CRED acquires Kuvera: What should Kuvera users do now?

This article lays out the options for users of Kuvera now that CRED has acquired them.

This article lays out the options for users of Kuvera now that CRED has acquired them.

CRED, known for credit card payments and CRED coins, has acquired online robo-advisor Kuvera for an undisclosed amount on Tuesday, 6-Feb, 2024.

Kuvera’s CEO, Gaurav Rastogi tweeted this:

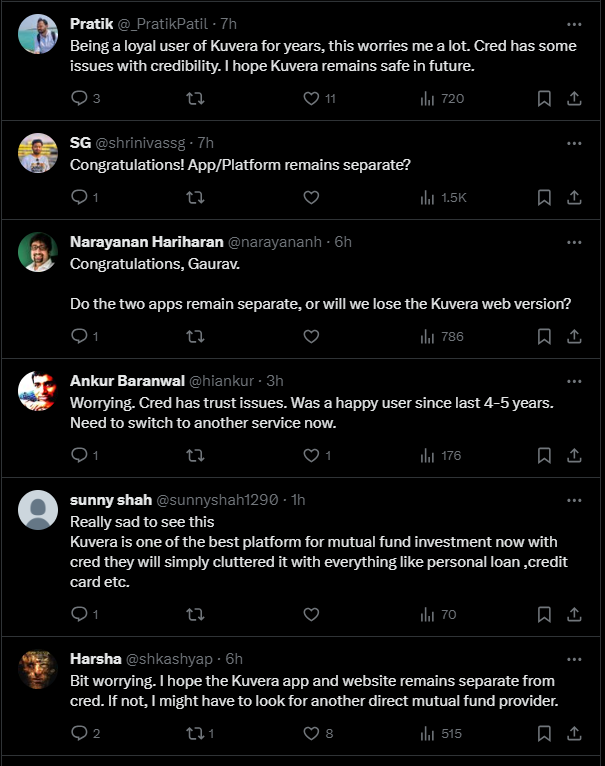

However, Twitter/X users expressed mixed emotions on the thread:

We will discuss three possible options for Kuvera users at this point.

A wait and watch approach is generally a good thing in such cases to avoid any knee-jerk reactions. Kuvera offers excellent user-friendly features like a simple UI/UX, family portfolio tracking, tax harvesting and automated imports of portfolios which make it very popular.

Also, Kuvera users should be happy that a fresh capital infusion will keep their platform of choice up and running longer.

For the time being, both CRED and Kuvera have provided statements about maintaining status quo. Customers should maintain the option of looking for changes that they do not like and then decide whether to switch or not.

Big changes like getting rid of the web version of Kuvera or integrating the app into CRED can be changes to watch out for.

If Kuvera users at all wish, there is no platform lock-in here since Kuvera does not place mutual fund units in a demat account. Therefore moving off is easy.

One of the biggest selling points of a platform like Kuvera is the data of the users it possesses like portfolio holdings, choice of funds and flows based on age, demographics and news flow. This kind of data can be extremely useful to another Fintech startup which can utilise this data for multiple purposes including cross-selling.

Fortunately for users, orders placed via Kuvera are in Statement of Account (SoA) mode. Even AMC websites, should you so desire, can be used to buy and sell your mutual funds. Most of them offer easy to create accounts via PAN and Folio number.

Kuvera users who are not comfortable with any changes have three things to do:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled CRED acquires Kuvera: What should Kuvera users do now? first appeared on 07 Feb 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.