Asset allocation for NPS: equity or debt / active or auto?

This article provides guidance on choosing the right combination of equity and debt along with an allocation plan for NPS subscribers.

This article provides guidance on choosing the right combination of equity and debt along with an allocation plan for NPS subscribers.

The investment options in NPS are governed by the Pension Fund Regulatory and Development Authority (PFRDA) rules. NPS funds are essentially mutual funds with the following four asset classes described below:

This class invests in stocks like other equity mutual funds, and risks/returns are in line with other equity mutual funds. Large fluctuations in equity funds are considered normal, say 40% or worse falls in a year or 60%+ rise in other years. Unless they have entered the stock market since the post-Mar 2020 bull run, investors are well aware of the nature of this fluctuation.

This class invests primarily in RBI, i.e. Government bonds. These bonds have a sovereign guarantee, i.e. no risk of default. However, based on the time to maturity of each bond in the portfolio, they have interest or duration risk. We extensively cover the concept of duration risk here: Should you match debt portfolio duration with goal duration?, but the summary is that the Scheme G NAV will fluctuate considerably due to interest rate changes in the economy.

This fact may surprise investors new to the concept of duration risk or who have only seen high returns from this category due to falling interest rates in line with global economic trends.

This class invests in corporate bonds, i.e. debt issued by companies, not the Central/State Governments. Apart from duration risk, this category has credit risk also since there is always the risk that the company that has issued the bond can fail to pay back interest and principal.

This class invests in alternative investments in products like Alternative Investment Funds (AIF), Mortgage-Backed Securities (MBS), REITs, InvIts, and other similar investments. Due to their nature, these products are high-risk investments and have existed since 2016 only in NPS. Therefore, we are excluding their discussion in this article. Still, the sequence of return risk applies to this category as well. Since the allowed allocation to this category is capped at 5% of the corpus, it does not make a material difference to the returns of the NPS portfolio.

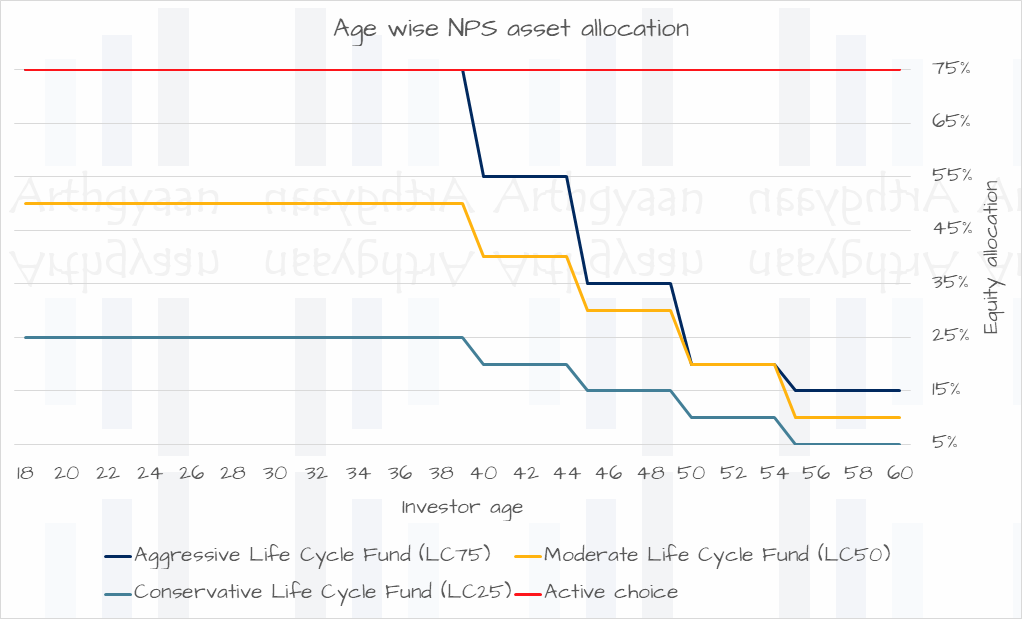

To understand where this risk comes from, let us look at the permissible asset allocation between the E, G, and C categories in NPS. NPS offers two asset allocation choices: active and auto.

Active choice:

Active choice gives a lot of flexibility to the investor with the maximum equity allocation capped at 75% up to age 60 as per the image above. Before 20-Oct-2022, the allocation to equity for active choice was capped up to 75% until the age of 50 and then used to reduce by 2.5% a year to 50% at 60.

Auto choice:

NPS offers three options under auto choice, with asset allocation slowly becoming more conservative as time passes, as shown in the chart below:

We will now discuss some suitable options for NPS asset allocation. Please note that we are only talking about Tier 1 NPS here. Tier 2 NPS does not have the tax benefits as Tier 1 NPS, and there is no reason why investors should invest in Tier 2 instead of Mutual funds.

We will consider these two categories of investors saving for retirement via NPS:

Before going to the categories, it will be good to recap the following points on NPS:

We do not advocate entering a scheme knowingly that puts your money behind bars as NPS does. As life situations are highly fluid, and things can change very fast, which will require access to cash:

Once you have your NPS investments up and running you can track your NPS portfolio value very easily:

NPS offers an excellent asset allocation option under the Auto choice option. Based on your risk profile, you can choose:

We can use some thumb rules here to choose the aggressive option vs the conservative option:

NPS allows up to two lakhs tax-saving per year, while corporate NPS subscribers can save slightly more tax. However, we believe that due to the lockin-upto-60 rule, investors do not invest in NPS Tier 1 beyond the minimum, which is not very useful, they need for tax savings. In such a case, investors can use the Active choice option with the same equity to debt asset allocation as their retirement corpus held outside NPS.

In this case, most of the retirement corpus will be invested outside NPS, which is easy to plan and manage using mutual funds.

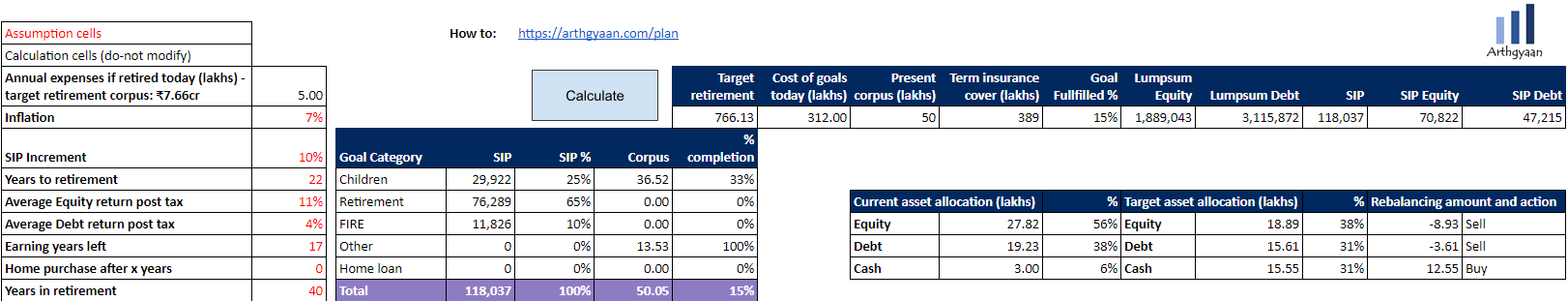

You can use the Arthgyaan goal-based investing tool to plan your retirement, including the proper asset allocation, SIP amount and rebalancing plan.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Asset allocation for NPS: equity or debt / active or auto? first appeared on 22 Jun 2022 at https://arthgyaan.com