Sovereign Gold Bond (SGB) 2023-24 (Series IV) is priced at 6263: Who Should Invest?

Sovereign Gold Bond (SGB) 2023-24 (Series IV): know all the details about it to decide if you should invest.

Sovereign Gold Bond (SGB) 2023-24 (Series IV): know all the details about it to decide if you should invest.

This article is a part of our detailed article series on the new issues of Sovereign Gold Bond (SGB) as well as maturity of existing SGBs. Ensure you have read the other parts here:

The Feb 2017 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Nov 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Sep 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Aug 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Mar 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

The Feb 2016 SGB showcased a fantastic return on maturity compared to other investment avenues like fixed deposits and some equity mutual funds.

Sovereign Gold Bond (SGB) 2023-24 (Series III): know all the details about it to decide if you should invest.

The 2015 Series I SGB showcased a notable return on maturity compared to other investment avenues like fixed deposits and certain equity mutual funds.

Sovereign Gold Bond (SGB) 2023-24 (Series II): know all the details about it to decide if you should invest.

Sovereign Gold Bond (SGB) 2023-24 (Series I): know all the details about it to decide if you should invest.

A Sovereign Gold Bond (SGB) is a piece of paper issued (in digital form) by the Government of India with the following features. For every unit of SGB purchased, the investor will:

To know more about SGB as an investment, please read this list of detailed SGB-related FAQs: Frequently asked questions on Sovereign Gold Bonds (SGB): the complete guide.

SGB is issued by the RBI periodically. This particular series or tranche is called Sovereign Gold Bond (SGB) 2023-24 (Series IV). These are the details of this particular series

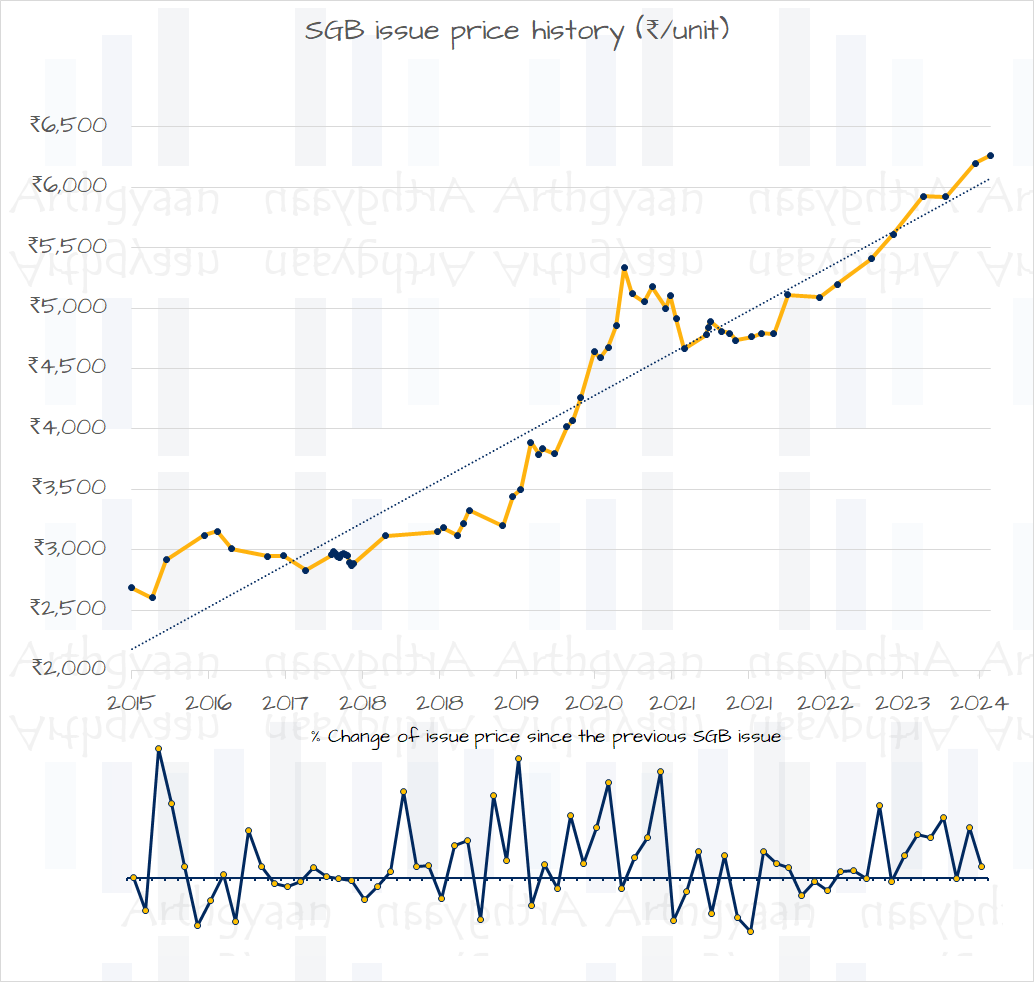

1 unit of Sovereign Gold Bond (SGB) 2023-24 (Series IV) is priced at ₹6263. Price for online subscription with digital payment is ₹6213 per unit.

The complete press-release is available here.

SGB is offered for purchase via most banks, post offices, stock exchanges like NSE/BSE (a demat account is needed) or via the Stock Holding Corporation of India Ltd (SHCIL).

If you have not invested in this tranche via the options above, you can buy SGB from the secondary market i.e. the stock exchange: How to buy SGB from the stock market?.

NRIs cannot invest in SGB.

SGB gives you the exact return of gold price movement (as measured by the IBJA rate of 999 purity gold) that too tax-free plus 2.5% interest.

There are 3 main ways of buying gold in India:

Of these three options, SGB gives the highest return in case you buy gold as SGB: The Ultimate Guide to Which Type of Gold Gives the Best Returns.

The actual return from holding SGB will depend on the price of gold on the maturity date 8 years later and is completely unpredictable. RBI will guarantee that if you invest ₹6263 in this tranche today, you will get the 6-monthly interest but the money you will get will on maturity depend again on the IBJA gold rates at that time.

Historically, gold has returned over 9% a year in India since the 1950s. This means that the price of gold has essentially doubled every 8 years as per the Rule of 72. Since we import most of our gold, the domestic price of gold has fluctuated a lot due to Rupee depreciation against the US Dollar over the decades. Over the years, the average 8-year gold price return has been around 10%. SGB gives a slight interest and is therefore the only option to invest in Gold with the highest possible return.

Here is a complete history of gold price in India: A complete history of gold prices in India since the 1950s.

To understand better about whether SGB is right for you:

We see the following use cases for purchasing SGB:

The complete SGB price history in India is here:

The complete details of all SGB issued so far are available here: Sovereign Gold Bond (SGB): complete issue price history in India.

1 unit of Sovereign Gold Bond (SGB) 2023-24 (Series IV) is priced at ₹6263. Price for online subscription with digital payment is ₹50 less per unit.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Sovereign Gold Bond (SGB) 2023-24 (Series IV) is priced at 6263: Who Should Invest? first appeared on 09 Feb 2024 at https://arthgyaan.com