Aggressive hybrid mutual funds: understanding the what, why, when and who

This article discusses mutual funds belonging to the aggressive hybrid category for investors to understand if they should invest in such funds.

This article discusses mutual funds belonging to the aggressive hybrid category for investors to understand if they should invest in such funds.

This article is a part of our detailed article series on the concept of hybrid mutual funds in India. Ensure you have read the other parts here:

This article highlights the main differences between arbitrage funds and fixed deposits in India to help investors make the best choice for their financial needs.

This article shows you how different categories of hybrid funds have performed for regular SIP investments for short durations.

This article talks about the hybrid mutual fund category in India and shows you which ones to invest in as per your goals.

Hybrid funds offer a mix of multiple asset classes (equity/debt/gold/arbitrage/international stocks) in a single fund. The biggest selling points of a hybrid fund are:

An Aggressive Hybrid Fund invests mostly in equity for growth and has a small amount of debt for stability purpose. A big selling point of this category of hybrid funds are equity-like taxation, automated rebalancing and single fund exposure to two asset classes.

An Aggressive Hybrid Fund, as per the SEBI classification rules, must have 65% to 80% investment in equity & equity related instruments; and 20% to 35% in Debt instruments.

There is currently no index fund operated in the aggressive hybrid category. All funds are active funds.

This category of funds is usually benchmarked vs. the CRISIL Hybrid 35+65 Aggressive Index which invests in equity and debt in 65:35 proportion.

Given that Aggressive Hybrid funds have an allocation to (Indian) equity of minimum 65, they are taxed as equity mutual funds.

For holding periods less than 365 days, profits are considered as Short Term Capital Gains (STCG) and taxed at 15%. If sold after 365 days, the profits are considered Long Term and taxed at 10% above ₹100,000 gains/year.

Read more here: How to calculate and save tax on mutual funds?

Aggressive Hybrid Funds are suitable for investors looking for long-term portfolio growth with the understanding that the intermediate journey can be volatile.

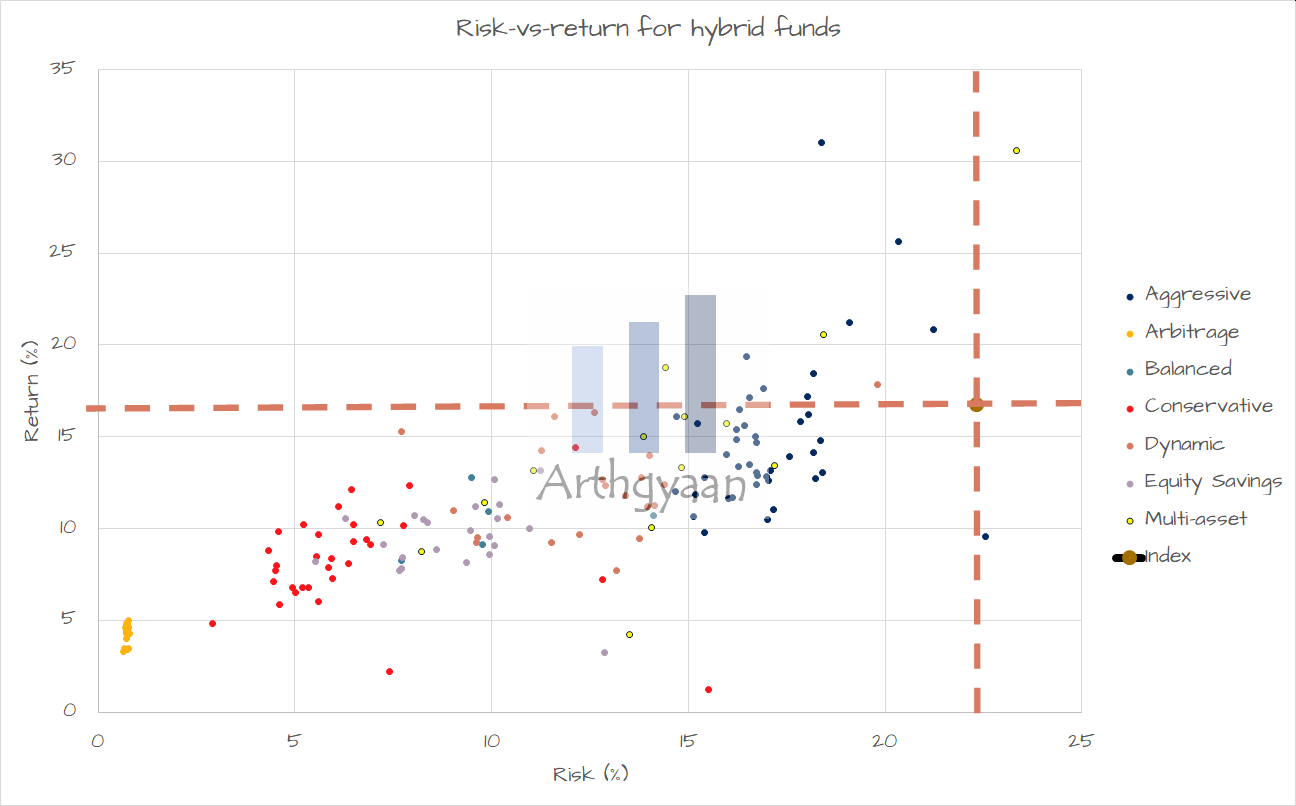

It is generally believed that hybrid funds have returned between pure debt and pure equity funds. It becomes interesting if you consider risk along with returns together. Please note that this chart is at a point in time and does not show rolling performance. It shows the last three years’ risk and return.

We can see the risk vs return, using data from Valueresearchonline, has some distinct clusters. We are also showing the current position of the Nifty 50 index funds at the intersection of two lines.

We can see that in this diagram most of the aggressive hybrid funds have given returns lower than the Nifty 50 index fund but the risk is also highest given the high equity exposure. We are therefore reiterating that investors should be mindful of this volatility.

These funds are taxed as equity funds. The current taxation rule is

| Hybrid Funds | Tax Treatment for FY2025-26 |

|---|---|

| Bought Anytime | Taxed at 20% before 1 year (STCG); Taxed at 12.5% after 1 year (LTCG) for CG above 1.25L/year |

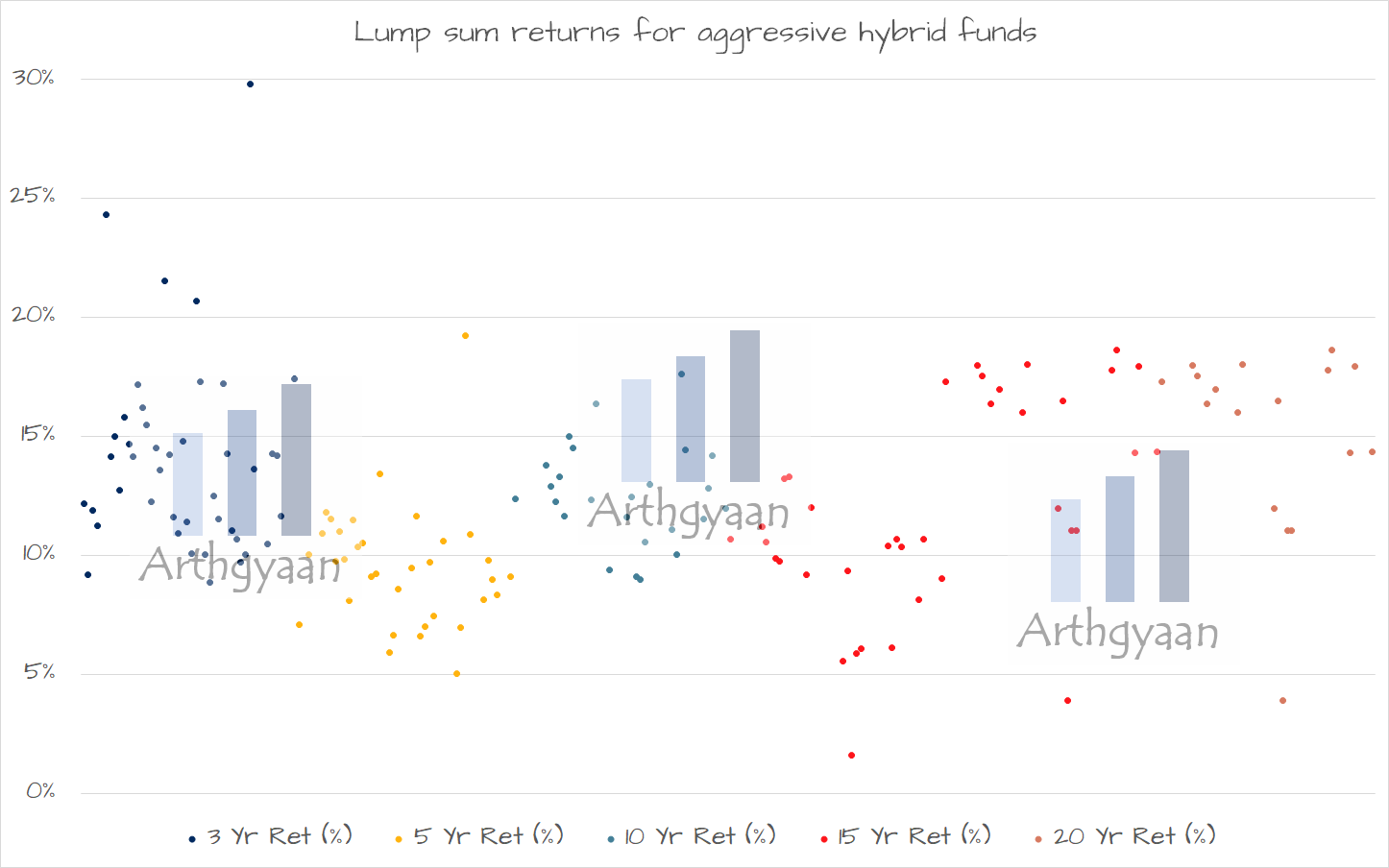

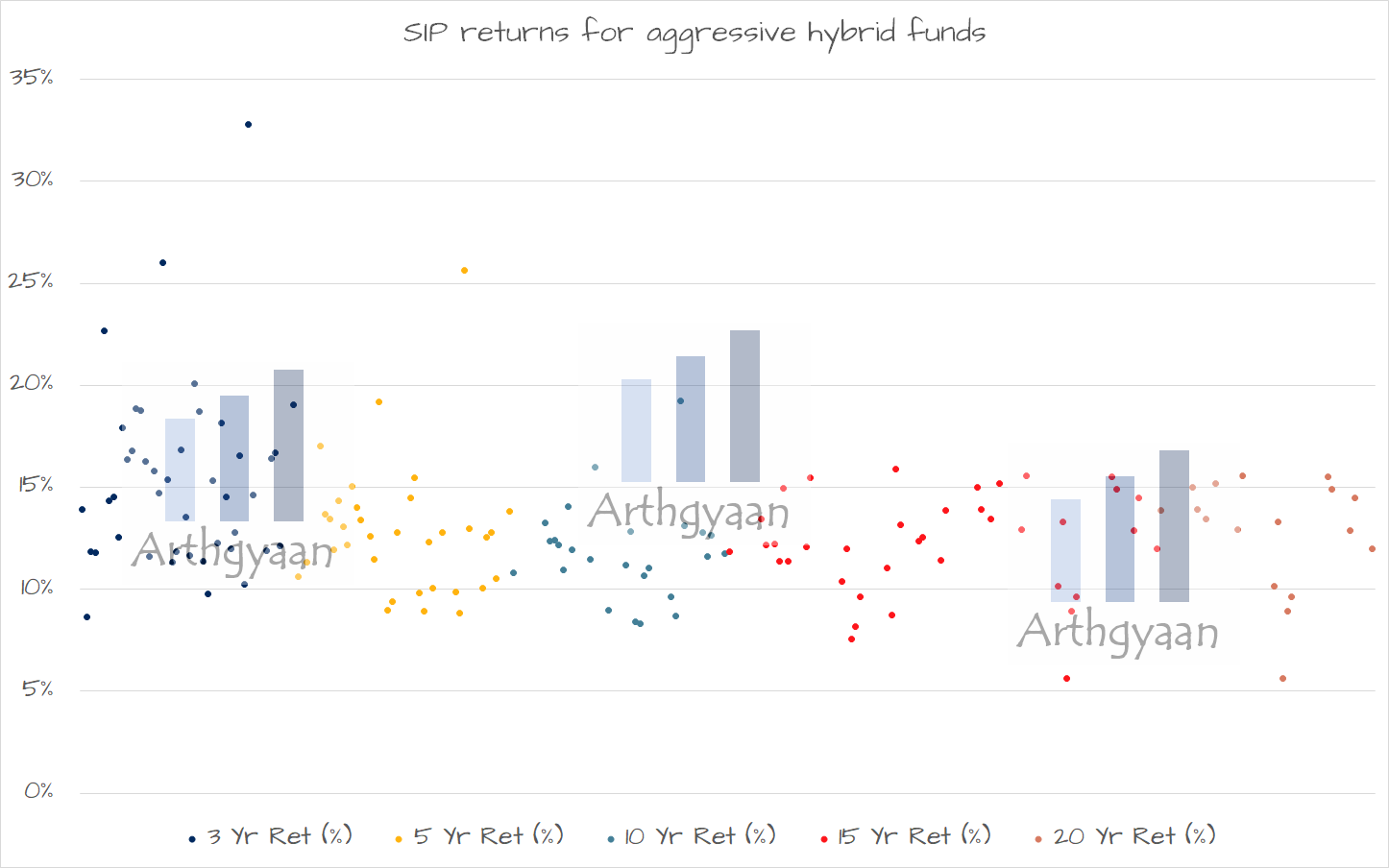

We use data from AMFI to show the return performance of these funds. These are averages of rolling returns.

| Category | Hybrid: Aggressive |

|---|---|

| Any 1Y SIP | 12.41% |

| Any 2Y SIP | 10.6% |

| Any 3Y SIP | 14.53% |

| Any 5Y SIP | 14.55% |

| Any 7Y SIP | 15.19% |

| Any 10Y SIP | 14.18% |

| Category | Hybrid: Aggressive |

|---|---|

| Any 1Y SIP | 12.41% |

| Any 2Y 目↑ SIP | 10.17% |

| Any 3Y 目↑ SIP | 13.99% |

| Any 5Y 目↑ SIP | 14.51% |

| Any 7Y 目↑ SIP | 15.74% |

| Any 10Y 目↑ SIP | 14.69% |

| Category | Hybrid: Aggressive |

|---|---|

| Any 1Y | 10.36% |

| Any 2Y | 14.56% |

| Any 3Y | 14.51% |

| Any 5Y | 14.51% |

| Any 7Y | 14.14% |

| Any 10Y | 13.74% |

| Category | Hybrid: Aggressive |

|---|---|

| Any 1Y SWP | 9.43% |

| Any 2Y SWP | 17.97% |

| Any 3Y SWP | 14.02% |

| Any 5Y SWP | 13.59% |

| Any 7Y SWP | 12.74% |

| Any 10Y SWP | 13.24% |

| Category | Hybrid: Aggressive |

|---|---|

| Any 1Y SWP | 9.43% |

| Any 2Y 目↑ SWP | 20.79% |

| Any 3Y 目↑ SWP | 16.41% |

| Any 5Y 目↑ SWP | 19.35% |

| Any 7Y 目↑ SWP | 14.02% |

| Any 10Y 目↑ SWP | 11.98% |

The wide variability of both returns and risk shows that these are active funds. If you look at the fund documents of this category, there is active decision-making involved at these points:

Given the large equity allocation, the short-term returns for both SIP and lump sum investments fluctuate a lot. The fluctuation dies down as the time horizon of investment increases. Investors should carefully consider the risk aspect before investing in these funds if the goal is short or medium-term.

We have done an analysis of rolling over your PPF maturity amount into aggressive hybrid funds if you don’t need an exact amount in 5-years: PPF Account Maturity in 2025: How Much Higher Returns Can You Get if You Withdraw and Invest in Mutual Funds?

In a future article, we will cover more details like rolling return/risk vs other fund categories and using these funds for both accumulation and retirement.

An Aggressive Hybrid Fund invests mostly in equity for growth and has a small amount of debt for stability purpose. A big selling point of this category of hybrid funds are equity-like taxation, automated rebalancing and single fund exposure to two asset classes.

An Aggressive Hybrid Fund, as per the SEBI classification rules, must have 65% to 80% investment in equity & equity related instruments; and 20% to 35% in Debt instruments.

There is currently no index fund operated in the aggressive hybrid category. All funds are active funds.

This category of funds is usually benchmarked vs. the CRISIL Hybrid 35+65 Aggressive Index which invests in equity and debt in 65:35 proportion.

Given that Aggressive Hybrid funds have an allocation to (Indian) equity of minimum 65, they are taxed as equity mutual funds.

For holding periods less than 365 days, profits are considered as Short Term Capital Gains (STCG) and taxed at 15%. If sold after 365 days, the profits are considered Long Term and taxed at 10% above ₹100,000 gains/year.

Aggressive Hybrid Funds are suitable for investors looking for long-term portfolio growth with the understanding that the intermediate journey can be volatile.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Aggressive hybrid mutual funds: understanding the what, why, when and who first appeared on 02 Nov 2022 at https://arthgyaan.com