should new investors do during a stock market correction? first appeared on 16 Mar 2025 at https://arthgyaan.com