NSE launches the Nifty Top 10 Equal Weight Index. Should you invest?

This article discusses the Nifty Top 10 Equal Weight Index covering the 10 largest mega-cap stocks in India and whether these stocks are suitable for investors.

This article discusses the Nifty Top 10 Equal Weight Index covering the 10 largest mega-cap stocks in India and whether these stocks are suitable for investors.

This article is a part of our detailed article series on specific indices in India. Ensure you have read the other parts here:

This article discusses the Nifty EV & New Age Automotive Index covering the EV ecosystem or new-age auto technologies in India and whether these stocks are suitable for investors.

This article discusses the blistering performance of the Nifty Defence index and how much defence stocks have beaten the broad market since its launch.

The Nifty Top 10 Equal Weight Index is an index (like the SENSEX or Nifty 50) tracking the top 10 largest stocks in India.

This is India’s first mega-cap (largest of large-cap stocks) stock index, and unlike the usual free-float market capitalization-weighted indices, this index invests equally in all ten stocks. DSP Mutual Fund has an ETF and an index fund which invests in that ETF tracking this index.

As per the index factsheet, the index details are as follows:

| Metric | Description |

|---|---|

| Methodology | Equal-Weighted |

| No. of Constituents | 10 |

| Launch Date | Jun 24, 2024 |

| Base Date | March 02, 2006 |

| Base Value | 1000 |

| Calculation Frequency | End of day |

| Index Rebalancing | Semi-Annually |

| Year | NSE Indices |

|---|---|

| 2013 | 36 |

| 2014 | 38 |

| 2015 | 48 |

| 2016 | 57 |

| 2017 | 69 |

| 2018 | 76 |

| 2019 | 78 |

| 2020 | 77 |

| 2021 | 87 |

| 2022 | 94 |

| 2023 | 104 |

| 2024 | 107 |

NSE makes money by creating indices and licensing that data to AMCs to launch index funds, ETFs, and other mutual funds tracking the index. It is such a great business that the number of indices published by NSE has increased three times from Jan-2013 to Jan-2024.

As per the index factsheet, these are the stocks in the index:

Nifty Top 10 Equal Weight Index aims to track the performance of the top 10 stocks, selected based on free-float market capitalization from the Nifty 50 Index.

We did not have such a concentrated mega-cap index in the past. Now that we have it, it will be interesting to see what kind of use cases AMCs and investors can think of for this index.

The index has these stocks:

| Company Name | Industry | Symbol |

|---|---|---|

| Axis Bank Ltd. | Financial Services | AXISBANK |

| HDFC Bank Ltd. | Financial Services | HDFCBANK |

| Hindustan Unilever Ltd. | Fast Moving Consumer Goods | HINDUNILVR |

| ICICI Bank Ltd. | Financial Services | ICICIBANK |

| Infosys Ltd. | Information Technology | INFY |

| ITC Ltd. | Fast Moving Consumer Goods | ITC |

| Kotak Mahindra Bank Ltd. | Financial Services | KOTAKBANK |

| Larsen & Toubro Ltd. | Construction | LT |

| Reliance Industries Ltd. | Oil, Gas & Consumable Fuels | RELIANCE |

| Tata Consultancy Services Ltd. | Information Technology | TCS |

The updated list is here: stocks.

The target weight of these 10 stocks is 10%, as this is an equal weight index. Investors should note the concentrated sector allocation: Banking 40%, FMCG 20%, IT 20%, and Construction and Energy 10% each.

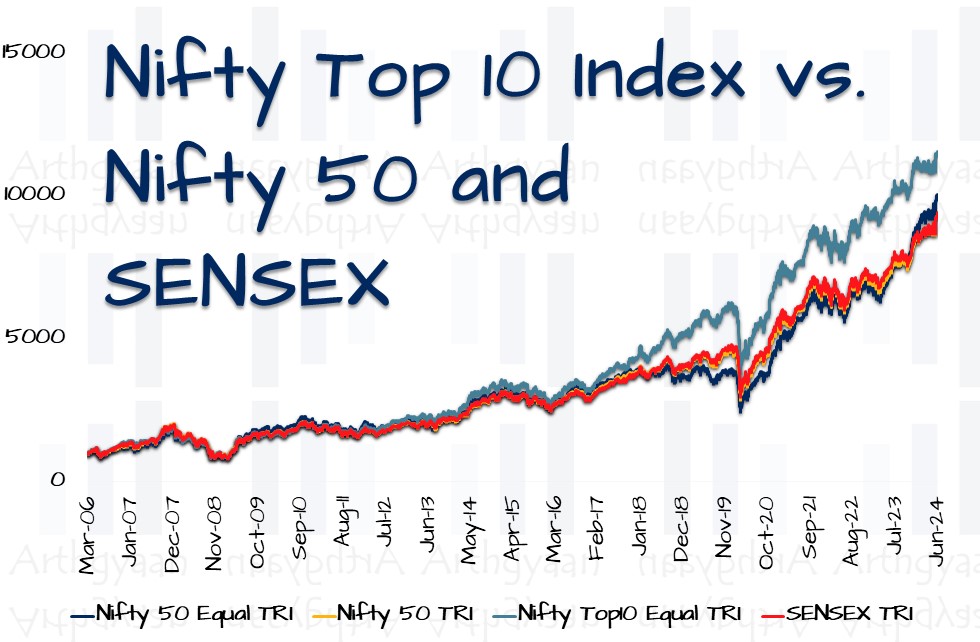

The Nifty Top 10 Equal Weight Index was started with a base date of March 02, 2006 and a starting value of 1000. The performance chart below shows how this index has performed versus the broad market index Nifty 50, the Nifty 50 Equal Weight (same stocks as the Nifty 50 but equal-weighted), and the SENSEX indices (total return = price changes plus reinvested dividends):

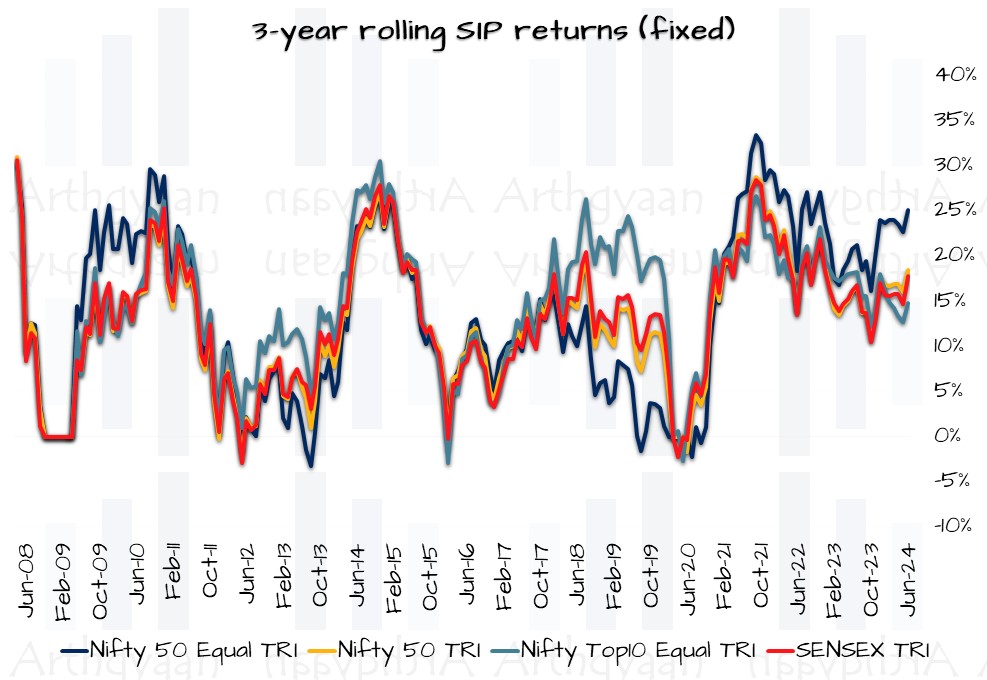

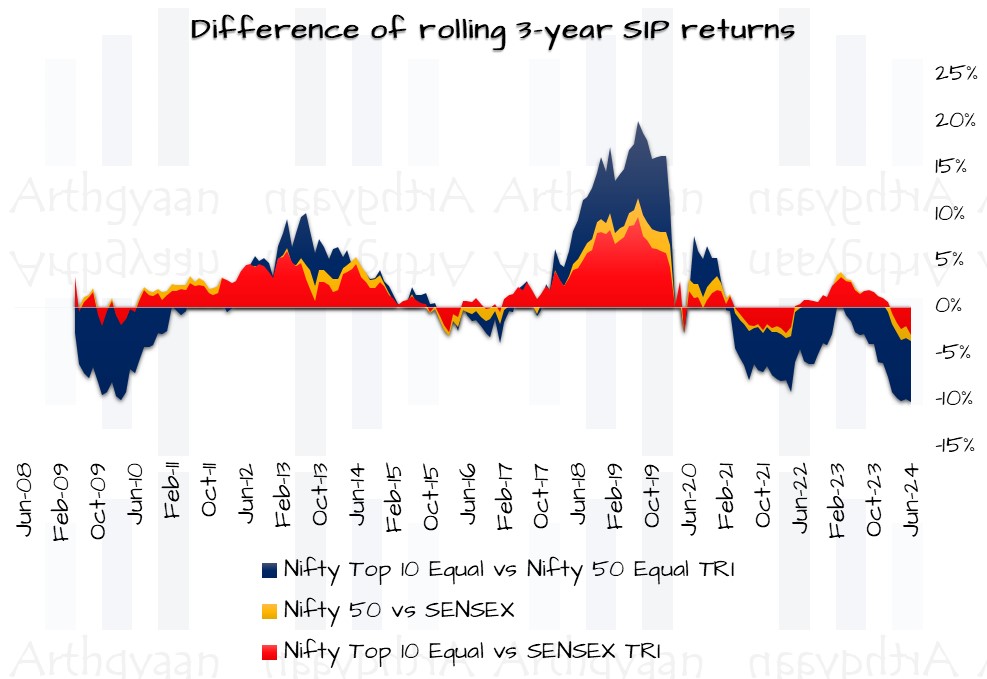

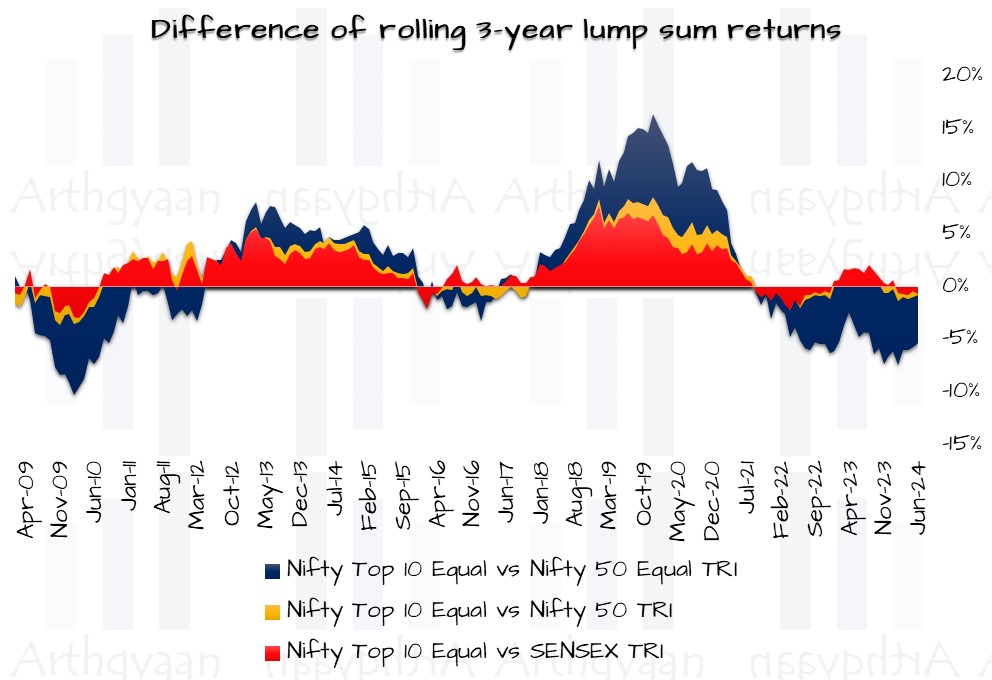

These rolling charts work on a window basis. Each point on the chart is calculated using a 3-year SIP like this:

Investors should note the outperformance of the Nifty Top 10 Equal Weight Index vs. the Nifty 50 and SENSEX around Feb 2019. This is called a concentration rally where the largest stocks give the highest returns. Predictably, the Nifty 50 Equal Weight index returns have suffered in this period.

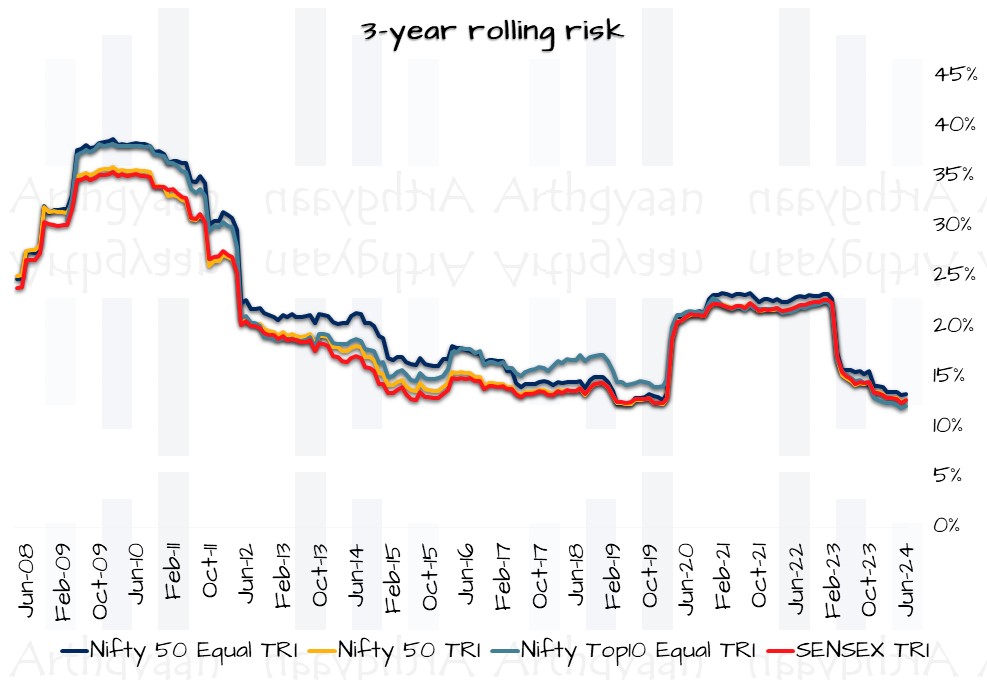

Here, using the same rolling window concept, we have calculated the standard deviation of the monthly returns using 36 months:

The cap-weighted indices have shown consistently lower risk compared to the equal weight indices. This is expected since in the equal weight index, even the smallest stocks, which are more volatile than the largest ones, contribute equally to the daily index movement.

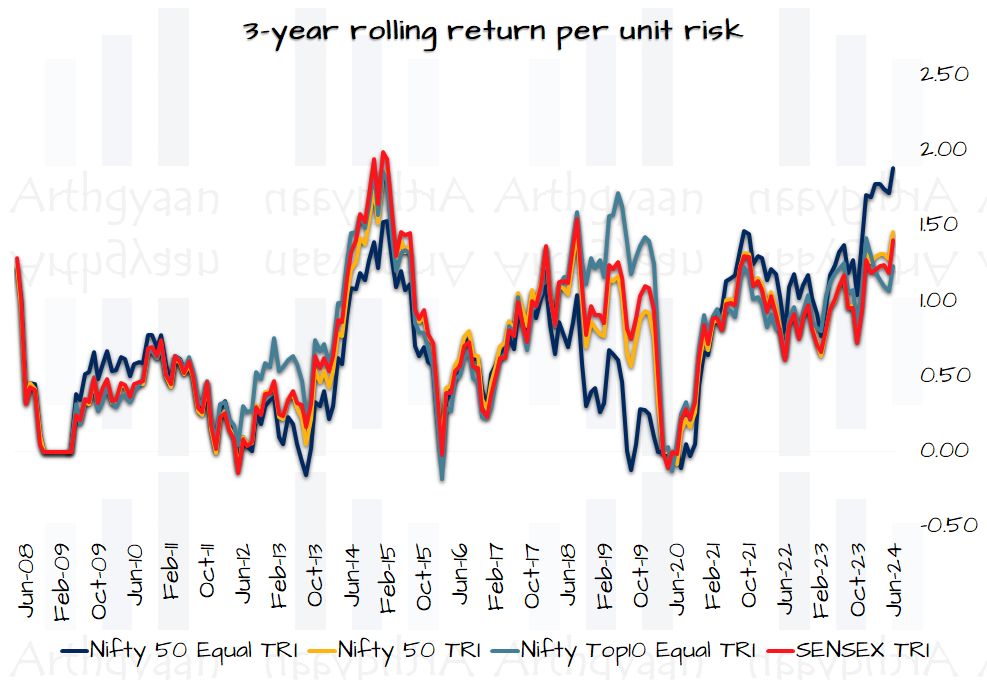

The risk-adjusted returns chart shows that these indices have unpredictably moved around each other: higher risk coming with higher return and vice versa:

An interesting observation from the rolling correlation (which measures how much the indices are similar to each other) chart:

A not-unexpected result of looking at equal-weighted indices vs. size-weighted (or cap-weighted) indices is seen in the correlation chart above. If the stock market goes up mainly due to the largest stocks doing well, then the equal weight indices and the cap-weighted correlations break down as seen around Feb 2019.

To understand how to use data to understand if this index is good or not:

The rolling return charts offer an interesting insight for this index vs. the closest peers:

We will show two charts for excess returns of Nifty Top 10 Equal Weight Index over the others for both SIP and lump sum.

These indices give an indication of the timing of this index launch by the NSE. The top 10 stocks, weighted equally, are underperforming broader indices as of this moment (vs. the opposite trend before July 2021).

You cannot directly invest in an index. You either need:

If you do not have an index fund or do not wish to invest in an ETF, the next best alternative is to invest directly in the underlying stocks. The current list of stocks is available on this page under “Index Constituent” in the Downloads section.

ON 9-Jul-2024, DSP AMC has filed draft applications with SEBI for an ETF and Index fund tracking the Nifty Top 10 Equal Weight Index:

These funds are now available for investment.

Investors can also buy the underlying stocks and rebalance the portfolio as per the index factsheet. This should be fairly straightforward to execute, barring the capital gains tax hit, since there are only ten stocks.

A word of caution: A Top 10 equal weighted index is not diversified. There are too few stocks and the allocation to some sectors is massively lopsided.

E.g., there are currently four banks in the index (Axis, HDFC, ICICI, and Kotak), leading to a 40% allocation to the banking sector. Such concentration, if not understood and risk-managed, may destroy wealth.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled NSE launches the Nifty Top 10 Equal Weight Index. Should you invest? first appeared on 26 Jun 2024 at https://arthgyaan.com