How much cash should I hold in my portfolio?

The answer is just enough as per your portfolio goals: here’s how to calculate it

The answer is just enough as per your portfolio goals: here’s how to calculate it

While “cash is king” in many cases, it is not the most suitable thing to have in large amounts in a portfolio since cash does not beat inflation. There are 4 uses of cash in a portfolio, beyond the usual monthly expenses:

Keeping cash beyond the 4 heads above will reduce gains due to low-interest rates on cash.

An emergency fund is money kept aside for usage in a sudden or unplanned expenditure or contingency. This money is needed to be available for immediate use in emergencies. Without this safety net in place, people will have to run around for money, depend on a loan or use a credit card at high interest rates.

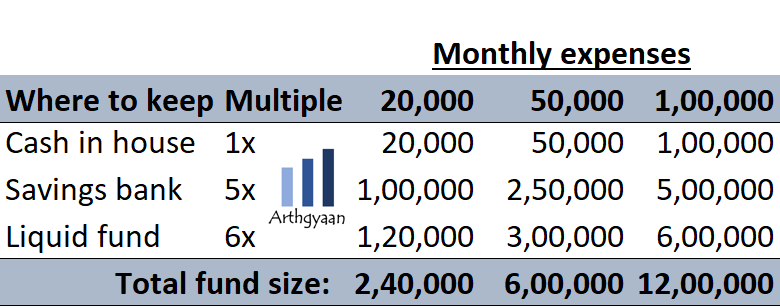

The standard advice is to store 6-12 times monthly mandatory expenses and EMIs in cash and equivalents as described in detail in this post. An additional cash balance is used to keep the sinking fund for known periodic expenses like insurance premiums and festival travel/gifting.

This fund is for taking advantage of opportunities that might arise in the markets or a deal that you are looking for. A few examples are:

The amount to be kept as “dry powder” will depend on the number of possible opportunities that may come up and their sizes. If the purpose is to take advantage of a stock market fall then a possible target will be to hold around 15-20% of the equity portfolio in cash form. This will however introduce significant cash drag on the returns of the portfolio and it is only suitable for those whose goals are funded.

Short term goals, as per the principles of asset allocation, need to be kept in safe and liquid assets like bank savings account, FD, RD or suitable debt mutual funds. These goals are of two types

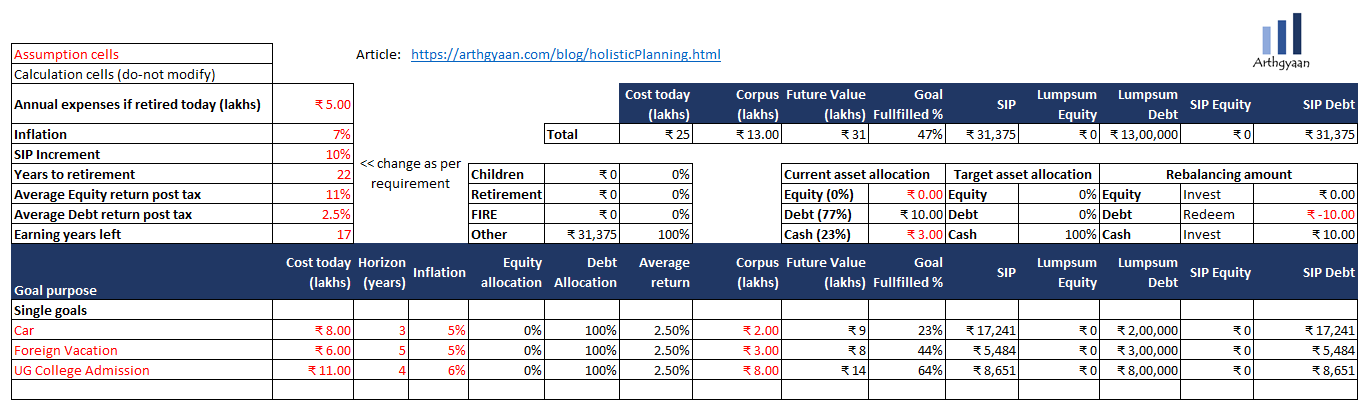

Let us say that the return in the cash bucket is 2.5%/year post-tax and there are 3 goals:

We will use the Plan Excel workbook for this example. The Excel model shows that for these 3 goals, we need to have ₹13 lakhs in the cash bucket and invest ₹31,375/month.

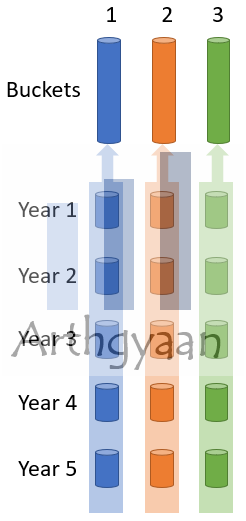

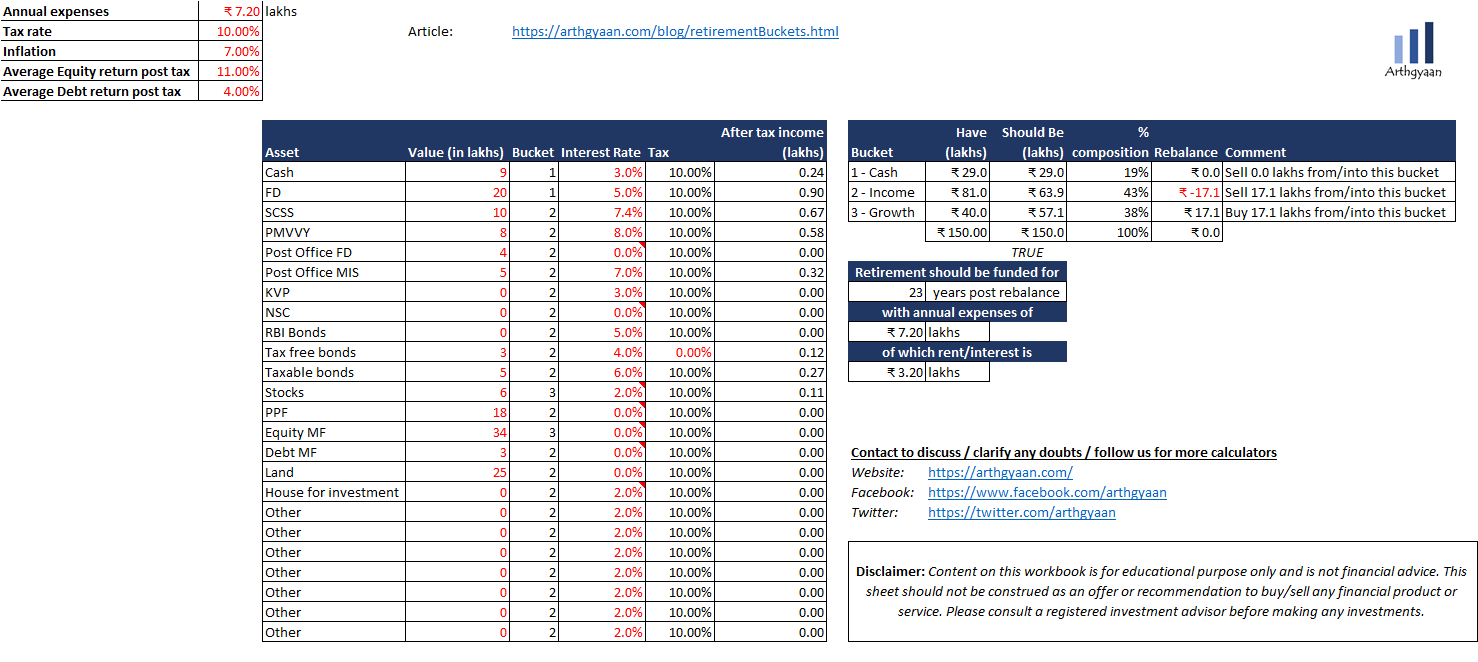

Here we will use the bucket theory of goal-based investing to calculate how much money we need for this cash balance for retirement. Bucket theory divides the portfolio into 3 buckets - broadly cash, debt assets and equity assets. The cash bucket is for funding goals due within the next 5 years. We choose 5 years as a reasonable balance of risk and return. This cash bucket gives the peace of mind that a 2008 style crash in the equity markets will not require a fire sale of the stock portfolio to fund regular expenses.

Here in the example, ₹1.5 crores are invested for 23 years with ₹7.2 lakhs of yearly expenses. The cash bucket has ₹29 lakhs and contains 5 years of living expenses and the emergency fund and is inflation adjusted to last 5 years.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much cash should I hold in my portfolio? first appeared on 17 Jul 2021 at https://arthgyaan.com