How to construct buckets for your retirement portfolio?

This article explains how retirees should allocate their investments between equity, debt and cash buckets for their post-retirement portfolio.

This article explains how retirees should allocate their investments between equity, debt and cash buckets for their post-retirement portfolio.

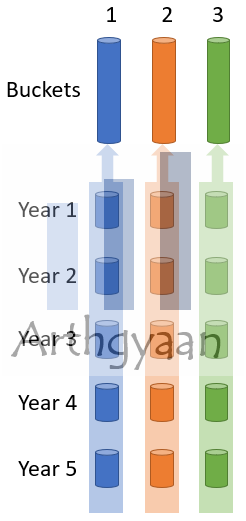

The concept of the 3-bucket retirement portfolio creates three risk-based asset pools or buckets out of the retirement portfolio:

In this article, we will discuss how retirees can split their assets between the three buckets based on the concepts of goal-based investing for retirement.

We will use the “Medium” risk profile and apply the allocation to each year in retirement. Once we do that, using the Arthgyaan goal-based investing calculator, we will arrive at the split of equity, debt and cash budgets. The theory of breaking down the expenses as per retirement years is explained here: How do you get SIP amount for retirement: Part 3. You can also implement as per our model portfolios below:

We will make the following assumptions:

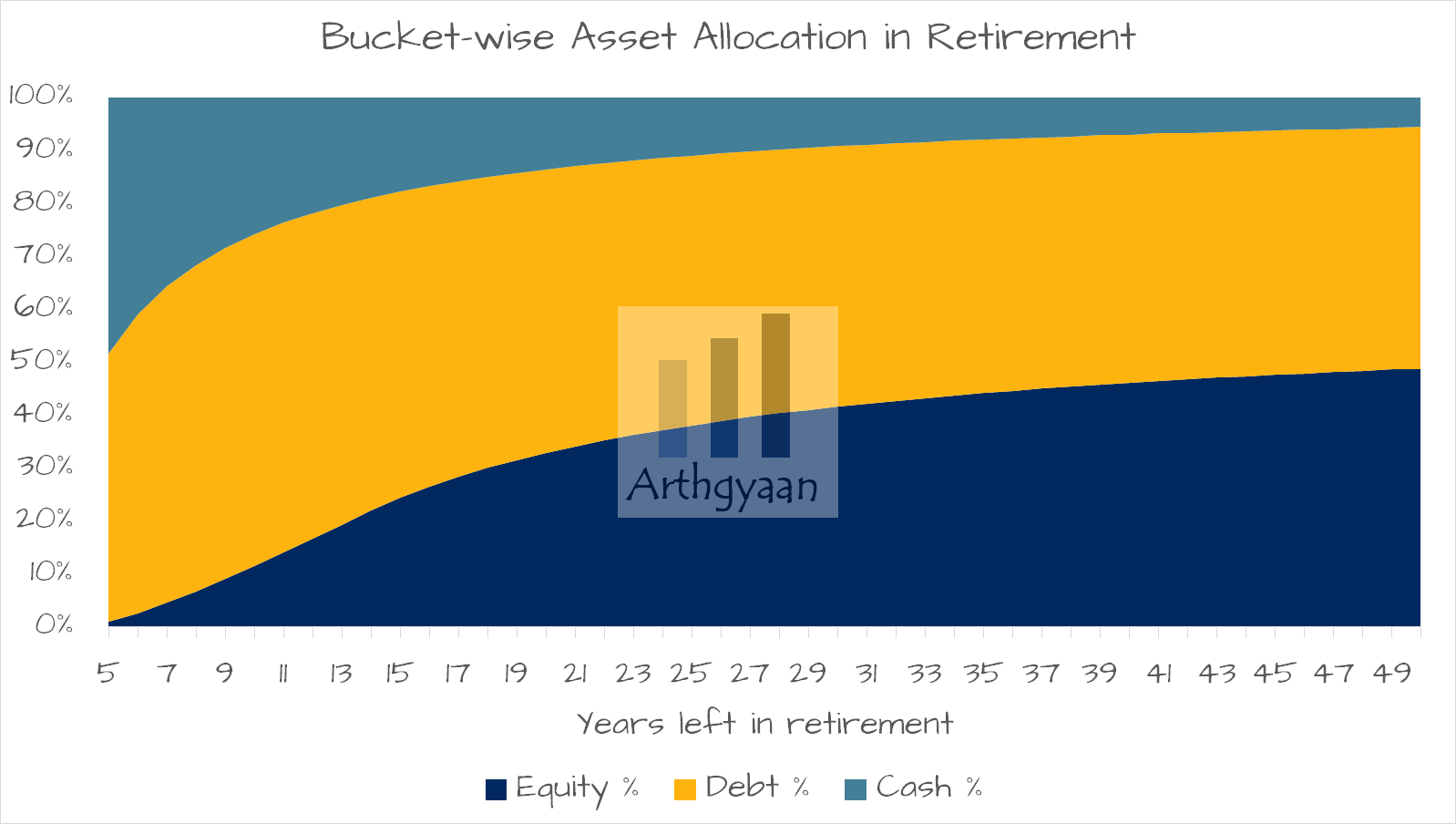

Running the model gives us the following chart:

We can read the chart like this:

Once the asset allocation is determined, you can choose investments in each bucket per this guide: How to plan for retirement using the bucket approach?

The process explained above is accurate as of today. A year later, you need to revisit the entire retirement portfolio since, in the X-Axis, you need to move one place to the left. In our example, the portfolio above, the passing of one year means 39 years are left. The asset allocation changes to a more conservative value of 45.75%, 47.13%, and 7.12%. The portfolio will need to be rebalanced by selling assets in the category which has excess and buying that category which has more to bring the allocation to the target figure.

The concept of the 3-bucket retirement portfolio creates three risk-based asset pools or buckets out of the retirement portfolio: Bucket 1: cash for short-term expenses (3-5 years) and emergency fund (12 months of expenses); Bucket 2: debt assets for portfolio stability and income Bucket; 3: inflation-beating assets like equity MF and direct equity stocks.

The basis of asset allocation in retirement is using the Medium risk profile and applying the allocation to each year in retirement. The Arthgyaan goal-based investing calculator is used to arrive at the split of equity, debt and cash buckets.

The split of buckets in retirement depends on several assumptions, such as equity return, debt return, and inflation rate. Based on these assumptions, the split of equity, debt, and cash is determined using the Arthgyaan goal-based investing calculator. The allocation changes every year as the X-Axis moves one place to the left, and the portfolio needs to be rebalanced accordingly.

To review the retirement portfolio every year, you need to revisit the entire retirement portfolio since, in the X-Axis, you need to move one place to the left. The asset allocation changes and therefore portfolio will need to be rebalanced by selling assets in the category which has excess and buying that category which has more to bring the allocation to the target figure.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to construct buckets for your retirement portfolio? first appeared on 08 Mar 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.