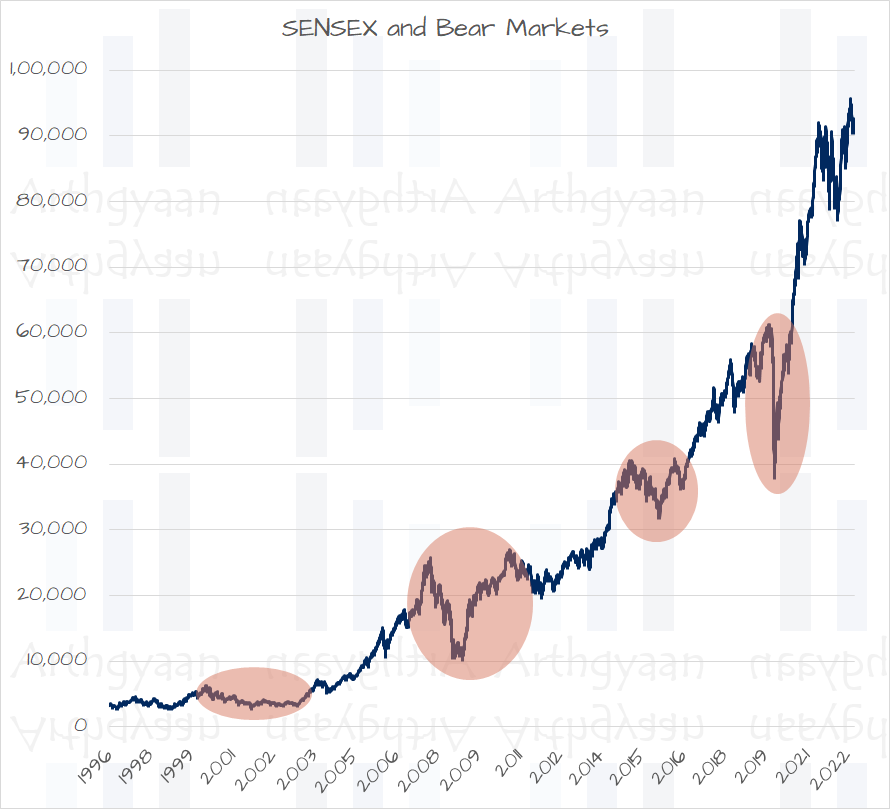

How many bear markets have we seen in India?

This article gives you a brief history of bear markets in India, where the stock market has fallen by 20% or more and has taken some time to recover.

This article gives you a brief history of bear markets in India, where the stock market has fallen by 20% or more and has taken some time to recover.

A bear market is a 20% or more fall in the stock market from a peak followed by a recovery lasting months. Knowing about bear markets is vital since it allows us to plan for worse-case scenarios. In addition, historical data can tell us how long an average bear market lasts, recovers and reaches the previous level.

This knowledge is critical to ensure that the asset allocation of our goals is such that we do not need to sell equity assets to fund a planned expenditure before the market can recover.

We have a shorter stock market history in India than in the US. This article will use data from the SENSEX Total Return Index (SENSEX TRI), which is BSE SENSEX 30 price plus dividends reinvested data, to study bear markets in India. We used Sensex price index data for the Harshad Mehta scam in 1992 since TRI data was unavailable.

A bear market is defined as a 20% or more fall from a recent market peak. The peak leads to a trough followed by a recovery where the same index level as the peak is reached.

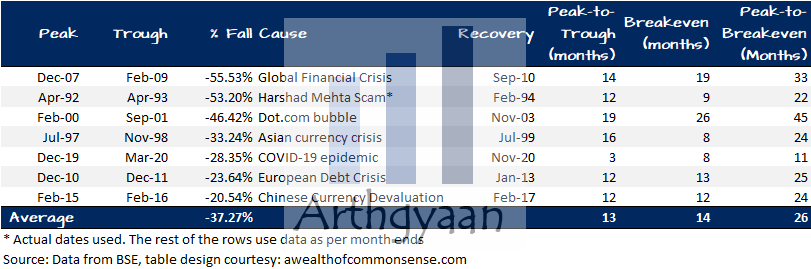

. Using the March COVID-19 example, we see the SENSEX TRI index reached:

Are these numbers typical? We see a few more examples below.

We are interested in three metrics:

Just because the worst recovery duration has been 45 months so far, it does not mean that the worst in the future will always be less than 4 years. We do not know what kind of financial crises will come in the future and how long they will last.

Our asset allocation model for goal-based investing, therefore, errs on the side of caution and completely exits equity before 4 years in the most aggressive risk profile case and before 6 years in the most conservative case.

For investors with the intermediate risk profile, we recommend exiting equity when the goal is 5 years or closer.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How many bear markets have we seen in India? first appeared on 05 Feb 2023 at https://arthgyaan.com