What are the best ways to pay off a large credit card balance quickly?

This article gives the list of people to whom you can give or receive gifts like cash, property, stocks, mutual funds or any other assets without paying tax.

This article gives the list of people to whom you can give or receive gifts like cash, property, stocks, mutual funds or any other assets without paying tax.

This article is a part of our detailed article series on the concept of paying off loans. Ensure you have read the other parts here:

This article shows a few ways to avoid and escape from EMI traps to be able to invest via goal-based investing.

We discuss the two common debt payment methods that exist which can be used to easily pay off multiple loans: the avalanche and snowball methods.

This article answers a question from our Facebook group.

Please feel free to join the private Facebook group to ask your own questions here:

See the actual post on Facebook.

Recently, I bought a house, and due to some last-minute changes, I had to use my credit card for 8 lakhs. Initially, I thought I could convert it to a 6-9 month EMI and pay it off quickly. However, I’m now unable to convert it to EMI, and the bank states they can’t assist. I’m comfortable repaying the entire 8 lakhs in 6 months, but I’m unsure how to handle this without incurring interest on the full amount.Because If I don’t pay whole 8 lacs outstanding then the interest would charge on whole 8 lacs(Pleas correct me If I am wrong).Any suggestions on how to proceed would be greatly appreciated.

Let us extract the key details from the query:

We can refer to this post to understand how interest charges on a credit card balance work: Don’t Get Caught in the Credit Card Debt Trap: Unmasking Interest Calculation & GST Charges

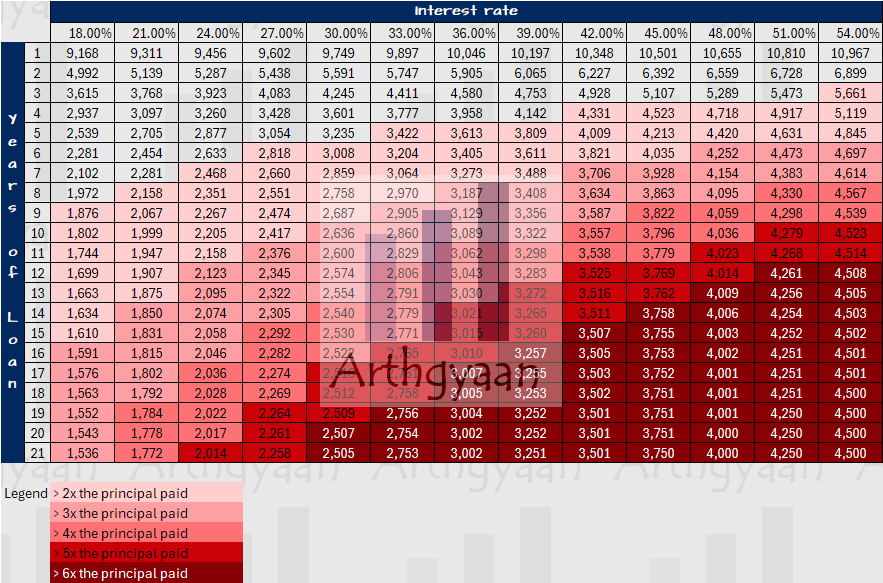

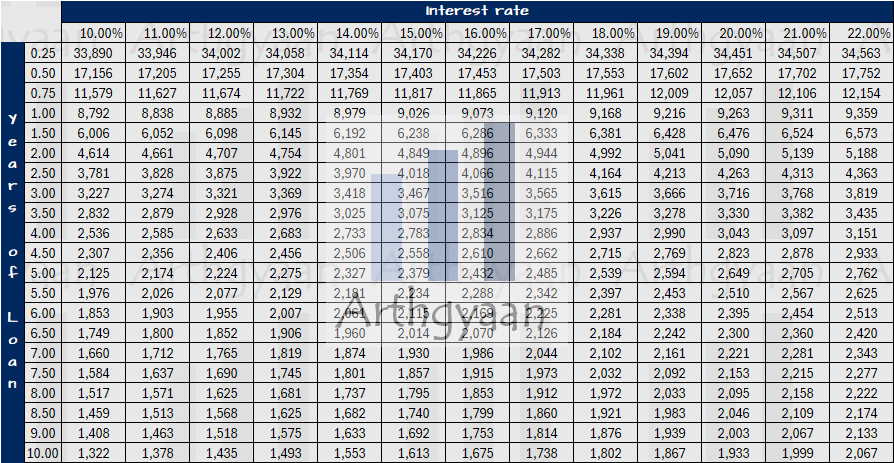

A personal loan say at a 12% interest rate will cost ₹23,006/lakh for 6 months. For this case, for an 8 lakh balance, the EMI will be:

The total interest paid for a ₹8 lakh loan will be

You can refer to the entire article on EMI per lakh for all loans here: EMI Calculator: know your EMI per lakh to easily know how much total EMI you have to pay.

A loan from friends or family might also work depending on how you can negotiate and amount and the interest rate. The same logic can be applied to a gold loan.

A simple option is to sell off any investments like shares or mutual funds to pay off the credit card balance. If there are any long-term capital gains and given that this is for a house purchase, there is a potential of saving capital gains tax under Section 54F: Sec 54F: a hack that can save lakhs in taxes when you buy a house. Even if there are no or limited long-term capital gains, the interest saved will likely be higher.

Then you can use the same EMI amount as the personal loan (or credit card EMI) to replenish the mutual fund portfolio. This plan works very well as explained here: Should you take a personal loan to invest in the stock market or mutual funds?.

If there are other cards available which allow an incoming balance at either 0% for 30-60 days or a low rate like 1.8% for 6 months. Card generally allow usage of up to 80% of their credit limit for a balance transfer.

If the home being purchased already has a home loan, then a top-up loan from the same bank as the home loan is a cheaper way to pay off the credit card loan:

Each of these options will have different processing times. A general thumb-rule for processing time could be:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the best ways to pay off a large credit card balance quickly? first appeared on 09 Feb 2024 at https://arthgyaan.com