Which category of debt mutual funds is best for rebalancing?

This article helps you decide which debt mutual fund category to choose when rebalancing between debt and equity.

This article helps you decide which debt mutual fund category to choose when rebalancing between debt and equity.

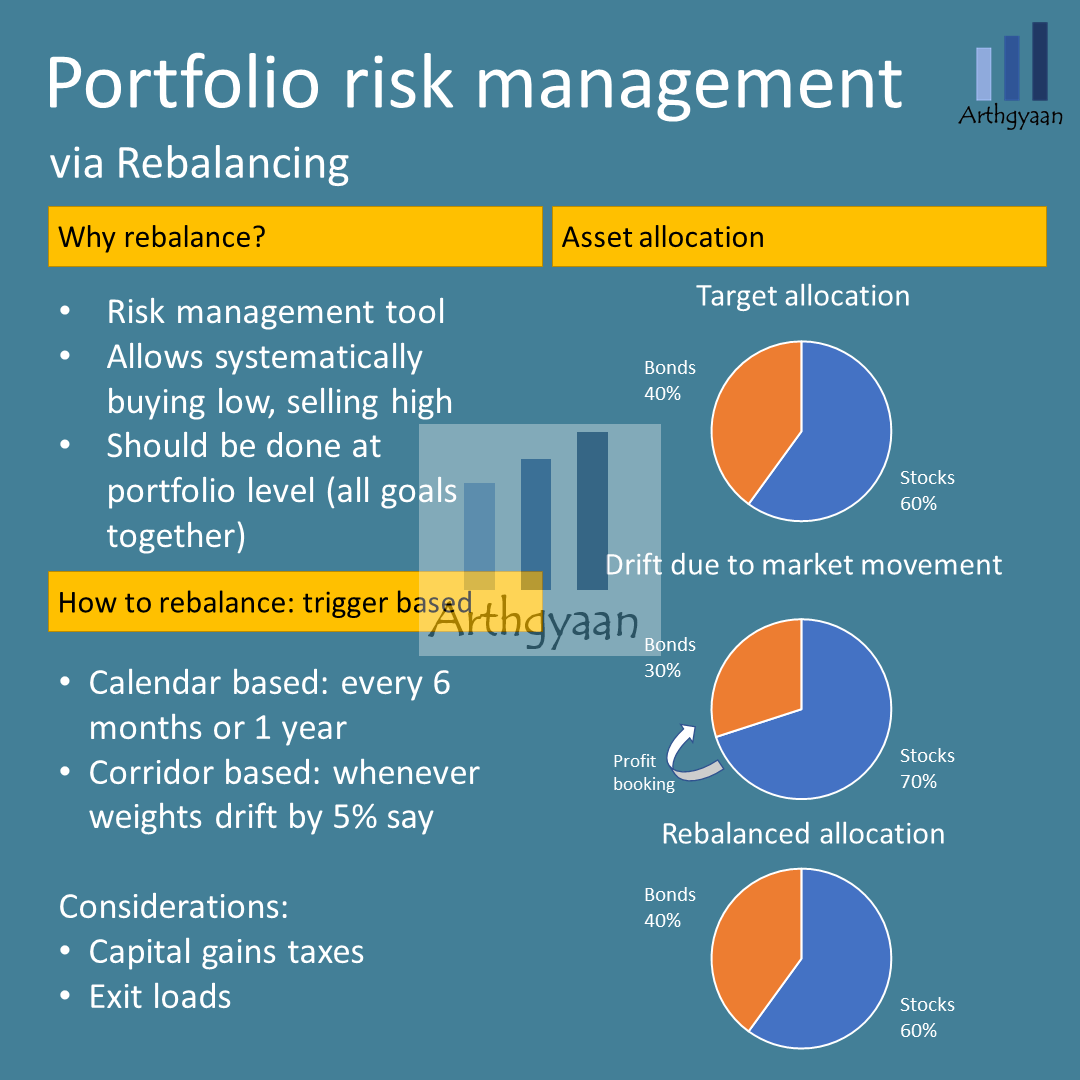

Rebalancing is a vital risk management tool to achieve one objective: portfolio risk over time needs to be managed per market movement and horizon of the goal. For example, bull markets increase the portfolio’s equity component, increasing the portfolio’s risk once a market correction comes. Having the plan to rebalance from equity to debt manages this risk. Similarly, a bear market has a buying opportunity if you sell a part of debt holdings to buy equity. Also, as the goal comes closer, the portfolio’s risk must be lowered by lowering the equity component. Rebalancing allows this as well.

Rebalancing allows you to

Here is a detailed post on how to get your risk profile for any goal in case you want to review that first.

In general, rebalancing is a trade-off where you balance the effects of mean reversion (what goes up will eventually come down and vice versa) and momentum (what goes up/down will keep going up/down for some time). Thus, there is no need to time market top/bottom while rebalancing as long as a systematic process is followed.

To know more about rebalancing, please check out this article: Portfolio rebalancing during goal-based investing: why, when and how?.

We will use mutual funds to create and manage a long-term portfolio like for retirement or children’s education goals. For such portfolios, we will examine which type of debt mutual funds are most suitable for rebalancing purposes.

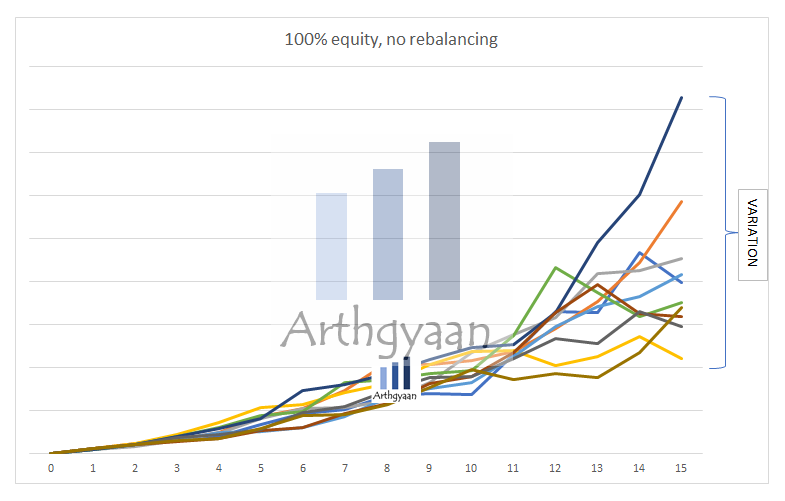

Here is an example of a 15,000/month SIP run for 15 years. The SIP amount is increased by 5% every year. The chart shows ten different possibilities assuming the average equity return is 11% post-tax and risk of 15%. The results are:

Here is our article about the danger of having only equity without rebalancing: The lie of wealth-creation via SIP in mutual funds

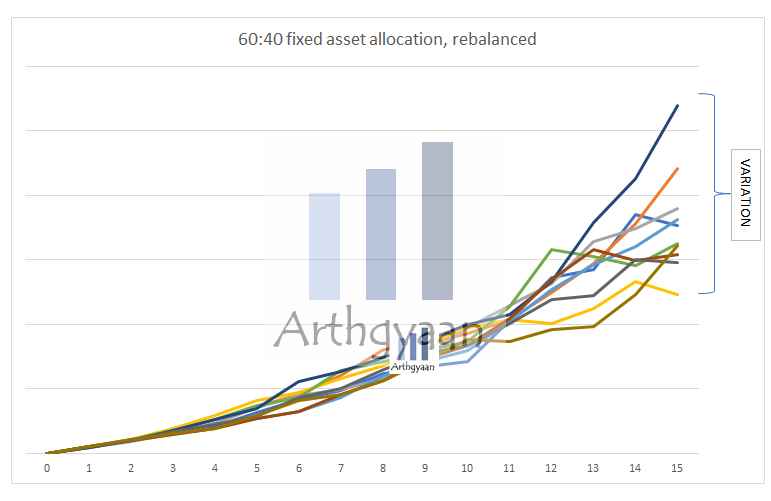

The variation in the previous case is the effect of market risk, showing us that the equity market returns are unpredictable. Since we need market risk to make high returns, we need a way to manage this risk. Rebalancing via a suitable asset allocation is the solution by allocating to equity and debt. For this example, we will invest 60% in equity and 40% in debt and keep this allocation fixed for 15 years by rebalancing annually. We will use the same sequence of equity returns as before. As these results show (corpus range of ₹49-108 lakhs), the variability is now lower.

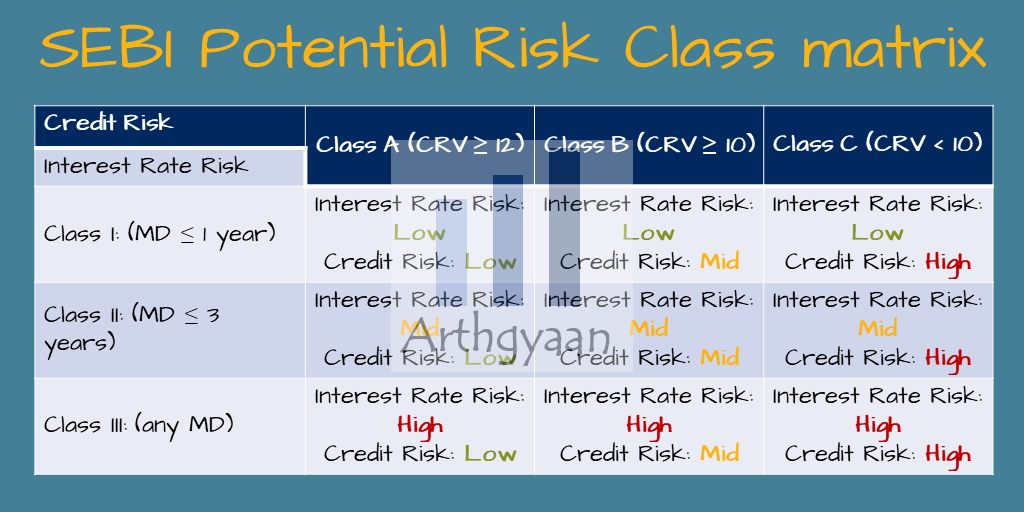

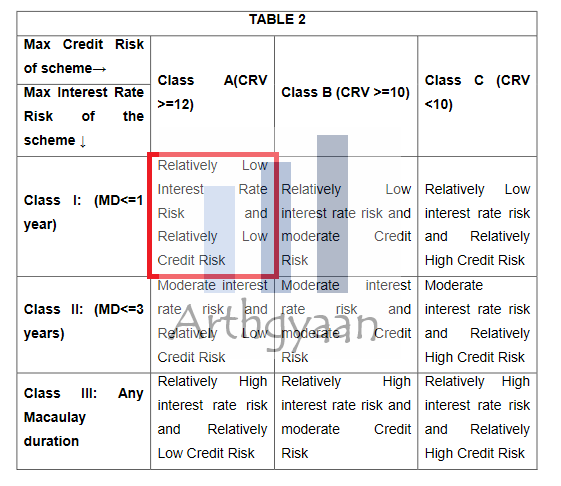

Now that we have made a strong case for including debt mutual funds in the portfolio for regular rebalancing, we will explore which type of debt fund is most suitable. Of the 17 types of debt mutual funds currently available, as per the SEBI mutual fund classification scheme, we have spoken about the following two categories, which fall in the top left quadrant of the chart:

Along with these, we add two other common categories:

For equity, we choose the category of Nifty 50 index funds.

We will perform our analysis for these four debt fund categories using the following three metrics:

We calculate simple rolling returns for all of the debt funds like this:

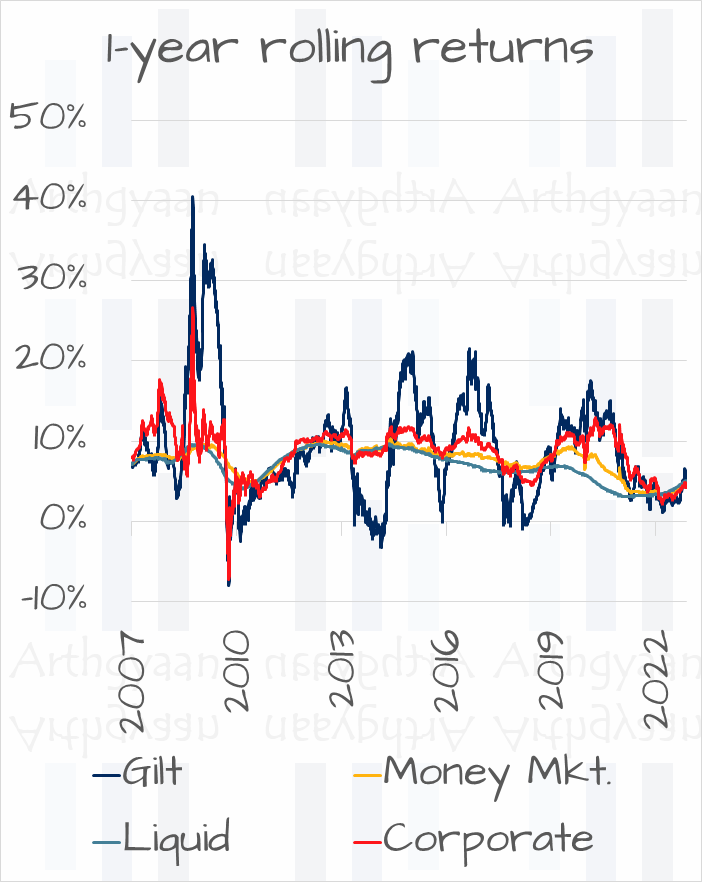

As the chart shows, gilt funds have the highest fluctuations, up and down, due to changes in interest rates. Conversely, liquid funds have minor fluctuations because credit risk exposure is minimal. The same applies to their interest rate risk exposure since they hold only 91-day T-Bills.

Investors choosing debt fund categories should be comfortable with the level of fluctuation they might get from their debt mutual fund. You can estimate the exposure to risk by reading the portfolio disclosure statement of the fund: How to understand the portfolio composition of a debt mutual fund?.

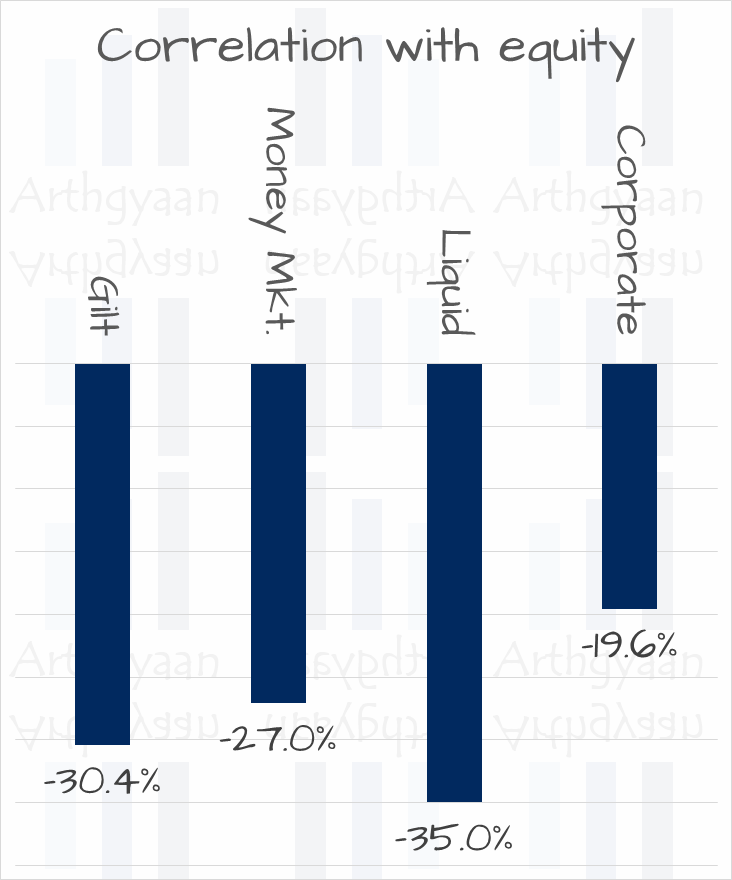

Correlation is a statistical measure of how two things behave vs each other

If you want to understand the concept of correlation in the simplest possible way, think about two kids in play school:

As the diagram shows

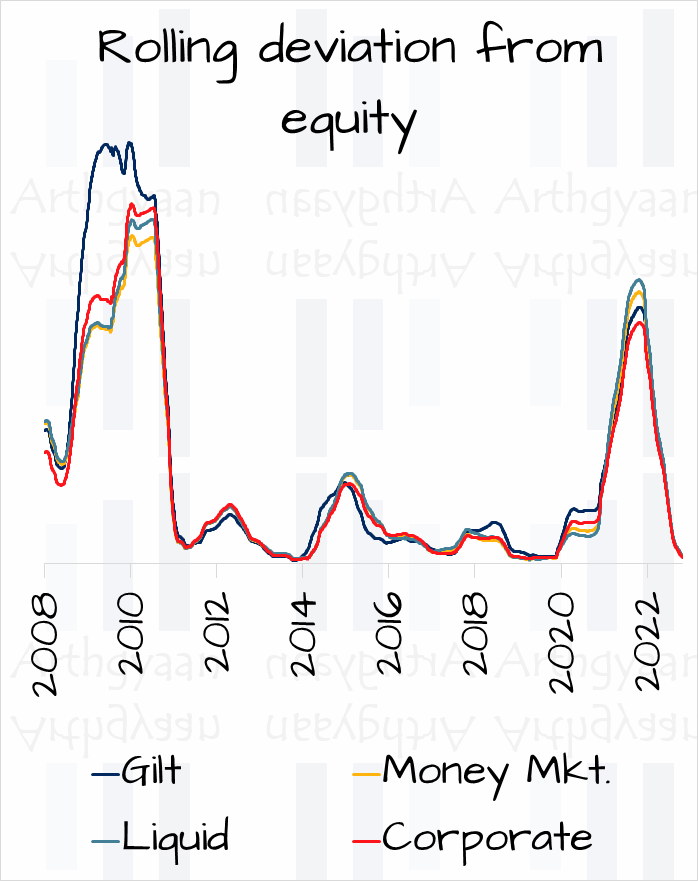

Deviation = Sum of [(Equity 1-y return - Debt 1-y return) ^ 2] over 1 year

We want the highest possible deviation between equity and debt since it measures how differently equity and debt move. So we have taken a 1-year rolling return, squared the difference to get rid of the sign, and then summed it up over the last 1-year’s values.

The chart shows that the various categories in the recent past are the same, and there is no consistent trend. Only post-2008, due to falling interest rates and high fluctuations in equity post the Global Financial Crisis, there was a considerable difference between equity and gilt compared to the rest.

As evidenced in this article, we stick to our stance on using debt mutual funds with the lowest credit and interest rate risk like this.

Decision making framework:

Pre-requisite: Goal > 3 years since otherwise, you can use FD

Debt funds are necessary for rebalancing to manage market risks, balance the effects of mean reversion and momentum, systematically buy low and sell high, and lower the portfolio's risk as the goal comes closer.

The analysis of debt fund categories is done based on three metrics: the rolling year of the fund for a one-year holding period, the correlation of rolling returns of debt vs equity, and rolling one-year absolute deviation (equity - debt return squared) added over a one year calculation period.

Among the four categories of debt mutual funds, gilt funds have the highest fluctuations in one-year rolling returns, up and down, due to changes in interest rates. Liquid funds, on the other hand, have minor fluctuations because credit risk exposure is minimal.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which category of debt mutual funds is best for rebalancing? first appeared on 22 Feb 2023 at https://arthgyaan.com