How to budget, save and invest without regular income from salary?

If you have an irregular income then follow these steps to spend, save and invest in a worry-free fashion.

If you have an irregular income then follow these steps to spend, save and invest in a worry-free fashion.

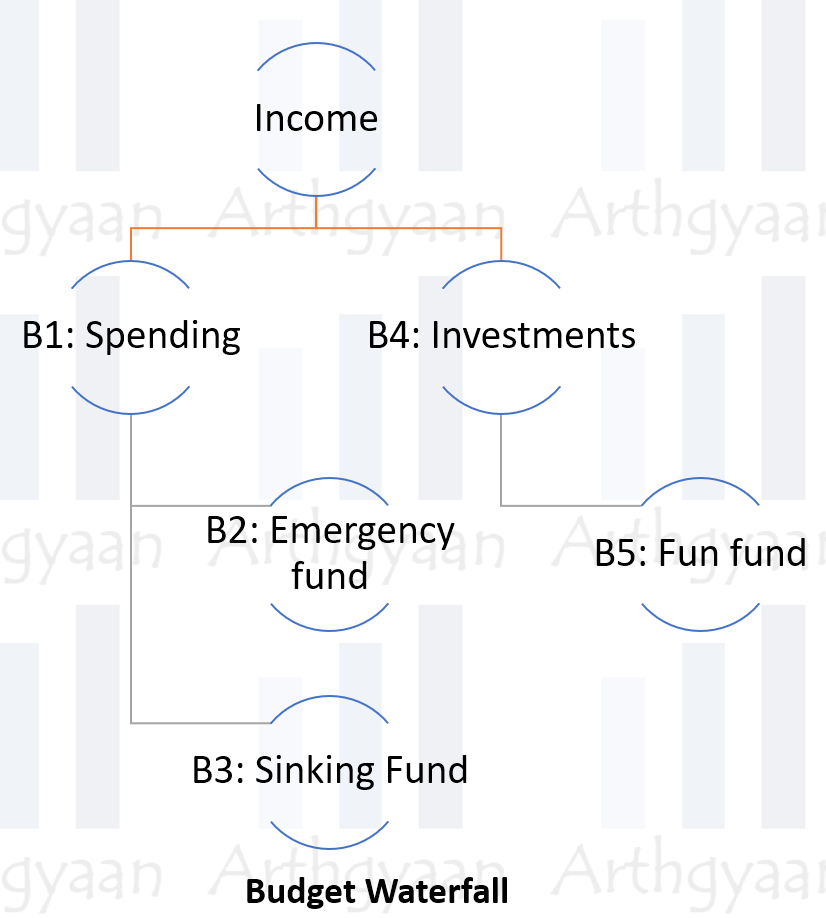

If you have an irregular income (via profession, business, freelancing or consulting) instead of a regular salary, use these techniques to smoothen your budget by creating multiple buckets for each area: spending, savings and investments.

Monthly mandatory (X): maintain 3X in a savings account for running the regular household and business-related expenses. Expense items like rent, maintenance, utilities (internet, mobile, electricity), food, transportation, petrol, newspaper, cable TV, medicines, software costs and EMIs come under this category.

Imagine a bucket that drips out slowly and gets filled when there is a water supply in the house (aka income). If you are paying your own taxes (as opposed to employer deductions), then include taxes to be paid on the next advance tax filing date here.

Monthly variable (Y): This bucket is a mix of expenses that can vary from month to month (work-related travel, clothing, personal care, entertainment and other miscellaneous costs) or are discretionary like Netflix and gym memberships. Keep 3Y in a savings account to draw down from when the expense happens.

For budgeting to be effective, you should track expenses via apps like Hello Expense, YNAB, or anything (even a spreadsheet or physical diary) that allows you to note down expenses as you make them. Use the Pareto principle (ensure that the biggest spends and recurring smaller spends are both captured). This way, it is not necessary to track every rupee spent. The target here is to be more or less accurate regarding your estimated and actual spending. Try to limit your monthly expenses to the amount leftover in this bucket as much as possible to prevent spilling over into the other buckets or taking on credit-card debt.

Any money above these two will go into your emergency fund. Target 6-12 times expenses over time into a bank account or liquid mutual fund for this purpose. Keep this bucket topped up for periods where income is lower than expected (the mandatory bucket is running low). Pay for any unforeseen expenses from this fund. The emergency fund is covered in detail in this post.

Annual fixed (Z): This is for items like insurance (life, health, personal accident, vehicle) payments, trips, festival shopping etc. Estimate the yearly value Z for all of these and target saving Z/12 every month in the bank. This account is called a sinking fund. Funds for the replacement of assets like computer/laptop and related equipment, household goods (fridge, TV , washing machine etc.) as well as software subscriptions, should be included in this category. For more details on the sinking fund, see this detailed post

Anything after this, as and when you have the surplus, goes into investment for goals. Start investing by setting your goals. Pay your SIPs from this bucket immediately once you transfer money to the bucket.

Over time once Buckets one, two and three are generally full, then make contributions into Bucket four a mandatory “expense”. This is called “Pay-yourself-first”. Start with a low figure like 10% and transfer that into Bucket four as soon as you have income. Over time increase this proportion higher as you get more visibility into your income. This way you do not have the money available to be spent for other purposes since you never get to see it.

Create another bucket called the fun fund: save money here for things that you want to do or have. Trips, gadgets, and experiences come from here. Do not use the emergency fund for “fun” or non-emergency expenses.

Since debt payment is a large topic, it is handled separately here which is to be read along with the post on paying yourself first.

There is a lot of advice out there on using thumb-rules like having out of total income use x% for expenses, y% for investing etc. The problem with this approach is that this gives a false sense of suitability. Everyone’s situation and goals are different.

If a expenses % value is given, then it becomes a target that may be too high for your case. Similarly, a y% target for investments may give a false sense of “investing enough”. In reality, given how inflation works, very few people are actually investing enough. A good way to know this is by tracking the progress of your goals.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to budget, save and invest without regular income from salary? first appeared on 17 Jun 2021 at https://arthgyaan.com