How to invest for college education goals for teenaged children?

This article discusses where to invest for college education goals based on when college starts and your retirement date with a focus on lowering taxes.

This article discusses where to invest for college education goals based on when college starts and your retirement date with a focus on lowering taxes.

Investing for teenagers for college education has its unique set of challenges.

On one side, you have a good idea of your income over the next 5-10 years. Knowing your income allows you to pinpoint a ballpark figure you can pay as college fees.

On the other hand, you will face uncertainty regarding where the child will finally study since factors like choice of subject, college, location, and entrance examination results are unknown.

Nevertheless, the income and investments factor places an upper cap on the amount you can reasonably spend. Since financial planning does not happen in isolation, you have to balance the amount you wish to pay for the college goal vs other goals like retirement.

If you already have some amount invested for a college goal in equity, you need to have a rebalancing plan to derisk the corpus from an equity market fall. This post shows a way to do that in a way to minimise portfolio risk while also reducing the taxes you need to pay.

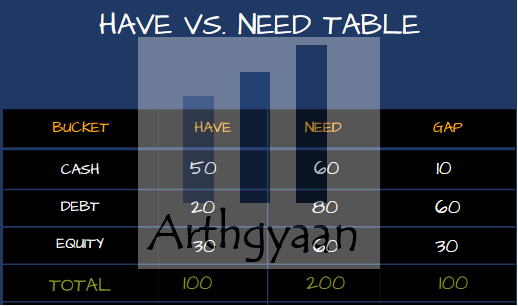

The Have-vs-Need (HvN) framework needs you to make a 4x4 simple table with three asset class buckets. For each bucket, you need to calculate three numbers: the amount you already have (the HAVE column), the amount you need to reach your goals (the NEED column) and the difference between the two (the GAP column).

The three buckets are:

The columns are:

We also have a TOTALs row to give a high-level view of the portfolio.

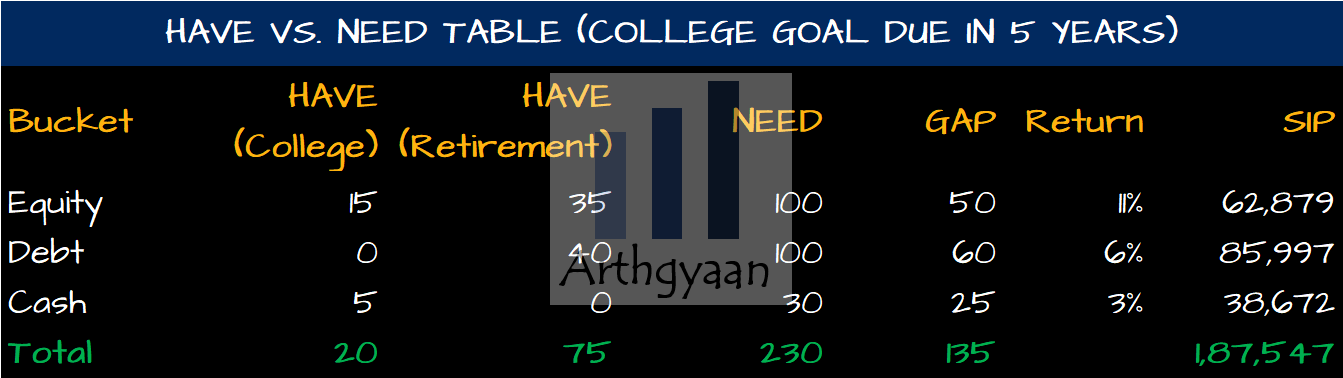

To simplify things, we assume that the child is 13 years old and college starts in 5 years. We will split the table like this:

We need 30 lakhs for the college goal in 5 years and there is currently 20 lakhs created for the college goal of which five lakhs is in cash and 15 lakhs in equity. There is a retirement goal as well with a 75 lakhs corpus today.

The standard risk-management practice will be to sell down the equity portion of the college goal since the asset allocation for a goal that is five years is 0% in equity. However, selling that equity today will require paying tax unnecessarily. Here the HvN framework comes to the rescue.

The HvN framework says to:

Some investors will object at this point and say, “but my child’s college goal money is not to be touched.” We are not doing that at all. We are optimising the allocation internally to minimise the taxes since we are not selling and buying at the same time for different goals.

The following points illustrate the benefits of the HvN framework:

We have made some implicit assumptions while applying the HvN framework that we will now call out:

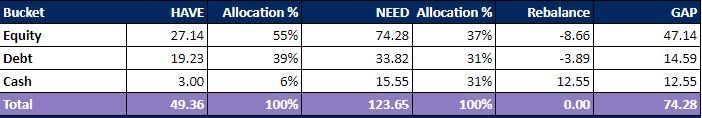

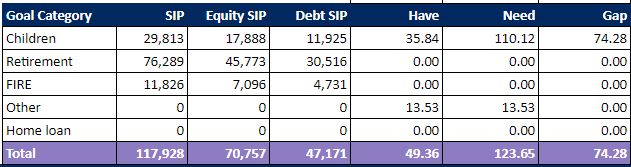

If you are using the Arthgyaan goal-based investing calculator, then it is effortless to calculate the numbers and use this framework as below:

Asset-wise view:

Goal-wise view:

You can read more on the framework here: How to use the bucket theory to plan for your goals?.

To implement all the steps related to investing for your child’s college goals in one easy-to-follow package, we have Arthgyaan Child Education goal packages. Choose the year closest to your desired college admission year to get started:

In the example above we have assumed that the child is 13 years old and college starts in five years. There are over 50 combinations of teenage children’s ages (13-19) and time left until college starts if you include master’s degrees as well.

The Arthgyaan Package is a goal-based investing plan to finance a postgraduate degree. SIPs provide a disciplined approach to accumulating the required funds over time. Choose the year closest to your desired PG college admission year to get started:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to invest for college education goals for teenaged children? first appeared on 06 Nov 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.