You cannot beat inflation even with equity mutual funds: here's why

Investing in a mixed portfolio of equity and debt mutual funds cannot beat inflation in most cases

Investing in a mixed portfolio of equity and debt mutual funds cannot beat inflation in most cases

Equity mutual funds are widely considered to be able to beat inflation over large periods while debt as an asset class does not. But even by investing in equity funds, it may not be possible to beat inflation at all.

For any long term goal, the asset allocation will have a mix of equity and debt. Also, to manage the risk of the portfolio over time the equity component has to be reduced over time as per the right glide-path via rebalancing. Both of these effects (a mix of equity and debt and maintaining a glide-path via rebalancing) together makes it very difficult to beat inflation over the entire duration of the investment.

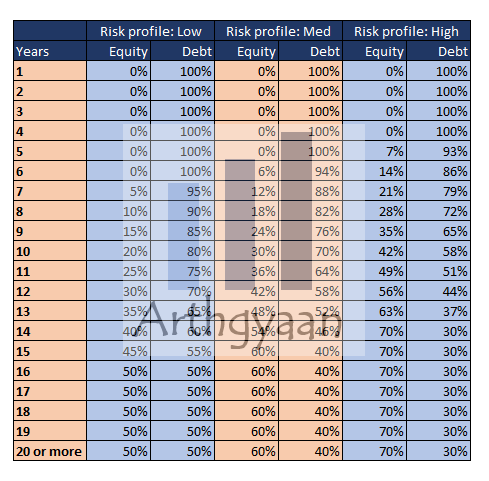

As discussed in this detailed post on asset allocation, a typical proportion of long term goals will be like this based on the risk profile of the goal and the investor. We will assume the Medium risk profile for the example in this post.

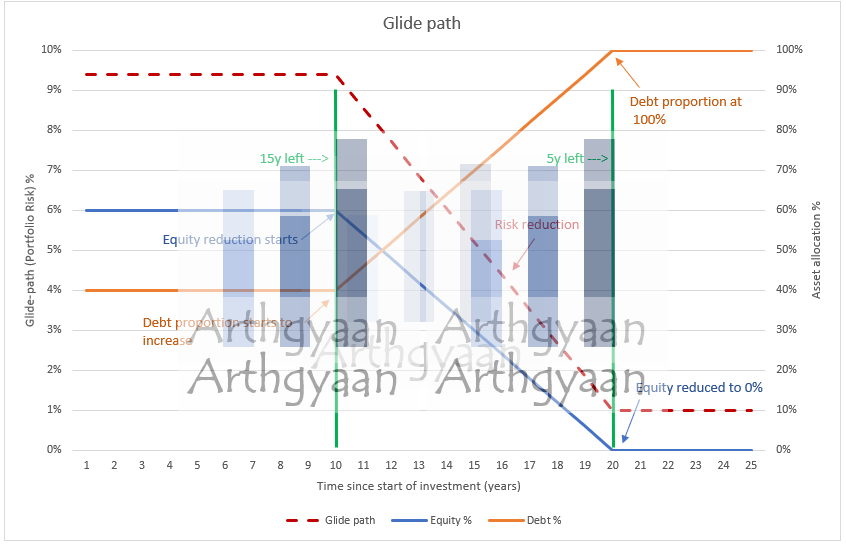

This post on glide-path describes how the equity portion of the portfolio is gradually brought down over time to manage risk via rebalancing.

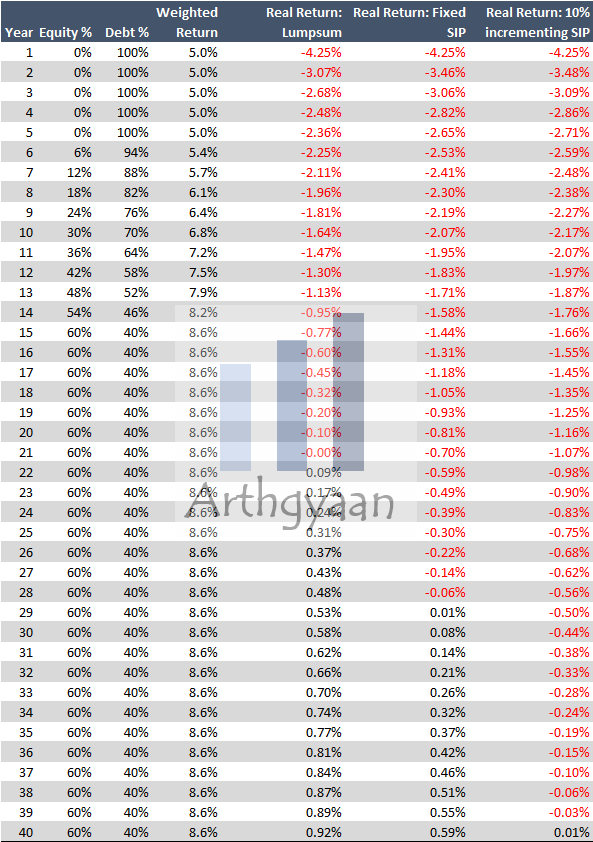

This table shows the calculation of effective return using the Medium asset allocation and average equity and debt returns of 4% above inflation and 2% below inflation respectively. This is deliberately chosen to not distract this analysis with assumptions of long term equity and debt returns. The columns show

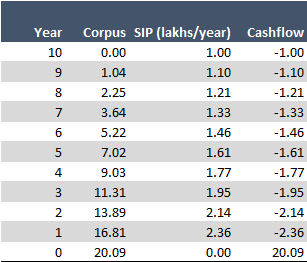

We use the table above to work out on case where a 10% incrementing SIP is created for 10 years. The corpus grows like this:

We use the last column of this table to calculate IRR which comes to 4.83%. With a 7% inflation assumption, this works out to a real return of -2.17% which is there in row 10, the last column of the table under Real Return: 10% incrementing SIP. AS this table shows, with these starting assumptions (7% inflation and equity/debt returns) we need to invest for:

Case 1 shows that a long term lump sum investment (say a gift for children’s education) needs more than 20 years to beat inflation with 60% starting equity investment

Case 2 shows that a standard SIP does not beat inflation before 30 years. This will come as a big shock to many investors who believe that starting a SIP will beat inflation over time.

Case 3 shows the same result but due to an incrementing SIP, a larger amount is invested near the end of the goal which has a more conservative portfolio.

The key takeaways for investors are

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled You cannot beat inflation even with equity mutual funds: here's why first appeared on 29 Jun 2021 at https://arthgyaan.com