Are you invested in these worst-performing mutual funds?

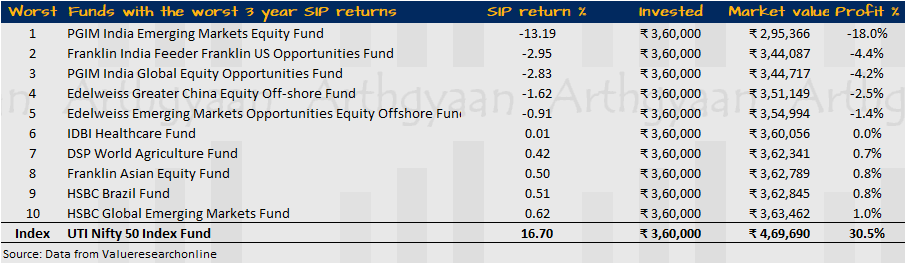

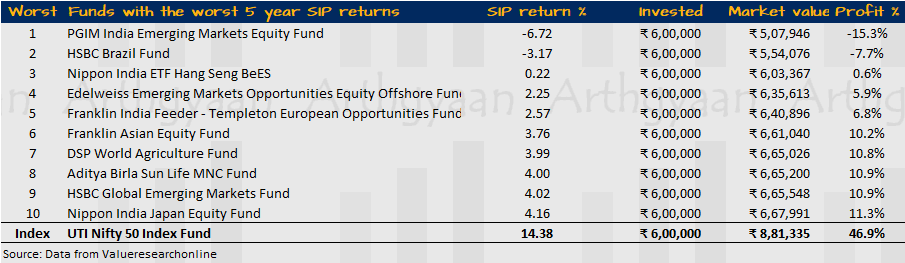

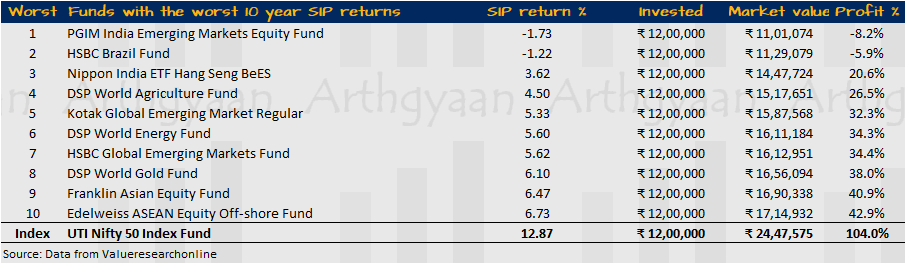

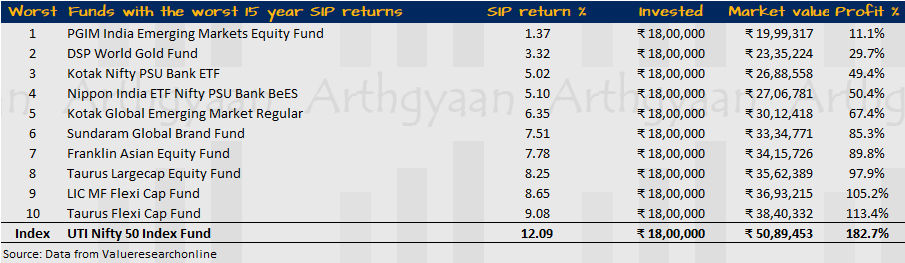

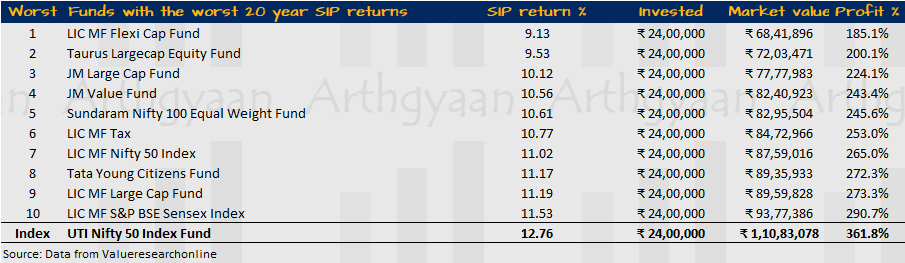

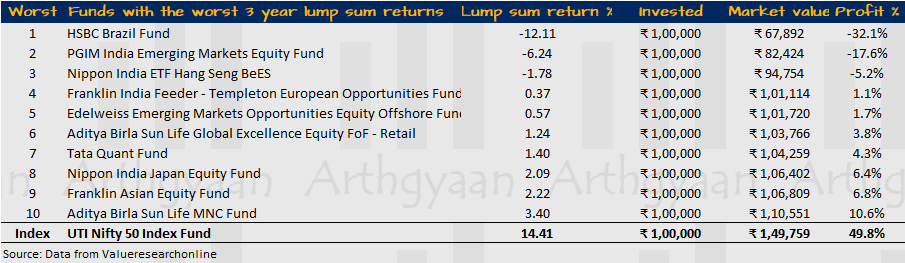

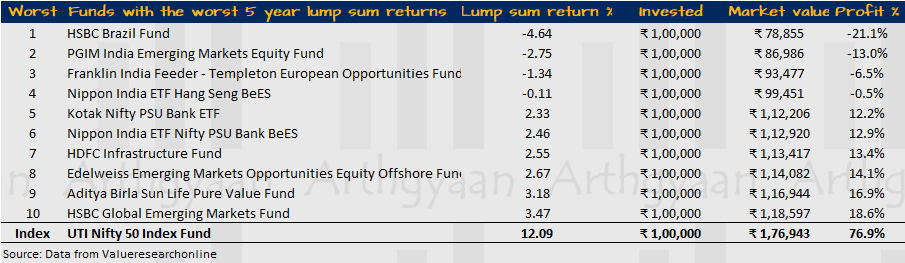

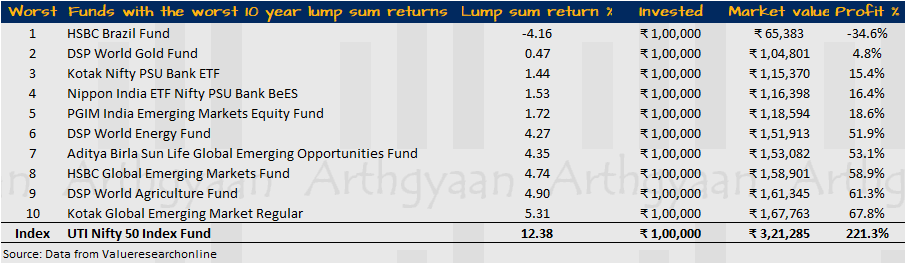

This article lists mutual funds with the worst historical performance over 3, 5, 10, 15, and 20 years.

This article lists mutual funds with the worst historical performance over 3, 5, 10, 15, and 20 years.

If you are unhappy with the performance of your mutual funds, you can get a free Mutual Fund Portfolio review.

This article is a part of our detailed article series on the worst performing mutual funds in India. Ensure you have read the other parts here:

This article categorizes mutual funds based on relative performance, highlighting those offering lower returns at higher risk which can be potentially avoided by investors.

This article shows the funds and categories of mutual funds which have been the worst performers in 2024.

This article shows the funds and categories of mutual funds which have been the worst performers in since the 2020 market crash caused by COVID.

This article lists all the mutual funds that fell the most due to market volatility on 4th June 2024.

This article shows the funds and categories of mutual funds which have been the worst performers in 2023.

This article shows the funds and categories of mutual funds which have been the worst performers in 2022.

This article shows the funds and categories of mutual funds which have been the worst performers in 2021.

Disclaimer: Fund names mentioned in the article are not recommendations for investing or not investing in them. The purpose here is to contrast active funds vs index funds in performance.

We have examined 680 funds using data from Valueresearchonline to create lists of the worst-performing funds by examining returns in lump-sum and SIP form.

Warnings and disclaimers before you use this data:

Reviewing such lists of worst-performing funds is part of the fund review process that all investors should implement for their portfolio: Are you checking the performance of your funds regularly?

In each of these cases, we have shown the final value of a ₹10,000/month SIP in these funds over the lookback period.

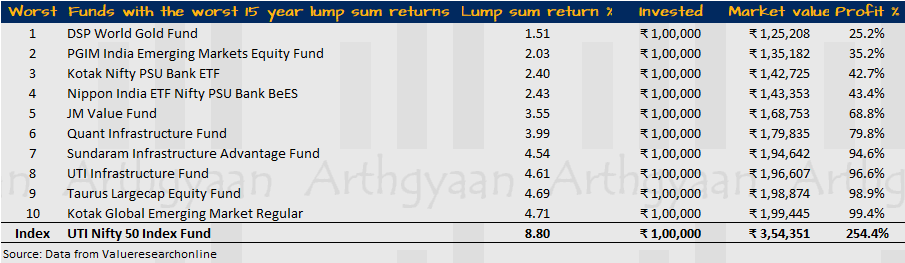

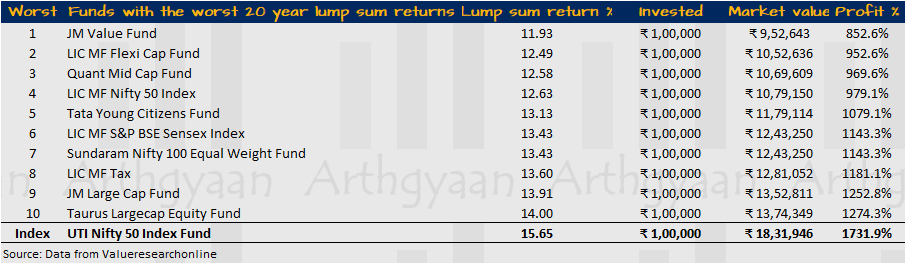

In each of these cases, we have shown the final value of a one-time ₹100,000 investment in these funds over the lookback period.

In each case, we have shown the fund performance along with a long-running Nity 50 index fund. Investors should note that in all cases, the index fund has done better than the funds in the list.

For example, in the worst 20-year SIP returns list, we also have SENSEX and Nifty 50 funds. In a future article, we will examine why these funds from the same AMC have performed poorly.

If you are investing in these funds via an advisor, now is an excellent time to revisit the rationale of sticking with these funds by sitting down with your advisor.

If you are a Do-It-Yourself (DIY) investor, you should reconsider why you need to invest in active funds and instead switch to index funds: What are the best index funds for new investors in India?

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Are you invested in these worst-performing mutual funds? first appeared on 08 Feb 2023 at https://arthgyaan.com