Bandhan Nifty Total Market Index Fund: should you invest?

This article discusses the NFO of the Bandhan Nifty Total Market Index Fund which is the second fund tracking the Nifty Total Market Index.

This article discusses the NFO of the Bandhan Nifty Total Market Index Fund which is the second fund tracking the Nifty Total Market Index.

Disclaimer: Image(s) from the Bandhan Mutual fund website is used for representational purposes only.

This article is a part of our detailed article series on new fund offerings (NFOs) in India. Ensure you have read the other parts here:

This article discusses a new offering by HSBC Mutual Fund focusing on companies in the Export sector.

This article discusses the NFO of the Tata Nifty India Tourism Index Fund which is the first fund tracking the Nifty Tourism Index.

This article discusses the NFO of the Motilal Oswal Nifty Defence Index Fund which is the second fund tracking the Nifty Defence Index.

A new Fund of Fund wants to capture the alpha from innovative technology companies globally. Should you invest?

This post discusses new Real Estate feeder funds being launched in India and whether investors should invest in such funds.

This post discusses new Blockchain feeder funds being launched in India and whether investors should invest in such funds.

Bandhan Asset Management (formerly IDFC Mutual Fund) filed a draft application with SEBI for an index (passive) mutual fund tracking the Nifty Total Market Index in Feb 2024.

This fund is an index fund that passively tracks the Nifty Total Market Index. The Nifty Total Market Index is an index (like the SENSEX or Nifty 50) tracking all (actually, the top 750) stocks in the National Stock Exchange (NSE). To put this into perspective, the popular Nifty 50 index tracks the top 50 stocks measured by free-float market capitalisation. The order of the indices looks like this:

The NFO period for this fund was from June 24 to July 5, 2024.

The Nifty Total Market Index consists of the Top 750 stocks as per free-float (the amount of the market capitalisation available for trading in the stock exchange) market capitalisation. Therefore the index contains all the Large-cap (Top 100), Mid-cap (101-250), Small-cap (251-500) and Micro-cap (501-750) indices in the same index.

Since the entire index is weighted by free-float market capitalisation, the allocation to each category is as follows, according to the Bandhan website:

It is interesting that as we go down the list, the size, and hence the impact of movements in the respective segments become less and less. For example, if the Mid-cap segment doubles, the effect on the index is 17% while the same doubling for the micro-cap segment only leads to a 3% change. However, the impact of the 30% mid/small/micro-caps on the index is substantial as we will now show.

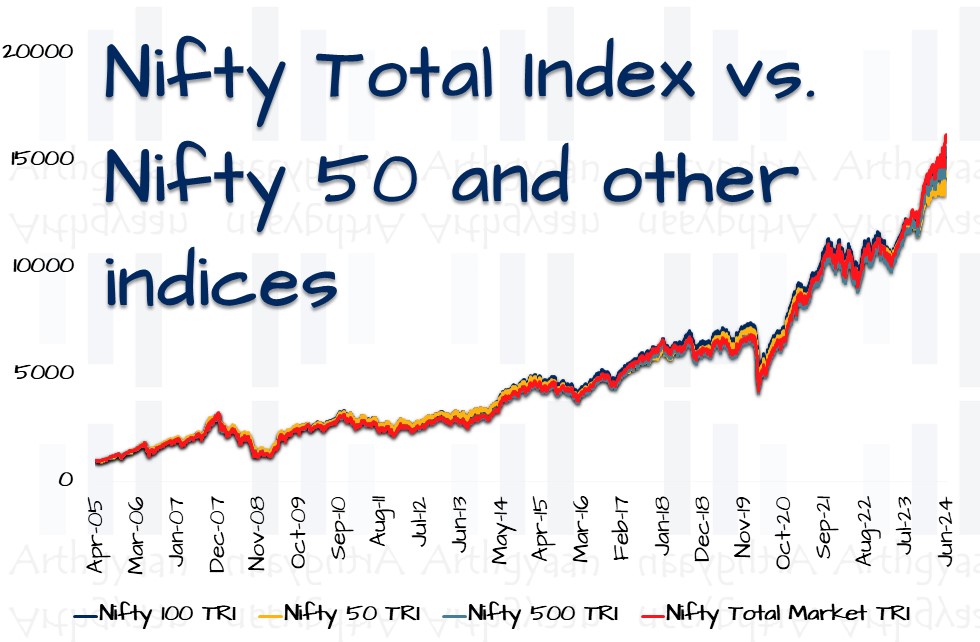

Here is how the index performed versus the Nifty 50, Nifty 100 and Nifty 500 (rebased to 1000 and starting from April 2005):

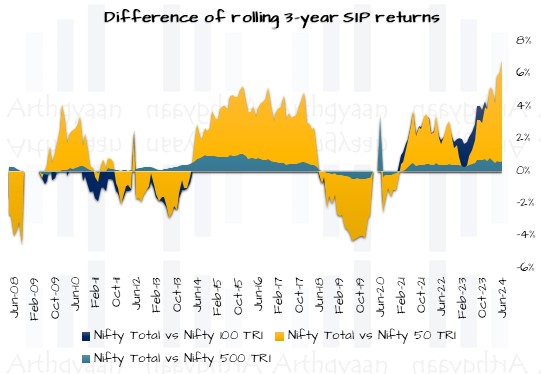

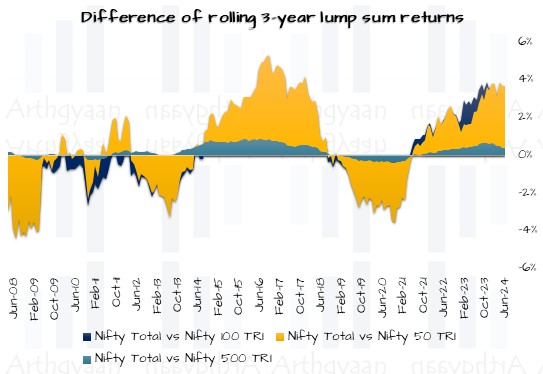

In the charts below, we will show rolling excess returns of Nifty Total Market Index vs. the Nifty 50, Nifty 100, and Nifty 500 using the Total Return Index data (price change and reinvested dividends).

As both charts show, the Nifty Total Market Index index:

Before Bandhan launched the NFO, there was only one fund that tracked this index: the Groww Nifty Total Market Index fund, active since October 2023. This is a modestly expensive fund with an expense ratio of 0.25% for the direct fund (at the time of publishing).

Given the short history, there is no way to draw any meaningful conclusion about this fund. We will revisit this topic in a future article once the Groww fund completes one year.

“Investors should remember that excitement and expenses are their enemies.” - Warren Buffett

The recent outperformance of the Nifty Total Market Index vs. the major indices can be an incentive for the AMC to launch such a fund. However, if you are looking to invest, you need to understand which concept is more appealing to you:

An investor who ticks one or more of the boxes below might consider investing:

☑ Is looking for a one-fund exposure to the Indian equity market

☑ Is unwilling to manage multiple index funds (large/mid/small etc.) and their changing weights in the portfolio over time

☑ Understands and has belief in the concept of indexing or passive funds over active funds

☑ Wishes to take a market-capitalisation-based exposure without specifically overweighting/underweighting any specific slice of the market

☑ Is interested in the Total Market index as a means of completeness in exposure to the investible market

An investor who ticks one or more of the boxes below should not invest:

☑ Already has continuing SIPs in multiple index funds and does not plan to stop them

☑ Is planning to an index fund to an active fund-heavy equity fund portfolio

☑ Has not done due diligence beyond reading about this index and funds online

☑ Will be investing a very small amount or will start a small SIP. Both indicate a lack of conviction and lead to portfolio clutter: How to clean up your mutual fund portfolio?

☑ Disagrees with the Warren Buffett quotation above

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Bandhan Nifty Total Market Index Fund: should you invest? first appeared on 21 Jun 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.