How to Buy Your Dream Home Without Any Savings: A Step-by-Step Guide

This article shows how sufficient cash flow is the key to purchasing a house, even if you are yet to save for the down payment.

This article shows how sufficient cash flow is the key to purchasing a house, even if you are yet to save for the down payment.

🎉 This is post number 300 in this blog

To buy a house, you need two things:

Given that Indian banks generally insist on a 75% loan to value (LTV), i.e. sanction no more than 75% of the cost of a house, it is essential to have a substantial down payment amount. We have written on this topic here: SMART goals: investing step-by-step for buying your dream home.

Note: Other companies like NBFCs may offer higher LTVs, but their loan rates are higher.

However, there are multiple reasons why saving for a down payment may not be possible:

Let us be clear on one point: if you do not have the down payment ready, you can:

Each option above has a high interest rate on borrowing or a high opportunity cost when you sell high-growth assets like equity.

We will now formulate a plan that considers all these considerations with two main caveats. We will:

Note: We are not advocating apartments vs. low rise units like a bungalow or builder floors. The same concept is freely applicable regardless of unit purchased.

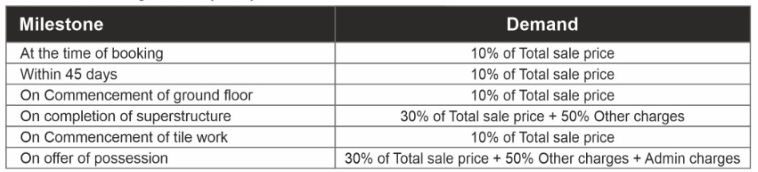

A sample payment plan:

Instead of saving for the down payment in a low-return FD, you can pay periodically to the builder for your new home as the construction progresses.

Under-construction properties lock in the price once purchased and do not increase while the down payment is saved. This plan takes care of FOMO (Fear of Missing Out) in a rising market and the risk of price appreciation while you are accumulating the down payment.

What happens if you instead start a SIP in an equity mutual fund to save the down payment?

Equities are volatile in the short run. If the stock market falls when you plan to buy the house, you must either buy a smaller house or postpone the purchase.

We need to check for these things for the builder who is offering the property:

Such properties will be predictably more expensive than those without all these checks being true.

When you apply for a home loan, you ask for a 48-month moratorium covering the entire construction period. During the moratorium period:

EMI payment for the loan starts once the moratorium is over.

EMI of ₹1 lakh requires a monthly income of ₹2.5-3.3 lakhs (30%-40% limit)

Banks generally do not allow more than 30-40% of the monthly income as EMI while sanctioning a loan. This limit restricts the amount of loan your will get and therefore the house you can buy. Of course, it is easier to reach such income levels as a dual income family so that you purchase the house (and then apply for loan) jointly: Home Loan Eligibility for Joint Applicants: how to buy a bigger house

Buying a home is a long-term commitment that requires the family income to be at a particular level and not fall below that due to illnesses, job losses or career breaks.Couples should carefully plan around any career breaks due to maternity.

The home loan EMI payments will start as soon as the moratorium period is over. Construction delays might occur due to multiple reasons which are unpredictable.

We have covered these topics in detail here: How does your risk profile change with a home loan?

In this example, we will show how to purchase a house as long as you can spend just 1% of the cost of the house in a month and increase that spending amount by a modest 5% yearly. The entire house will be yours in 9 years: 4 years in construction and the home loan paid off in 5 more years.

| Month | Payment plan |

|---|---|

| 1 | 10% |

| 2 | 10% |

| 12 | 10% |

| 30 | 30% |

| 42 | 10% |

| 48 | 30% |

| 49 | 15% |

The last 15% is the cost of registration, etc. The loan EMI starts this month. We will assume:

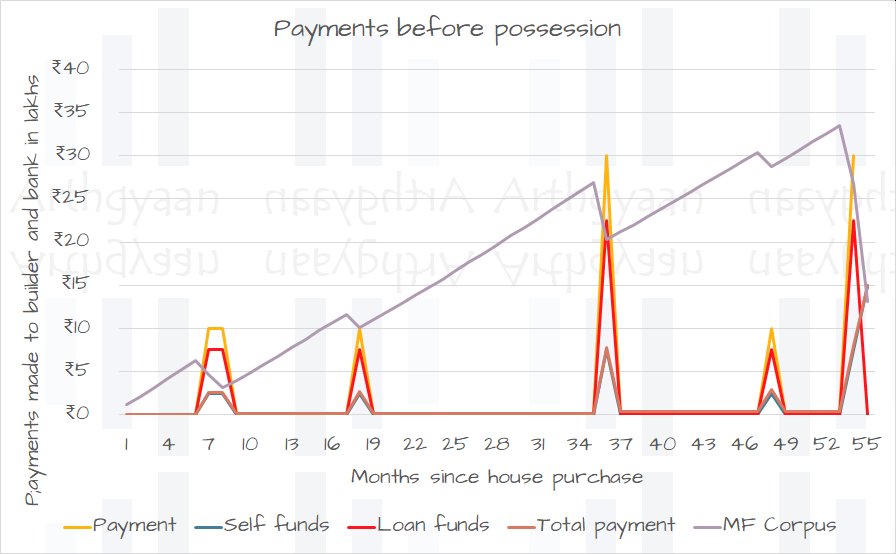

Once you decide to buy a house, the 6-month timer starts, and you immediately start a SIP of ₹1 lakh a month in a money-market or arbitrage debt mutual fund:

This SIP continues until the property registration happens and the entire dues to the builder are paid off. The purpose of the SIP is to accumulate a corpus to:

For each payment made to the builder:

If all goes well, you will have some money left over in the fund for:

As per the plan, you are now at the end of month 54:

Home registration, interiors and shifting will now happen. The loan EMI will also start.

| Year | Amount spent/month |

|---|---|

| 1 | ₹ 1,00,000 |

| 2 | ₹ 1,05,035 (+5% over last year) |

| 3 | ₹ 1,10,324 (+5%) |

| 4 | ₹ 1,15,878 (+5%) |

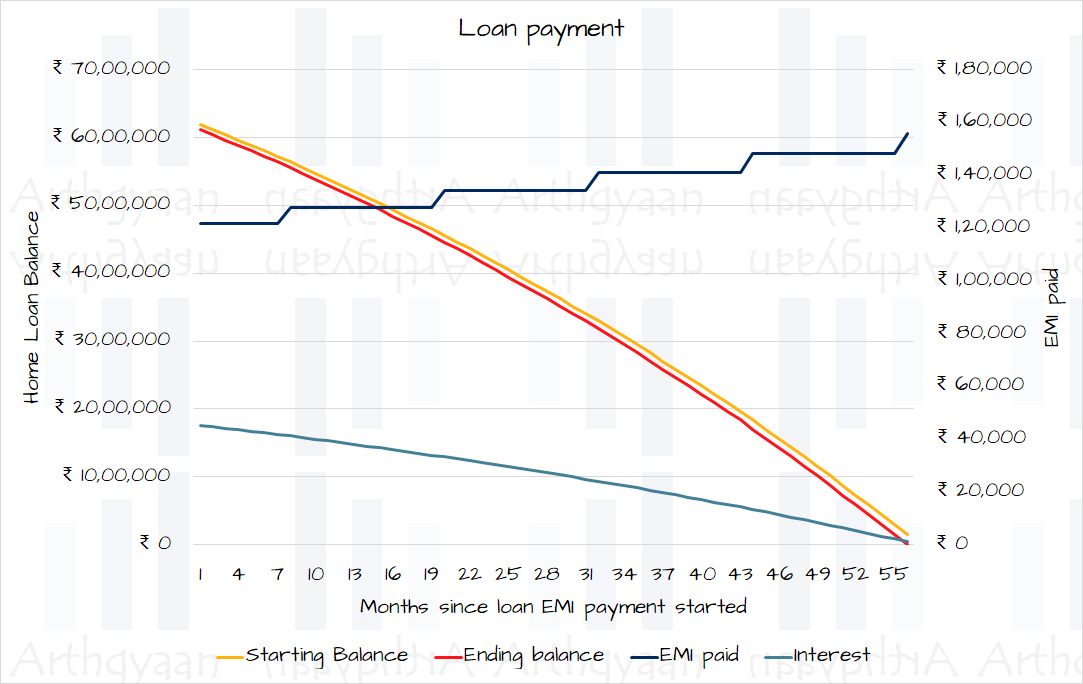

After spending ₹1 lakh/month for 54 months and increasing the amount by 5% a year, you are now spending ₹1.15 lakhs/month. The loan EMI, assuming no rate changes, is ₹75,000/month: How much EMI do I have to pay for my home loan?.

You can, therefore, prepay the loan by at least ₹40,000/month. Since you are used to it, we will also increase the EMI by 5% a year.

| Year | EMI | Starting Loan balance | Ending Loan balance |

|---|---|---|---|

| 5 | ₹ 1,21,713 | ₹ 61,90,160 | ₹ 52,02,951 |

| 6 | ₹ 1,27,841 (+5% over last year) | ₹ 52,02,951 | ₹ 40,47,582 |

| 7 | ₹ 1,34,278 | ₹ 40,47,582 | ₹ 27,04,784 |

| 8 | ₹ 1,41,039 | ₹ 27,04,784 | ₹ 11,53,331 |

| 9 | ₹ 1,48,140 | ₹ 11,53,331 | ₹ 0 |

The chart shows that your loan will be paid off in less than 5 years. The house will be yours as per this plan:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to Buy Your Dream Home Without Any Savings: A Step-by-Step Guide first appeared on 30 Sep 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.