Why you must complete your mutual fund nominations before 31st December 2023?

As per SEBI rules, mutual fund investors must have nominees in their folios or explicitly opt out. Otherwise they will face restrictions in selling units.

As per SEBI rules, mutual fund investors must have nominees in their folios or explicitly opt out. Otherwise they will face restrictions in selling units.

This article is a part of our detailed article series on the concept of nominees, legal heirs and wills in India. Ensure you have read the other parts here:

This article touches upon the important distinction between nominees and legal heirs in India and shows the right thing to do avoid disputes over succession.

This article gives you a list of common terms in use in Indian succession law on the concept of legal heirs, nomination and the concept of making a will.

Update: As on 29-Dec-2023, the deadline has been pushed to 30-Jun-2024 from 31-Dec-2023.

In accordance with SEBI Circulars #SEBI/HO/IMD/IMD-II DOF3/P/CIR/2022/82 dated Jun 15, 2022, and SEBI/HO/IMD/IMD-I POD1/P/CIR/2023/47 dated Mar 28, 2023, in case of existing individual unitholder(s), who haven’t registered their nomination / opting out of nomination, before June 30, 2024, their folios will be frozen for any debits including redemption. [Redemption, Switch and Transactions of already registered Systematic Transfer Plans (STP) / Systematic Withdrawal Plans (SWP) will not be allowed].

Having a nominee in your mutual funds will make transmission easier in case the investor dies.

In case of absence of nomination, the legal heirs will have to produce additional documentation like a succession certificate which might make the process lengthy and cumbersome.

It might also happen, and this is very common, that the family does not have any clue what investments are there and how to access them. In a future article, we will cover the best way to make a list of assets and share them with family members to avoid such a situation.

A nominee is a temporary custodian of assets until the transfer to the legal heir is completed

Only the legal heir get the units eventually after the investor’s death. The nominee is just the executor of the estate but may not necessarily be the legal heir.

As per the AMFI notification, those folios will not be allowed to sell any units either as a redemption or a switch out.

As per the AMFI notification, you can either update the nominee details in mutual fund portfolios, or explicitly opt out. Since one folio might have multiple mutual funds in it, you need to update only on a per-folio basis and not on a per-fund basis.

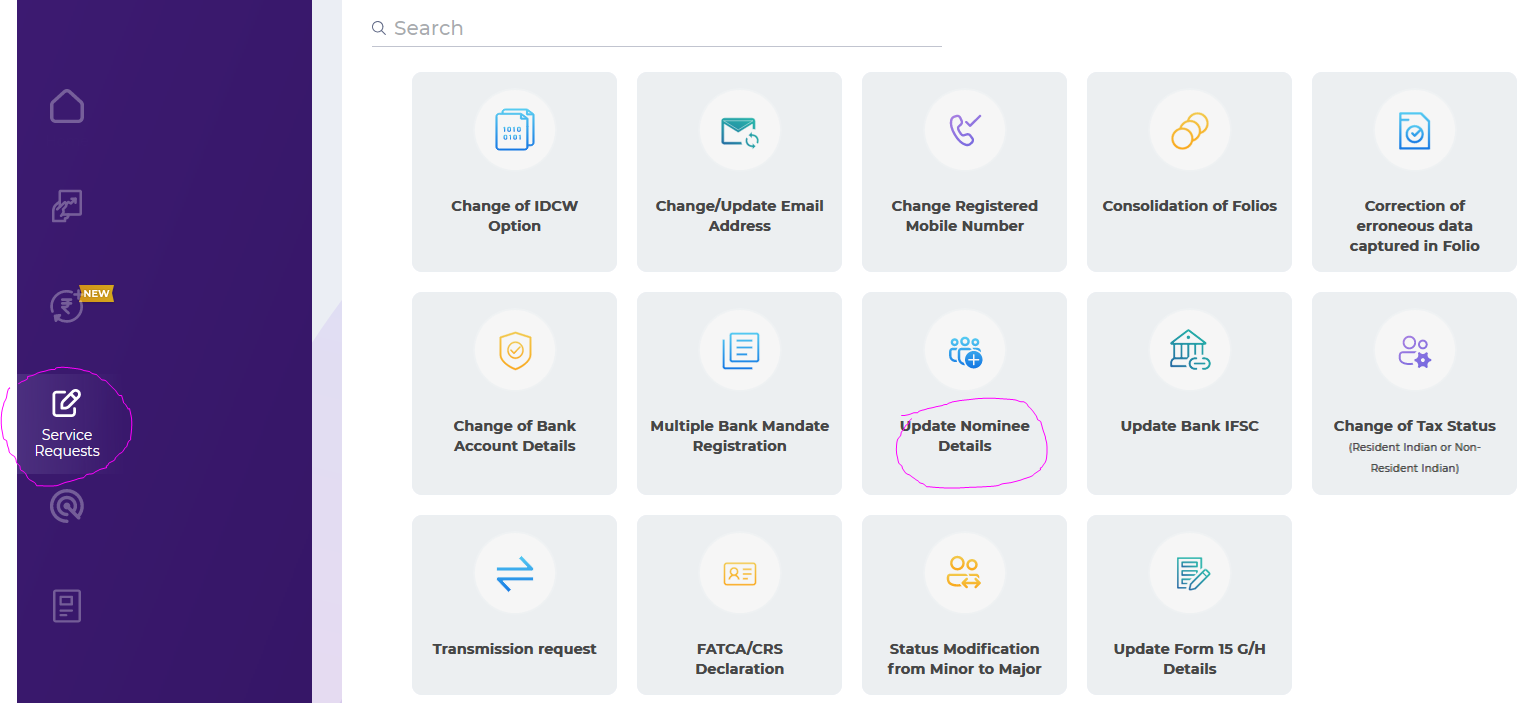

There are multiple ways to update the nomination:

CAMs and KFintech websites offer the facility to update nominees or opt out fully online. We will not give the direct links here, to avoid phishing or stale links, but you can use Google search:

In this method you need to remember which AMCs are with CAMs and which are with KFintech and act accordingly. The easier on-stop method is described below.

MFCentral offers all mutual funds serviced by both CAMs and KFintech. You can seee all folios mapped to MFCentral and update them in one place.

If you have invested in mutual funds via your demat account, for example with Zerodha Coin, please login to your demat account to check the nomination. The same nomination for stocks will be carried over to your mutual fund units.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Why you must complete your mutual fund nominations before 31st December 2023? first appeared on 24 Sep 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.