What is the net-worth needed to FIRE in India?

A Step-by-step guide for finding out how much money you need to FIRE in India.

A Step-by-step guide for finding out how much money you need to FIRE in India.

FIRE is defined as:

FIRE = FI (Financially Independent) + RE (Retired Early)

FI = you do not need income from a job or profession since your investments generate enough to sustain your lifestyle

RE = retiring early before traditional retirement age

We have covered the rationale of pursuing FIRE at length in this post: What is the quickest way to reach FIRE?. In the context of creating a portfolio that allows you to FIRE, there is the obvious question that how much is enough. The corpus you need to accumulate is a function of your target lifestyle, savings rate and the time left. The net worth for FIRE is defined as:

Net Worth = Assets - Liabilities

Assets: shares and bonds, mutual funds, investments, gold, houses etc Liabilities: loans of any kind (home, personal, gold, education etc), credit card balance

We need to subtract loans from asset values since while you are paying off a loan, your portfolio value is reducing. It is also important to add a liquidity filter to the above definition of assets since when you are in FIRE you need assets that either generate sufficient income like stock dividends, bond coupons, rental income or enough capital gains due to price increases that you can use to live off. A portfolio of plots, apartments and houses that do not generate sufficient income should be excluded from FIRE calculation simply because you cannot convert that into cash to live off.

In this article, we will show a step-by-step way to arrive at your FIRE networth that is easy to implement and also ensures that your FIRE plan is successfully so that you do not run out of money mid-way.

Where you decide to live in FIRE will play an important role in figuring out your target corpus. The general rule is determining your quality of life (QOL) vs. the cost of living (COL) as per location:

The first parameter i.e. QOL is a personal choice. The lifestyle you want to have once you FIRE impacts the time it will take to reach the target. There are three kinds of FIRE:

The second parameter which is COL is shown below with some examples.

The table below shows monthly living costs for a family using data from Numbeo as well as real estate price trends using data from 99acres to give you an idea of costs in major cities. This excludes around ₹10-15,000/month of daycare and ₹10-30,000/month of school fees.

| City | Family of 4 | Single person | Rent 3BHK | Buy 1,250 sqft flat |

|---|---|---|---|---|

| Bangalore | 97,605 | 27,364 | 26,602-32,467 | 74L-91L |

| Mumbai | 1,03,223 | 29,333 | 64,222-76,623 | 1.81cr-2.12cr |

| Gurugram | 1,19,954 | 33,845 | 29,574-35,289 | 91L-1.07cr |

| Hyderabad | 91,227 | 25,540 | 24,203-29,230 | 57L-71L |

| Chennai | 90,181 | 25,472 | 24,509-30,706 | 72L-89L |

| Kolkata | 87,409 | 24,804 | 21,511-26,620 | 62L-75L |

You can use a template like this to figure out the expenses in the FIRE period: How can you figure out your expenses in retirement/FIRE?

The concept of inflation needs to be applied to all of your goals: how much do you think the goal will increase in cost every year in the future. It would be best to beat this figure, including the investments you make and the returns you get.

Important: CPI/WPI figures from the government are different from actual inflation applicable to your lifestyle. You should be in a position to calculate the changing cost of your basket of goods and services consumed under major budget heads on a year-on-year basis.

Some inflation assumptions:

Review goals at least yearly to figure out the current prices of your goal (the change since the last review will indicate the inflation)

There is an additional level of complexity if you consider paying for goals like children’s education/marriage as well as goals like regular foreign travel. If you do not have income, you are effectively at the mercy of stock markets. You can reduce your exposure to market fluctuations by using our goal-based investing calculators here or here but the fact remains that once you have FIREd, you should have saved for other goals already and kept them safe in non-risky assets. For example, if you need ₹1 crore for a child’s higher education in 8 years and you decide to FIRE today, then the present value of that 1 crore should be in a fairly safe debt mutual funds at the point of FIRE. If we assume that the fund will return around 3% after tax over 8 years then you need to invest 100/1.03^8 = 79 lakhs in the debt MF today when you FIRE.

Read more:

There are three parts to this question since you need to determine much time is there:

Reaching FIRE depends not on income but on investing to reach the FI stage - Author

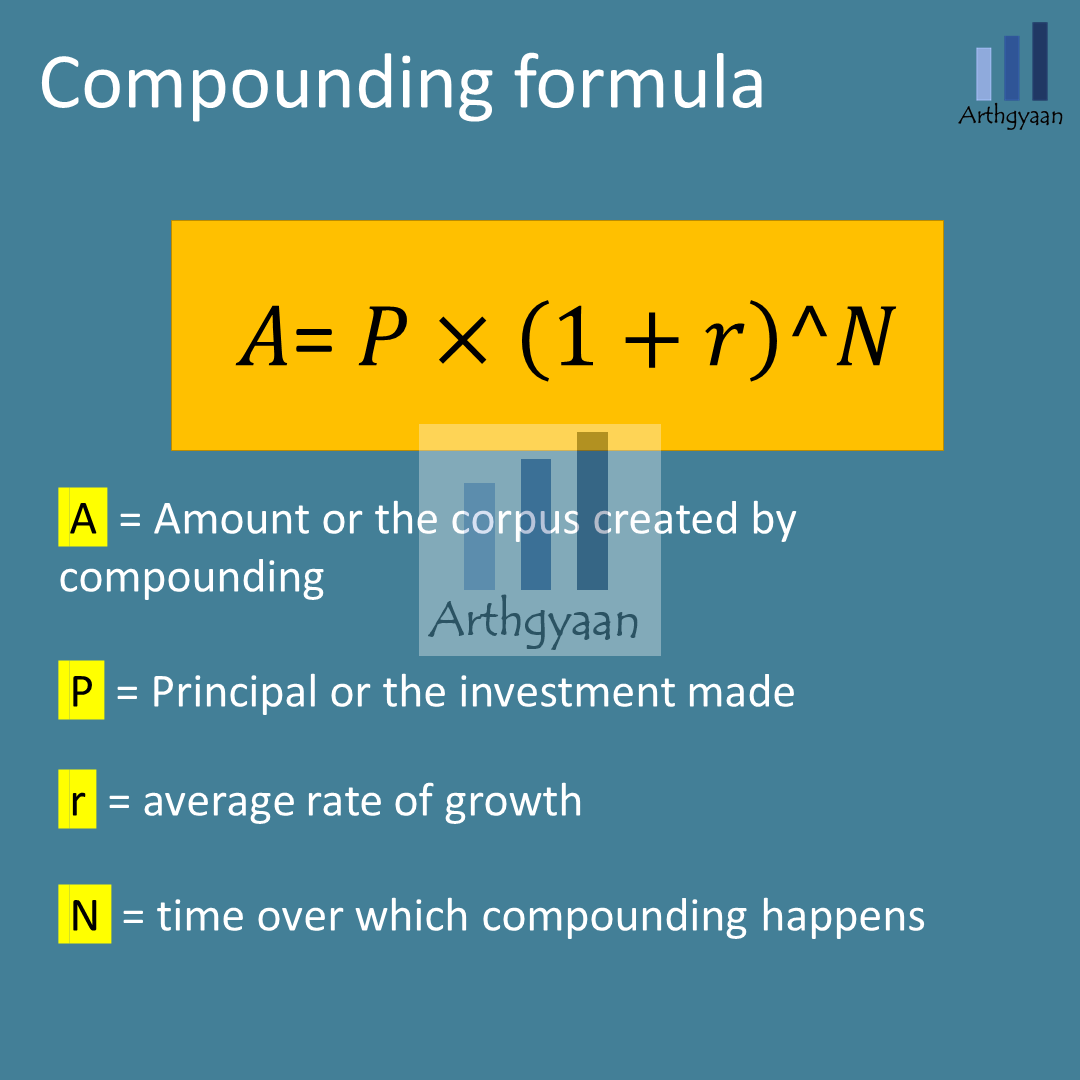

If you are explicitly targeting FIRE, it becomes a different type of goal. While we all know that compounding is magical, specifically while reading How compounding works: the journey to a 10 crore portfolio, it works best when you have time at your side. Unfortunately, suppose you wish to FIRE 5-15 years before your normal retirement age. In that case, you do not have the luxury of time to compound your portfolio.

The conclusions to be drawn from the compounding formula, when applied to a FIRE candidate, are:

The bottom line here is that you need to invest a lot and the only way to do that is by investing at a rate that you can maintain from today until FIRE. As a FIRE candidate, you need to fix a target savings rate that works and keep investing every month until you reach your FIRE target.

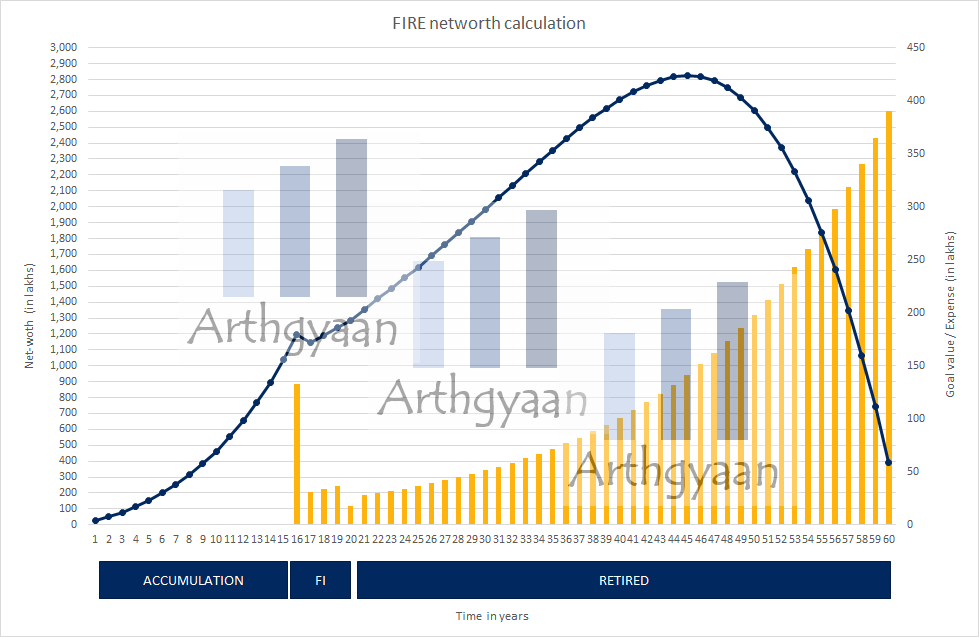

We will plan this in three stages:

The accumulation stage will have the same approach as anyone saving for retirement with two important changes:

If you are taking a home loan, the EMI should be completed before this stage ends.

Please review this detailed article on how to construct your portfolio in the Accumulation stage: I am 25 and want to FIRE by 40. How much should I save per month?

On the other hand, if your income increases steadily or there is a windfall gain, say from a rich relative or sale of real-estate, you might reach a stage where there is no need to invest more. At this point, the corpus you have is enough to grow on its own to reach the target value on its own. This is the concept of CoastFIRE.

This stage is an intermediate stage where your expenses may be fully funded by your FIRE portfolio, as per the definition of FI, but you may not choose to RE immediately. You can plan this using the method described in this post here: How do you get SIP amount for early retirement.

We are not a proponent of the Safe Withdrawal Rate (SWR) approach for managing the FIRE corpus since we believe that SWR leaves too many things to chance and cannot be demonstrated to work for India due to lack of data

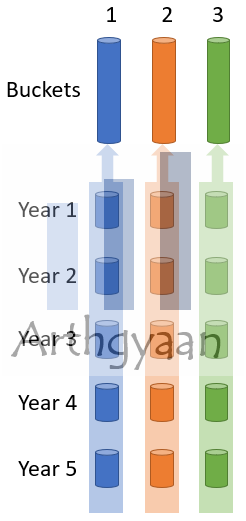

We use a modified version of the bucket theory of portfolio construction by creating 3 buckets: cash, debt and equity for each year in the RE stage. We believe that applying goal-based investing along with risk management via an appropriate glide-path per goal of yearly expenses maximises the chances of successfully completing the RE stage.

Please review this detailed article on how to construct your portfolio in the RE stage: How to plan for FIRE using the bucket approach?

The following needs to be done in this order every year:

At all times ensure that you have the following in place

Once you start investing,

We assume a family with the following goals:

The monthly expense figure is calculated at the beginning of this 15+5+40 = 60 year period and will be inflation-adjusted by 7%. We will use the comprehensive goal-based investing calculator to derive the monthly investment assuming 25 lakhs of current corpus and 10% increase in investments every year. There will not be any income in the RE stage and in the FI stage there will be 20k/month income using a variation of BaristaFIRE which accounts for the gap in spending in the FI and RE stages.

The family will have to create

The total SIP amount comes to almost 2lakhs/month of which ₹1.16 lakhs is in equity and the rest is in debt. The SIP amount will have to be increased by 10% every year based on annual portfolio review. This amount looks very large but look at what you are getting:

If the amount looks unachievable for the time being, you can start small and adjust your goals along the way.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the net-worth needed to FIRE in India? first appeared on 03 Apr 2022 at https://arthgyaan.com