How Sukanya Samridhhi Yojana (SSY) and Public Provident Fund (PPF) can together take your daughter from college to PhD?

This article shows you how much corpus you can create via SSY and PPF for your daughter’s education from college to PhD.

This article shows you how much corpus you can create via SSY and PPF for your daughter’s education from college to PhD.

Sukanya Samriddhi Account is a Government of India backed saving scheme targeted at the parents of girl children. The scheme encourages parents to build a fund for the future education of their female child. - Wikipedia

SSY is allowed only for girl children and has a ₹1.5 lakhs/year limit. It offers a deduction under 80C and has a 8.20% interest rate as of today. The amount is locked in until 21 years from account opening and allows partial withdrawal once the child is 18.

Just like PPF, the interest on SSY is calculated on the 10th of the month so you should invest as much as possible or need to by that date.

A new SSY account can be opened before the girl child is 10 years old. A maximum of two SSY accounts can be opened in a family. You can deposit a minimum of ₹1,000/year up to a maximum of ₹1.5 lakhs. Deposits are allowed only for 14 years from the date of opening the account.

50% of the balance in the account may be withdrawn once the girl child is 18 years old for higher education or marriage. The account matures 21 years after the opening date (and not when the child is 21).

The legal owner of the money in the SSY account is the girl child for whom the account was opened.

As per Wikipedia, the Public Provident Fund (PPF) is a savings-cum-tax-saving instrument in India introduced by the National Savings Institute of the Ministry of Finance in 1968. PPF allows you to save small sums of money and offers a guaranteed interest rate and tax benefits that make it attractive for many conservative investors.

PPF is a fantastic debt instrument which has guaranteed return (though it has fallen over time) but it is still higher than the market rate in other options. Since there is a 15-year lock-in (which can be extended in blocks of 5 years) and to keep the account active you need only ₹500/year, open it and keep it active

In this example, we will consider a girl child whose parents open both a PPF and SSY account when the child is 3 years old and start depositing ₹1.5lakhs/year (₹12,500/month) in each account. SSY investment continues for the next 14 years as per the rules.

The timeline and goals are as below:

| Age of girl | PPF | SSY | Goal |

|---|---|---|---|

| 1 | |||

| 2 | |||

| 3 | Open | Open | |

| … | |||

| 17 | Renew | ||

| 18 | 50% withdrawal of SSY | UG | |

| 19 | UG | ||

| 20 | 60% withdrawal PPF | UG | |

| 21 | UG | ||

| 22 | Renew | ||

| 23 | Matures | ||

| 24 | PG | ||

| 25 | PG | ||

| 26 | |||

| 27 | Renew | ||

| 28 | |||

| 29 | 60% withdrawal PPF | PhD | |

| 30 | PhD | ||

| 31 | PhD | ||

| 32 | Matures | PhD | |

| 33 | House down-payment |

When planning for fixed goals via accounts like PPF and SSY with lock-ins, it is very important to be sure that money is available when needed.

For example, we need to keep in mind the following rules

The money grows and gets spent like this (amounts are in ₹ lakhs/year):

| Age | PPF | SSY | Goal | Investment | PPF balance | SSY balance | Corpus | Spending |

|---|---|---|---|---|---|---|---|---|

| 3 | Open | Open | ₹ 3.0 | ₹ 1.5 | ₹ 1.5 | ₹ 3.0 | ||

| 4 | ₹ 3.0 | ₹ 3.2 | ₹ 3.2 | ₹ 6.4 | ||||

| 5 | ₹ 3.0 | ₹ 5.0 | ₹ 5.0 | ₹ 10.0 | ||||

| 6 | ₹ 3.0 | ₹ 6.9 | ₹ 7.0 | ₹ 13.8 | ||||

| 7 | ₹ 3.0 | ₹ 8.9 | ₹ 9.1 | ₹ 18.0 | ||||

| 8 | ₹ 3.0 | ₹ 11.2 | ₹ 11.3 | ₹ 22.5 | ||||

| 9 | ₹ 3.0 | ₹ 13.5 | ₹ 13.8 | ₹ 27.3 | ||||

| 10 | ₹ 3.0 | ₹ 16.1 | ₹ 16.4 | ₹ 32.5 | ||||

| 11 | ₹ 3.0 | ₹ 18.8 | ₹ 19.3 | ₹ 38.1 | ||||

| 12 | ₹ 3.0 | ₹ 21.8 | ₹ 22.4 | ₹ 44.2 | ||||

| 13 | ₹ 3.0 | ₹ 24.9 | ₹ 25.7 | ₹ 50.6 | ||||

| 14 | ₹ 3.0 | ₹ 28.3 | ₹ 29.3 | ₹ 57.6 | ||||

| 15 | ₹ 3.0 | ₹ 32.0 | ₹ 33.2 | ₹ 65.1 | ||||

| 16 | ₹ 3.0 | ₹ 35.9 | ₹ 37.3 | ₹ 73.2 | ||||

| 17 | Renew | ₹ 1.5 | ₹ 40.0 | ₹ 40.3 | ₹ 80.3 | |||

| 18 | 50% withdrawal SSY | UG | ₹ 1.5 | ₹ 44.5 | ₹ 43.4 | ₹ 88.0 | ₹ 43.4 (from SSY) | |

| 19 | UG | ₹ 1.5 | ₹ 49.4 | ₹ 46.9 | ₹ 96.2 | |||

| 20 | 60% withdrawal | UG | ₹ 1.5 | ₹ 21.8 | ₹ 50.5 | ₹ 72.4 | ₹ 32.7 (from PPF) | |

| 21 | UG | ₹ 1.5 | ₹ 25.0 | ₹ 54.5 | ₹ 79.5 | |||

| 22 | Renew | ₹ 1.5 | ₹ 28.4 | ₹ 58.8 | ₹ 87.2 | |||

| 23 | Matures | ₹ 1.5 | ₹ 32.0 | ₹ 63.4 | ₹ 95.5 | |||

| 24 | PG | ₹ 1.5 | ₹ 35.9 | ₹ 35.9 | ₹ 63.4 (from SSY) | |||

| 25 | PG | ₹ 1.5 | ₹ 40.1 | ₹ 40.1 | ||||

| 26 | ₹ 1.5 | ₹ 44.6 | ₹ 44.6 | |||||

| 27 | Renew | ₹ 1.5 | ₹ 49.4 | ₹ 49.4 | ||||

| 28 | ₹ 1.5 | ₹ 54.6 | ₹ 54.6 | |||||

| 29 | 60% withdrawal | PhD | ₹ 1.5 | ₹ 24.1 | ₹ 24.1 | ₹ 36.1 (from PPF) | ||

| 30 | PhD | ₹ 1.5 | ₹ 27.4 | ₹ 27.4 | ||||

| 31 | PhD | ₹ 1.5 | ₹ 31.0 | ₹ 31.0 | ||||

| 32 | Matures | PhD | ₹ 1.5 | ₹ 34.8 | ₹ 34.8 | |||

| 33 | House | ₹ 1.5 | ₹ 38.9 | ₹ 38.9 | ₹ 38.9 (from PPF) |

The picture painted here is extremely rosy with over ₹2 crore being spent over the years. However, the period involved is over 30 years and at this point, inflation cannot be ignored.

| Age | Goal | Spending | Spending (8% Inflation adjusted) |

|---|---|---|---|

| 18 | UG | ₹ 43.4 | ₹ 11.7 |

| 20 | UG | ₹ 32.7 | ₹ 7.6 |

| 24 | PG | ₹ 63.4 | ₹ 10.8 |

| 29 | PhD | ₹ 36.1 | ₹ 4.2 |

| 33 | House | ₹ 38.9 | ₹ 3.3 |

| - | Total | ₹ 214.6 | ₹ 37.6 |

If we apply a modest 8% inflation to these amounts the total amount, in today’s money is just above ₹37 lakhs. With these amounts, only government colleges can be used for education. Private colleges will be too expensive and the house down payment cannot be a practical goal.

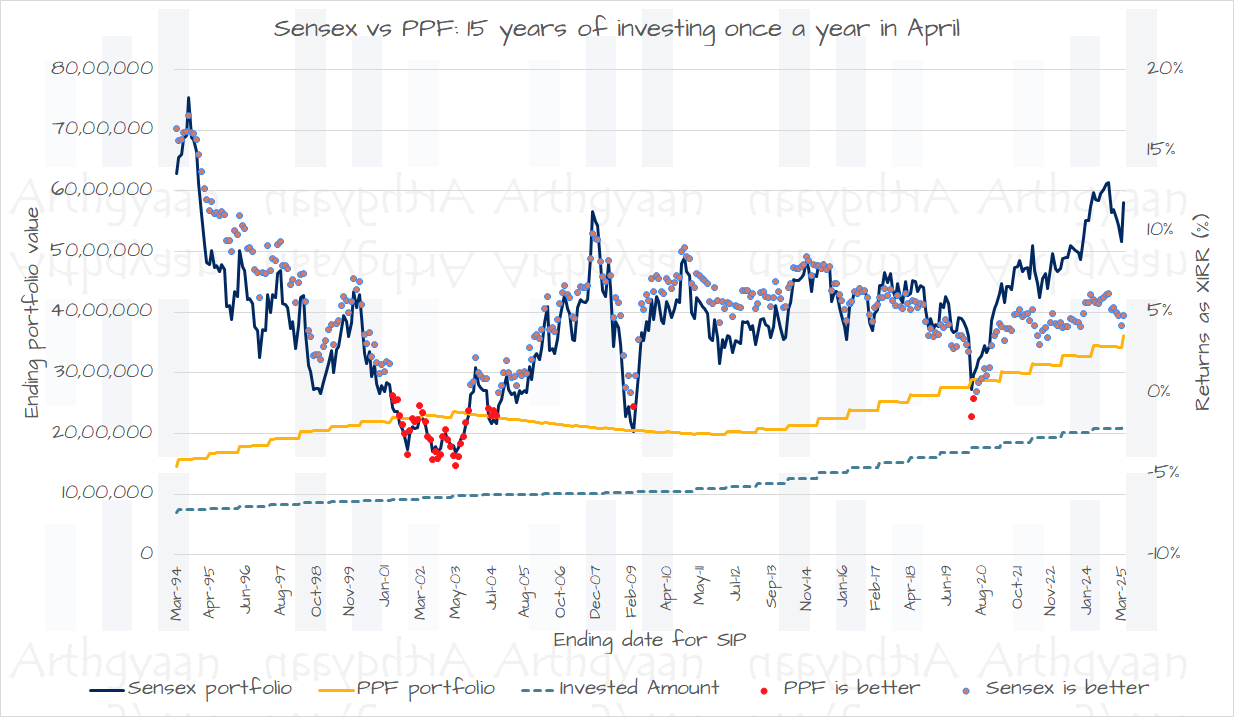

PPF and SSY create a much lower corpus compared to mutual funds and that is the cost of choosing safety as we just showed. Here is an example of the performance of mutual funds.

We have already shown that PPF has not beaten risky assets like equity in less than 10% of cases since 1979: The latest result of PPF vs. SENSEX.

You can follow the complete goal-based investing process as explained:

Your child’s school and other regular expenses will come from monthly income. But you need to plan for bigger expenses in advance:

Which of these are you saving for:

To understand how to create a child’s education plan:

You need to ensure that an untimely death will not prevent your child from going to their future dream college. Term insurance is the right product here. Every earning member of the family must have adequate term insurance.

The whole family, i.e. child and parents should also have sufficient health insurance. This step prevents loss of income or a setback to investment goals due to illness.

Children’s education and other goals do not exist in isolation. They are a part of the comprehensive goal-based planning that parents need to do for their own retirement and everything else. The process is explained best with these examples:

There are more case studies here: Case Studies.

We have proven that the goal-based investing process works in most market conditions in this article: What is the best way to invest for your child’s college education?.

As time passes, things change:

Therefore the plan created in Step 3 has to be reviewed and rebalanced to check if you are still on track: Are your investments on track for your goals?.

To implement all of the above steps in one easy-to-follow bundle, we have Arthgyaan Child Education goal packages. Choose the year closest to your desired college admission year to get started:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How Sukanya Samridhhi Yojana (SSY) and Public Provident Fund (PPF) can together take your daughter from college to PhD? first appeared on 03 Apr 2024 at https://arthgyaan.com