Will you always get at least 12% return from mutual funds?

This article shows under which circumstances you can reasonably expect a 12% or higher return from your equity mutual funds.

This article shows under which circumstances you can reasonably expect a 12% or higher return from your equity mutual funds.

SIP Calculator Image copyright Groww.com

Getting a 12% return on the long-term from mutual funds is something you will see everywhere:

Another popular pitch talks about reaching ₹1 crore by investing 15,000/month for 15 years and getting 15% returns: The myth of the 15x15x15 or crorepati rule for mutual funds in India

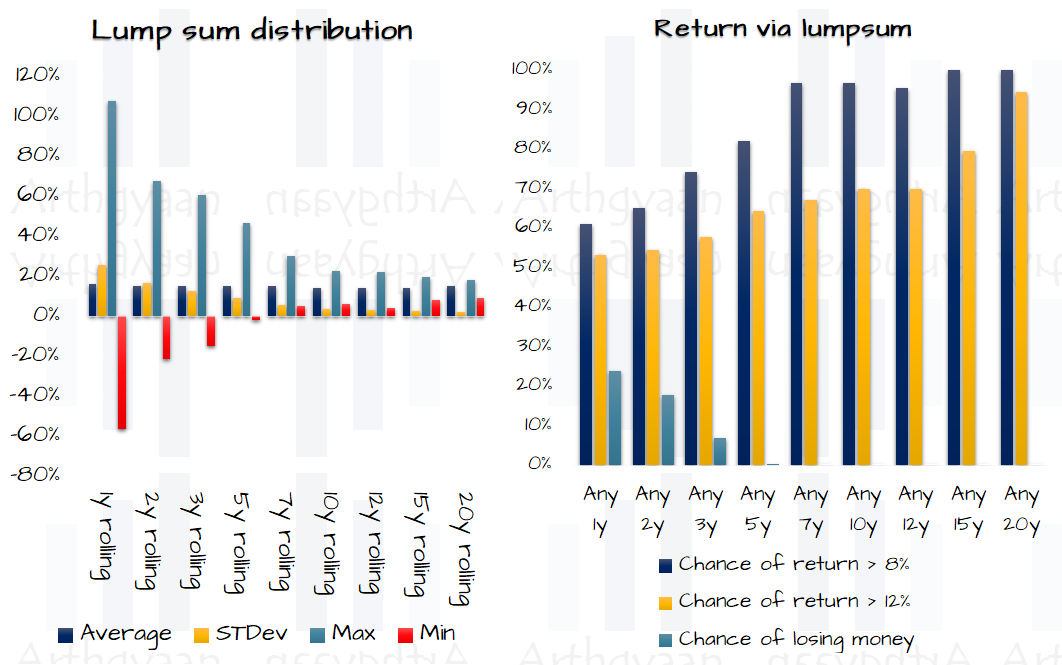

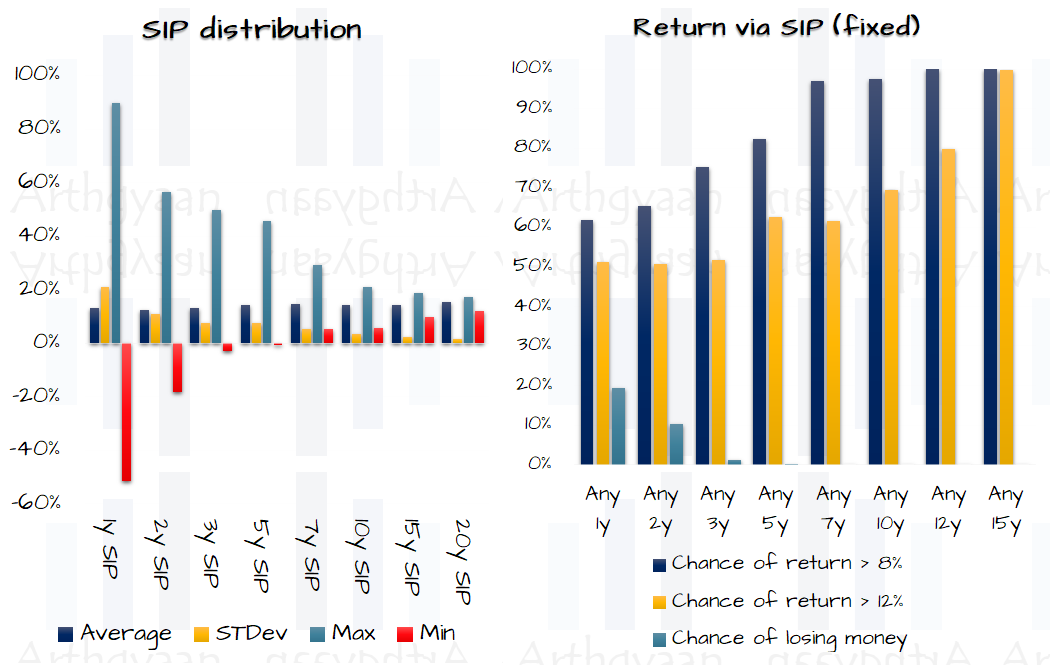

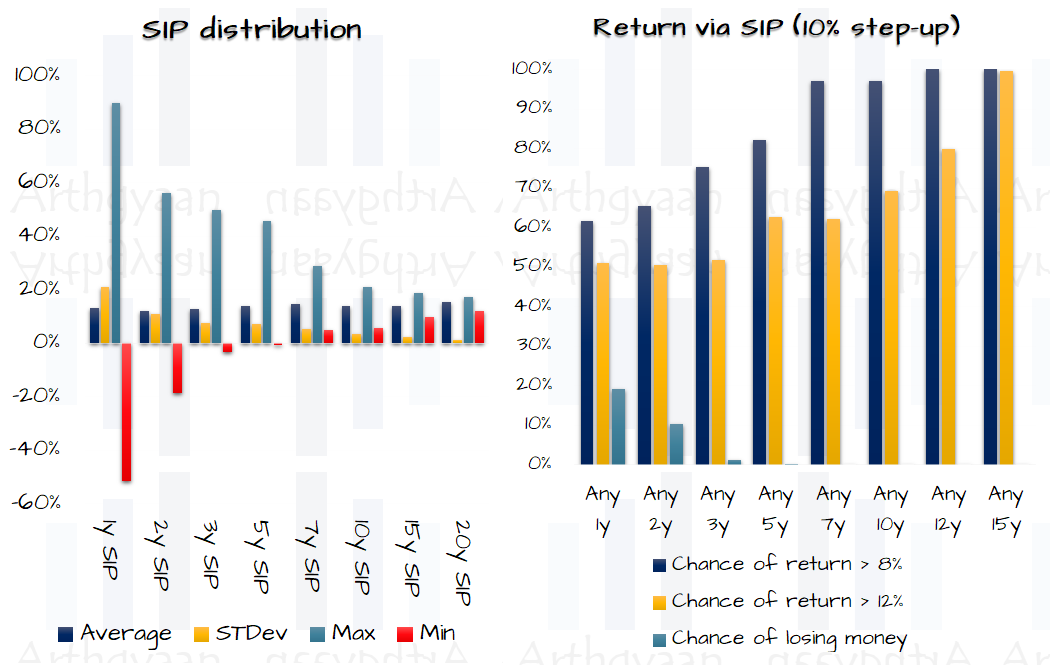

We will use historical data of the Nifty 50 TRI index that includes Nifty price movements and reinvested dividends and see how much the chance of getting 12% or higher returns.

We will show the results for rolling returns for lump-sum, fixed SIP and 10% step-up SIP.

As the data below shows, for longer investment periods, the chance of getting a return of 12% or more increases.

To understand what returns should you expect from your equity funds:

However, it is essential to understand one important caveat to the statement: “The longer the investment period, the higher the chance of getting a return higher than 12%”.

When you are finally getting ready to spend the money, you are no longer in the long term. Let us say that you have invested for 12 years for a child’s college education goal and now admission is due in the next 3 years.

You are now at the short-term end and there is now a considerable risk of loss:

| Metric | Any 1y | Any 2y | Any 3y | Any 5y |

|---|---|---|---|---|

| Average | 16.1% | 15.0% | 15.3% | 15.4% |

| STDev | 25.8% | 16.6% | 12.8% | 8.9% |

| Max | 107.4% | 67.4% | 60.7% | 46.5% |

| Min | -56.3% | -21.1% | -14.7% | -1.9% |

| Median | 13.1% | 13.6% | 13.7% | 13.5% |

| Chance of return > 8% | 61% | 65% | 74% | 82% |

| Chance of return > 12% | 53% | 55% | 58% | 64% |

You need to take immediate steps to safeguard the amount accumulated for your goal via rebalancing into safer assets. If you are using the Arthgyaan goal-based investing calculator, this aspect will be automatically taken care of as the goal comes closer: See our Case Studies on goal-based investing.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Will you always get at least 12% return from mutual funds? first appeared on 19 Jun 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.