How much money will you lose if the stock market falls in the short term?

This article shows you the amount of loss you will potentially make when the stock market falls in the short term and how to deal with such a market fall.

This article shows you the amount of loss you will potentially make when the stock market falls in the short term and how to deal with such a market fall.

It could be a lot. However, seeing a loss depends greatly on how frequently you look at your portfolio. As long as you don’t do something rash, your portfolio will be fine as it recovers soon.

In this article, we will build on our previous coverage of using broad-market index funds to create long-term wealth in the stock market. Our last article in this series is here: How to Avoid Losing Money in Indian Stocks: 2 Proven Strategies for Long-Term Success

Rule 1 to never lose money in the stock market: never buy individual stocks

As discussed in the linked article above, there is no way to make any meaningful analysis of a portfolio of stocks created and maintained by an individual retail investor. This conclusion comes from the inherent randomness of decisions that the stock-picking investor makes over the lifetime of the portfolio.

Rule 2 to never lose money in the stock market: only invest for the long term

Instead, we will explore the effects of short-term market movements on a portfolio with many stocks, passively managed as a broad market index fund. Here we use Nifty 50 price return data from 1996 onwards for this analysis.

| Time | Best | Average | Worst |

|---|---|---|---|

| 1 day | 17.7% | 0.1% | -13.0% |

| 1 week | 24.5% | 0.3% | -19.3% |

| 1 month | 35.4% | 1.1% | -39.3% |

| 3 months | 77.9% | 3.3% | -43.1% |

| 6 months | 87.3% | 6.8% | -50.6% |

| 1 Year | 103.9% | 13.7% | -56.8% |

As the above table shows, there is a good chance of both making and losing money in the short term. This fact can be unnerving if you suddenly see one year or more of your monthly SIP amount has suddenly vanished due to market fluctuations.

Here we will assume that the portfolio value is ₹1 crore and the monthly SIP amount is ₹1 lakh. We have taken the same short-term profit and loss numbers to see how many months of SIP are made or lost due to market movements.

| Time | Best | Average | Worst |

|---|---|---|---|

| 1 day | 18 months’ profit | Less than 1 month profit | 13 months’ loss |

| 1 week | 24 months’ profit | Less than 1 month profit | 19 months’ loss |

| 1 month | 35 months’ profit | 1 month’s profit | 39 months’ loss |

| 3 months | 78 months’ profit | 3 months’ profit | 43 months’ loss |

| 6 months | 87 months’ profit | 7 months’ profit | 51 months’ loss |

| 1 Year | 104 months’ profit | 14 months’ profit | 57 months’ loss |

In this case, experience with equity market volatility will make it easier to digest these kinds of fluctuations. It will be distressing to see that more than 3 years’ SIP amount was wiped out in the worst kind of monthly fall. However, this is the kind of fluctuation that is normal with making money in equity.

In this table, we show the probability of profit, frequency of loss and the average of the worst ten losses historically.

| Time | Profit probability | Loss every | Worst 10 losses |

|---|---|---|---|

| 1 day | 54% | 3 days | -8.1% |

| 1 week | 57% | 3 weeks | -17.2% |

| 1 month | 61% | 3 months | -33.8% |

| 3 months | 66% | 3 quarters | -40.1% |

| 6 months | 70% | 4 half-years | -47.8% |

| 1 Year | 80% | 5 years | -55.7% |

The less frequently you look at your portfolio, the less likely you will see a loss: For example:

There are some important conclusions here for everyone who gets unnerved by market gyrations:

But the market does recover as we show below.

| Time | Worst 10 losses | Days to recover |

|---|---|---|

| 1 day | -8.1% | 50 |

| 1 week | -17.2% | 113 |

| 1 month | -33.8% | 199 |

| 3 months | -40.1% | 245 |

| 6 months | -47.8% | 193 |

| 1 Year | -55.7% | 255 |

As the table shows above:

Stock market falls should be approached in the same way as the Amazon Diwali Sale

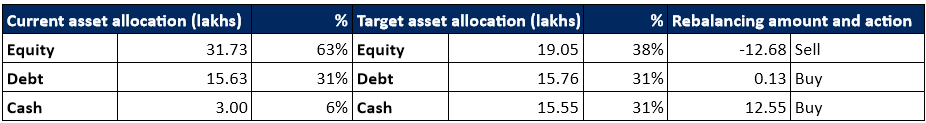

If you understand the concept of rebalancing, stock market falls are a good time to buy low (due to the fall) and later sell high.

Rebalancing is a vital risk management tool to achieve one objective: portfolio risk over time needs to be managed per market movement and horizon of the goal. For example, bull markets make the portfolio’s equity component go up, increasing the portfolio’s risk once a market correction comes. Having the plan to rebalance from equity to debt manages this risk. Similarly, there is a buying opportunity in a bear market if you sell a part of debt holdings to buy equity. Also, as the goal comes closer, the portfolio’s risk must be lowered by lowering the equity component. Rebalancing allows this as well.

Rebalancing allows you to

We have a detailed article on the concept of rebalancing here: Portfolio rebalancing during goal-based investing: why, when and how?.

If you are using the Arthgyaan goal-based investing tool, you can perform rebalancing very easily as the image above shows. For real-life examples of rebalancing in practice, refer to our portfolio case studies.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much money will you lose if the stock market falls in the short term? first appeared on 20 Oct 2024 at https://arthgyaan.com