The NIFTY Defence Index has risen more than 6x in 6 years. Should you invest?

This article discusses the blistering performance of the Nifty Defence index and how much defence stocks have beaten the broad market since its launch.

This article discusses the blistering performance of the Nifty Defence index and how much defence stocks have beaten the broad market since its launch.

This article is a part of our detailed article series on specific indices in India. Ensure you have read the other parts here:

This article discusses the Nifty Top 10 Equal Weight Index covering the 10 largest mega-cap stocks in India and whether these stocks are suitable for investors.

This article discusses the Nifty EV & New Age Automotive Index covering the EV ecosystem or new-age auto technologies in India and whether these stocks are suitable for investors.

The Nifty Defence Index is an index (like the SENSEX or Nifty 50) tracking the stocks from the defence theme.

As per the index Factsheet, the index details are as follows:

| Metric | Description |

|---|---|

| Methodology | Periodic Capped Free Float |

| No. of Constituents | 15 |

| Launch Date | Jan 19, 2022 |

| Base Date | April 02, 2018 |

| Base Value | 1000 |

| Calculation Frequency | End of day |

| Index Rebalancing | Semi-Annually |

| Year | NSE Indices |

|---|---|

| 2013 | 36 |

| 2014 | 38 |

| 2015 | 48 |

| 2016 | 57 |

| 2017 | 69 |

| 2018 | 76 |

| 2019 | 78 |

| 2020 | 77 |

| 2021 | 87 |

| 2022 | 94 |

| 2023 | 104 |

| 2024 | 107 |

NSE makes money by creating indices and licensing that data to AMCs to launch index funds, ETFs, and other mutual funds tracking the index. It is such a great business that the number of indices published by NSE has increased three times from Jan-2013 to Jan-2024.

As per the index Factsheet, these are the stocks in the Index:

From the Nifty Total Market index, stocks forming part of eligible basic industries or those which obtain at least 10% of revenues from the defence industry are eligible to be included in the index

Under the “ATMANIRBHAR BHARAT INITIATIVE IN DEFENCE PRODUCTION” initiative, the defence sector is currently receiving considerable attention from the Central Government. A stock market index tracking the theme is a logical offering from the NSE.

The index has these stocks:

The updated list is here: stocks

The Nifty Defence Index was started with a base date of 2nd April 2018 and a starting value of 1000. The performance chart below shows how this index has performed versus the broad market index Nifty 50:

This index tested the patience of the investors up to August 2022 (see up to the red oval in the chart), underperforming the Nifty 50 consistently, and then went up like a rocket. Investors must study the events that led to this tremendous jump before investing in these stocks.

Here is how the index performed versus the Nifty 50 (rebased to 1000 and starting from April 2018) on certain milestone dates:

| Date | Nifty 50 Index | Nifty Defence Index | Comments |

|---|---|---|---|

| Apr-18 | 1,000.00 | 1,000.00 | Launch of Nifty Defence Index |

| Aug-22 | 1,717.69 | 1,717.16 | Catches up to Nifty 50 |

| Jun-23 | 1,829.91 | 2,429.14 | HDFC Defence fund launched |

| Nov-23 | 1,919.71 | 3,398.67 | Doubles in 15 months |

| May-24 | 2,267.65 | 6,559.43 | Doubles in 6 months |

| Jun-24 | 2,310.23 | 6,740.42 | Up 6.74x since launch |

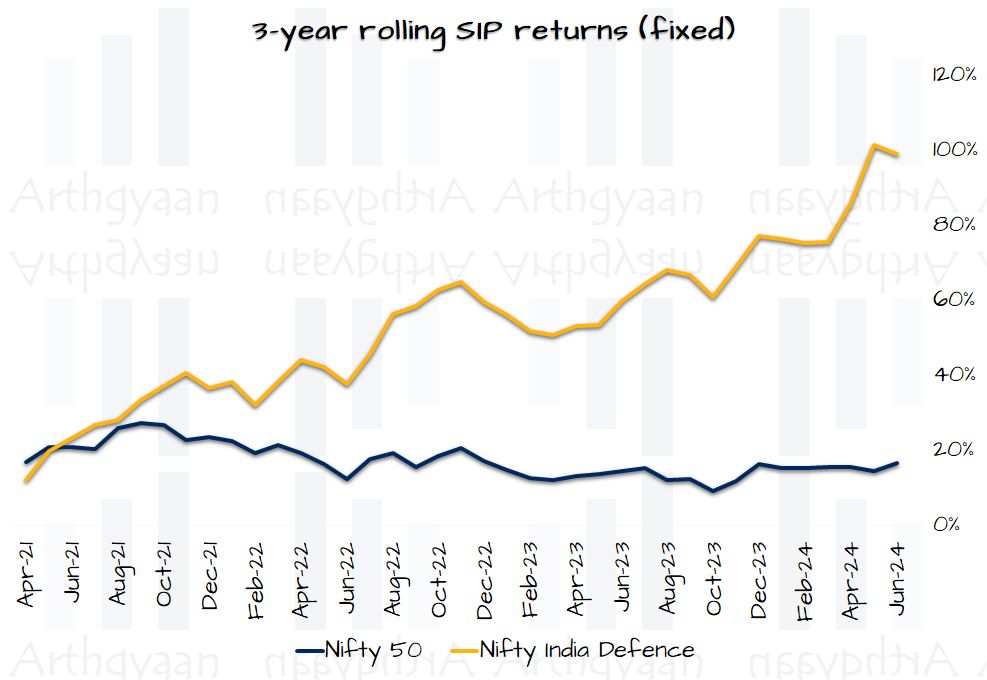

These rolling charts work on a window basis. Each point on the chart is calculated using a 3-year SIP like this:

The data shows that for 3-year SIPs reviewed after April 2021, the new Nifty Defence Index has given a consistently higher return and massive returns vs the Nifty 50.

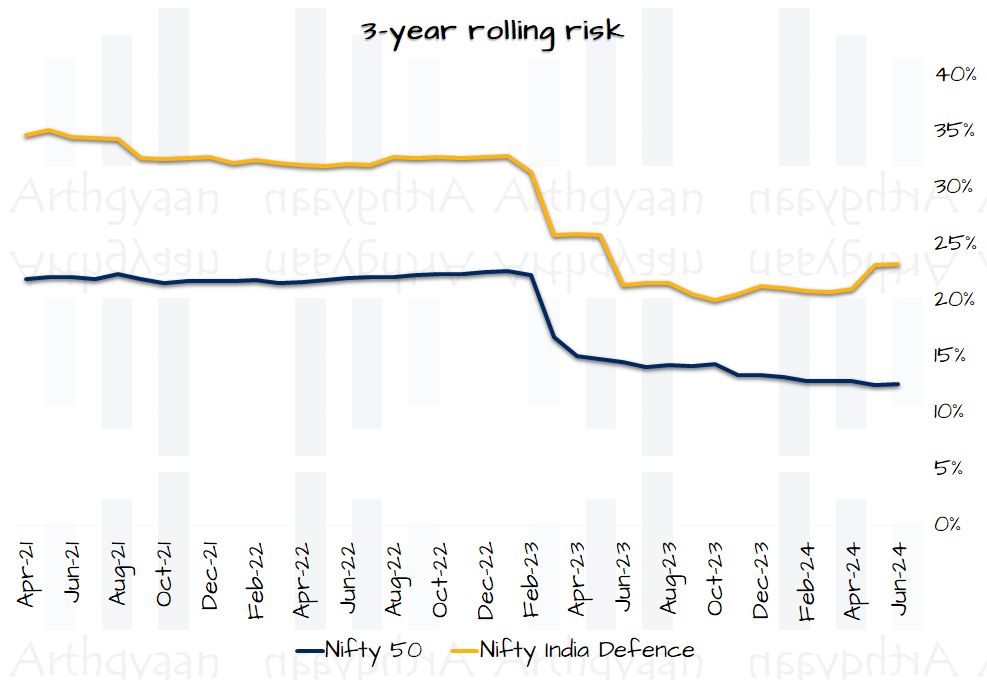

Here using the same rolling window concept, we have calculated the standard deviation of the monthly returns using 36 months:

Unsurprisingly, the new Nifty Defence Index is consistently more volatile than the Nifty 50 as expected from a basket of stocks with only 15 members and limited sector diversification.

If we summarise the results over the entire 3-year rolling windows:

| Index | Return | Risk |

|---|---|---|

| Nifty 50 | 17.48% | 18.71% |

| Nifty Defence Index | 53.55% | 28.53% |

An important point for all indices with backtested results is that they can be created by tweaking the rules to give great results in the past. Such results may or may not be seen in the future. This particular index did not exist before January 2022 and the entire history since 2018 is only backtested data.

To understand how to use data to understand if this index is good or not:

As per the May 2024 index Factsheet, the index holds these stocks:

| Row # | Stock | Weight (%) |

|---|---|---|

| 1 | Hindustan Aeronautics Ltd. | 21.69 |

| 2 | Bharat Electronics Ltd. | 20.72 |

| 3 | Solar Industries India Ltd. | 13.9 |

| 4 | Bharat Dynamics Ltd. | 9.16 |

| 5 | Cochin Shipyard Ltd. | 8.87 |

| 6 | Mazagoan Dock Shipbuilders Ltd. | 6.18 |

| 7 | Astra Microwave Products Ltd. | 4.69 |

| 8 | Data Patterns (India) Ltd. | 4.57 |

| 9 | Garden Reach Shipbuilders & Engineers Ltd. | 2.62 |

| 10 | MTAR Technologies Ltd. | 2.24 |

| 11 | 5 additional stocks | 5.36 |

| 12 | Total | 100.00 |

Therefore, this index is essentially a play on these 5 stocks which have more than 74% weight:

| Stock | Weight (%) | 6M return | 1Y return | Since 4th June 2024 |

|---|---|---|---|---|

| Hindustan Aeronautics Ltd. | 21.69 | -5.72% | 3.24% | -0.30% |

| Bharat Electronics Ltd. | 20.72 | 83.14% | 147.28% | 18.92% |

| Solar Industries India Ltd. | 13.9 | 43.29% | 156.36% | 8.66% |

| Bharat Dynamics Ltd. | 9.16 | 3.16% | -15.93% | -2.73% |

| Cochin Shipyard Ltd. | 8.87 | 237.44% | 632.91% | 25.99% |

You cannot directly invest in an index. You either need:

If you do not have an index fund or do not wish to invest in an ETF, the next best alternative is to invest directly in the underlying stocks. The current list of stocks is available on this page under “Index Constituent” in the Downloads section.

There is only one fund that tracks this index: HDFC Defence fund which has been active since June 2023. This is an expensive fund with an expense ratio of 0.74 for the direct fund (at the time of publishing).

Motilal Oswal Asset Management has filed a draft application with SEBI for an index (passive) mutual fund tracking the Nifty Defence Index on May 2024. The NFO period for this fund is 13-Jun to 24-Jun 2024.

“Investors should remember that excitement and expenses are their enemies.” - Warren Buffet

An investor who ticks one or more of the boxes below might consider investing:

An investor who ticks one or more of the boxes below might consider investing:

☑ A keen follower of the Defence sector news and companies

☑ Willing to invest a substantial portion of the portfolio (say 5% or more) as a satellite portfolio: What is a core-satellite portfolio and when can you use it?

☑ Would understand the inherent risks of theme-based investing

☑ Has research-based conviction on the entry and exit points for this theme

☑ Understands that thematic stocks have tendencies of a sudden reversal that can wipe out all gains

An investor who ticks one or more of the boxes below should not invest:

☑ Interested in this theme now that the index (and funds) exist

☑ Attracted by the recent high returns of this theme

☑ Has not done due diligence beyond reading about this index and funds online

☑ Will be investing a very small amount or will start a small SIP. Both indicate a lack of conviction and lead to portfolio clutter: How to clean up your mutual fund portfolio?

☑ Disagrees with the Warren Buffett quotation above

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled The NIFTY Defence Index has risen more than 6x in 6 years. Should you invest? first appeared on 14 Jun 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.