What is MFCentral and why you should be using it?

This article introduces MFCentral as a one-stop-shop for transacting in mutual funds for Indian mutual fund investors.

This article introduces MFCentral as a one-stop-shop for transacting in mutual funds for Indian mutual fund investors.

Please use the Find feature of your browser to look for specific items of interest.

MFCentral is a free-to-use website owned by the Mutual fund Registrar and Transfer Agents (RTAs) CAMS and Karvy. Using the MFCentral website / app, individual resident Indians can buy/sell every mutual fund available for investing from all AMCs. Also, the site offers an easy-to-use facility to place service requests like Folio merging, updating contact details and others.

MFCentral is a free-to-use website owned by the Mutual fund Registrar and Transfer Agents (RTAs) CAMS and Karvy. Using the MFCentral website / app, individual resident Indians can buy/sell every mutual fund available for investing from all AMCs. Also, the site offers an easy-to-use facility to place service requests like Folio merging, updating contact details and others.

If you are an existing mutual fund investor with KYC completed, using MFCentral is fully online.

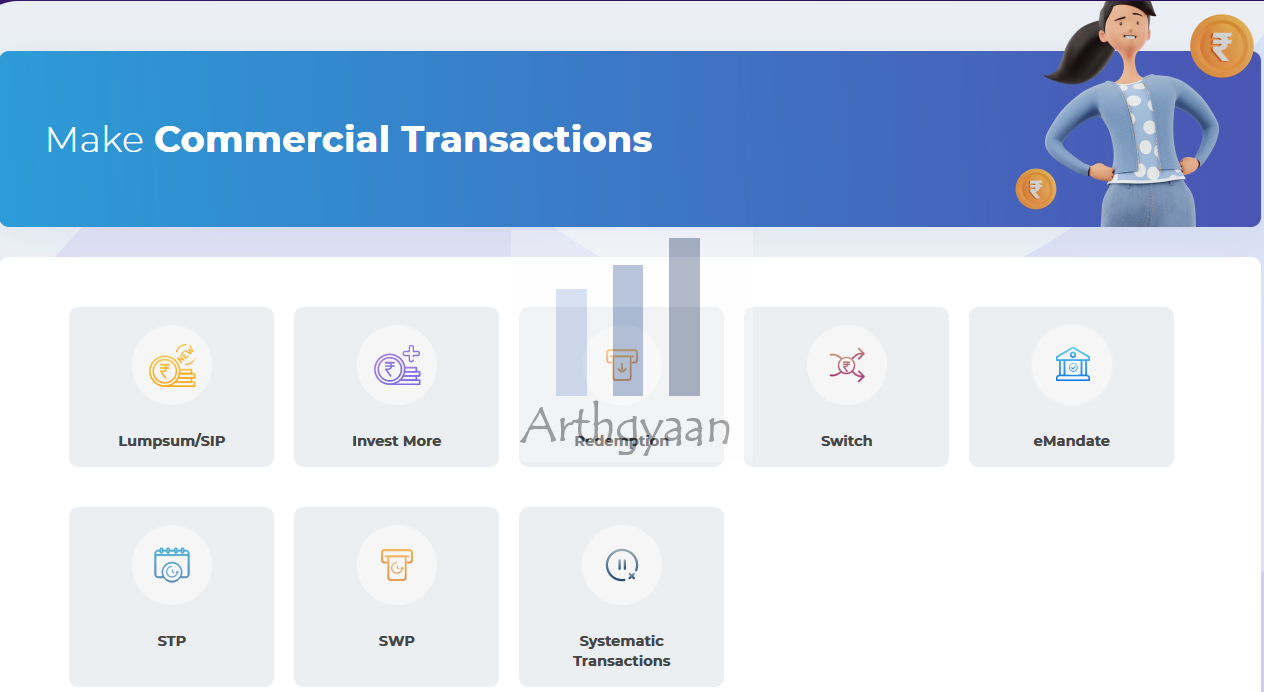

MFCentral supports both lumpsum and SIP for buying funds as well as SWP and STP for selling funds

MFCentral offers online transactions across all mutual funds, service requests and portfolio tracking in an easy-to-use and modern UI all for free. Investors have one login id (which can be PAN) and have password/OTP based logins for all funds.

MFCentral offers all mutual fund plans including Direct plans. Growth and Dividend (IDCW) plans are also available.

MFCentral offers equity, debt, and hybrid funds from 43+ AMCs.

MFCentral offers portfolio view for all funds held under your PAN, buy/sell/switch/SIP/SWP etc. for all mutual funds as well as service requests.

MFCentral offers portfolio view for all funds held under your PAN, buy/sell/switch/SIP/SWP etc. for all mutual funds as well as service requests.

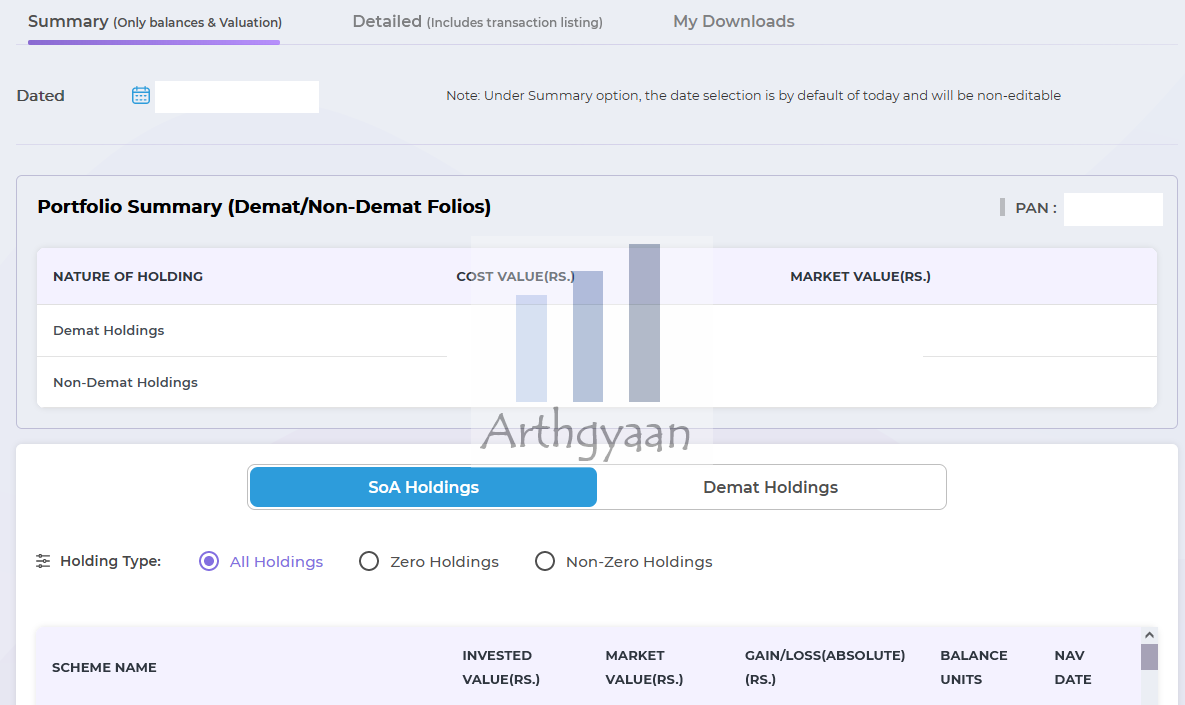

MFCentral offers portfolio view by asset class (equity/debt/liquid), AMC wise and fund wise. Invested value, current market value at latest NAV and absolute profit/loss is shown. Percentage of holding in different funds and AMCs is also available.

MFCentral allows buy, sell, switch along with SIP, SWP and STP transactions across all supported mutual funds.

MFCentral allows buy, sell, switch along with SIP, SWP and STP transactions across all supported mutual funds.

At the time of writing, MFCentral offers mutual funds from 43+ AMCs.

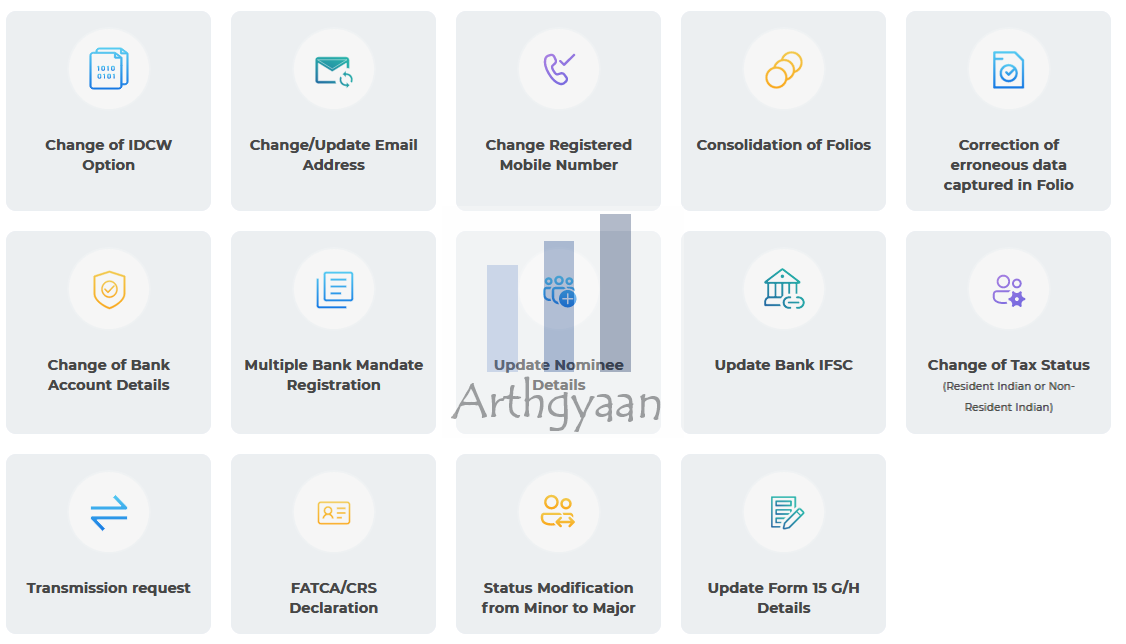

MFCentral supports mostly online, and some offline, service requests like update of contract details, data correction in folios, update of bank details, nominee updates and many others. One useful feature they have is closing folios with zero balance.

MFCentral supports mostly online, and some offline, service requests like update of contract details, data correction in folios, update of bank details, nominee updates and many others. One useful feature they have is closing folios with zero balance.

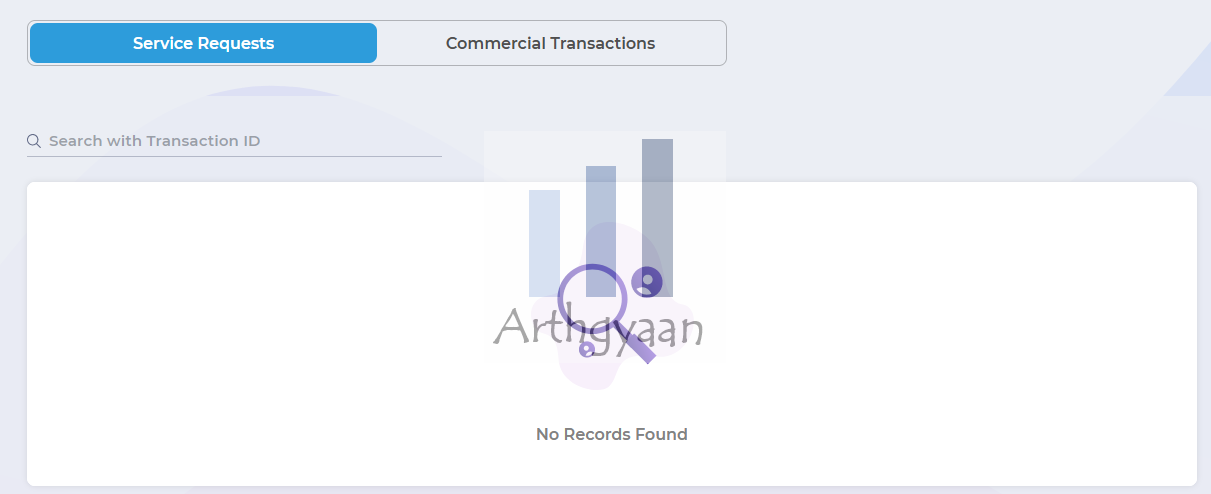

MFCentral shows the status requests for both Service Requests and Financial Transactions (like buy/sell/switch etc.) placed though the platform.

MFCentral shows the status requests for both Service Requests and Financial Transactions (like buy/sell/switch etc.) placed though the platform.

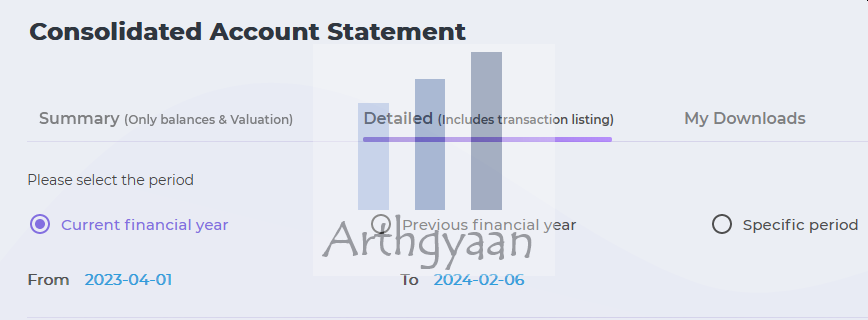

MFCentral offers list-wise transaction, SIP/SWP and portfolio holding statements.

MFCentral offers list-wise transaction, SIP/SWP and portfolio holding statements.

Yes, MFCentral shows demat-based holdings like ETFs and any funds held in a demat account. The data is sourced from NSDL or CDSL directly.

Yes, MFCentral shows demat-based holdings like ETFs and any funds held in a demat account. The data is sourced from NSDL or CDSL directly.

MFCentral does not offer capital gains statement. You can however get it from the Consolidated Gains statement from CAMs website.

MFCentral currently does not support NRIs. But you can submit a service request to change your status between resident Indian to NRI.

Portfolio and CAS will be shown only for those folios when the first holder’s PAN and mobile are used to register into the MFCentral website.

MFCentral does not show metrics like XIRR.

MFCentral is a free-to-use website owned by the Mutual fund Registrar and Transfer Agents (RTAs) CAMS and Karvy. Using the MFCentral website / app, individual resident Indians can buy/sell every mutual fund available for investing from all AMCs. Also, the site offers an easy-to-use facility to place service requests like Folio merging, updating contact details and others.

If you are an existing mutual fund investor with KYC completed, using MFCentral is fully online.

MFCentral supports both lumpsum and SIP for buying funds as well as SWP and STP for selling funds

MFCentral offers online transactions across all mutual funds, service requests and portfolio tracking in an easy-to-use and modern UI all for free. Investors have one login id (which can be PAN) and have password/OTP based logins for all funds.

MFCentral offers all mutual fund plans including Direct plans. Growth and Dividend (IDCW) plans are also available.

MFCentral offers equity, debt, and hybrid funds from 43+ AMCs.

MFCentral offers portfolio view for all funds held under your PAN, buy/sell/switch/SIP/SWP etc. for all mutual funds as well as service requests.

MFCentral offers portfolio view by asset class (equity/debt/liquid), AMC wise and fund wise. Invested value, current market value at latest NAV and absolute profit/loss is shown. Percentage of holding in different funds and AMCs is also available.

MFCentral allows buy, sell, switch along with SIP, SWP and STP transactions across all supported mutual funds.

At the time of writing, MFCentral offers mutual funds from 43+ AMCs.

MFCentral supports mostly online, and some offline, service requests like update of contract details, data correction in folios, update of bank details, nominee updates and many others. One useful feature they have is closing folios with zero balance.

MFCentral shows the status requests for both Service Requests and Financial Transactions (like buy/sell/switch etc.) placed though the platform.

MFCentral offers list-wise transaction, SIP/SWP and portfolio holding statements.

Yes, MFCentral shows demat-based holdings like ETFs and any funds held in a demat account. The data is sourced from NSDL or CDSL directly.

MFCentral does not offer capital gains statement. You can however get it from the Consolidated Gains statement from CAMs website.

MFCentral currently does not support NRIs. But you can submit a service request to change your status between resident Indian to NRI.

Portfolio and CAS will be shown only for those folios when the first holder's PAN and mobile are used to register into the MFCentral website.

MFCentral does not show metrics like XIRR.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is MFCentral and why you should be using it? first appeared on 06 Feb 2024 at https://arthgyaan.com