How much portfolio return do you need over your lifetime to meet all your goals?

This article shows the calculation for your portfolio’s lifetime XIRR which allows you to meet all your goals.

This article shows the calculation for your portfolio’s lifetime XIRR which allows you to meet all your goals.

A portfolio, as we have discussed many times before, has the single purpose of providing you with money to spend on goals like:

For this to happen, you invest from your family income. External income like inheritances also gets invested.

The overall investor-to-portfolio relationship looks like this:

Here we see that the investor gives money to the portfolio (which we will consider with a negative sign). In contrast, the portfolio creates returns (with a positive sign).

With this understanding in place, we can now calculate returns.

We will use the IRR function provided in both Excel and Google Sheets to calculate this:

| Year | Investment | Return | Net Cash Flow | Comment |

|---|---|---|---|---|

| 1 | -5.00 | 3.00 | -2.00 | Earning phase |

| 2 | -5.50 | 0.00 | -5.50 | Earning phase |

| 3 | -6.05 | 2.00 | -4.05 | Earning phase |

| 4 | -6.66 | 0.00 | -6.66 | Earning phase |

| 5 | -7.32 | 0.00 | -7.32 | Earning phase |

| … | … | … | … | … |

| 30 | 0 | 30.00 | 30.00 | Retired |

| 31 | 0 | 32.10 | 32.10 | Retired |

| 32 | 0 | 34.35 | 34.35 | Retired |

| 33 | 0 | 36.75 | 36.75 | Retired |

| 34 | 0 | 39.32 | 39.32 | Retired |

| … | … | … | … | … |

To get the lifetime portfolio return, we will apply the IRR function on the “Net Cash Flow” column since these are annual numbers. You can do this exercise with monthly numbers also, but then you will have to use the XIRR function.

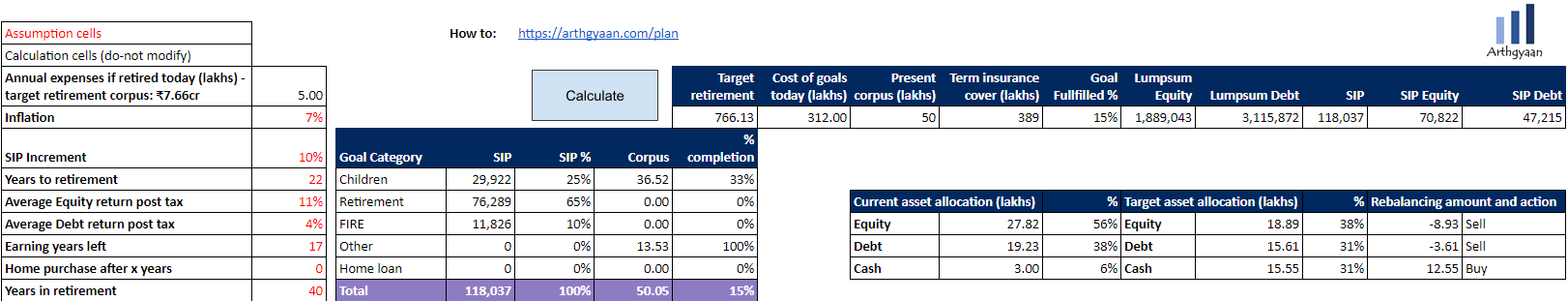

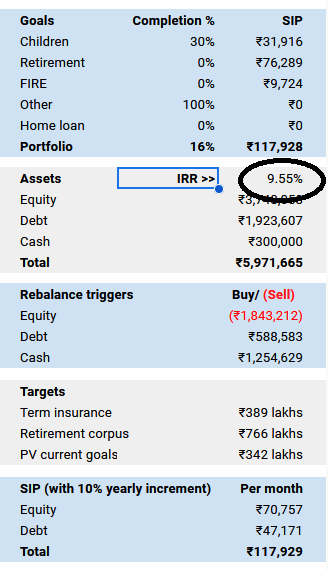

If you are using our goal-based investing calculator shown in the above screenshot, your lifetime portfolio return is available in the dash tab:

Many investors, when they create their portfolio, look for the best-performing investments: best mutual funds, best stocks and other “only-the-best-will-do” investments. However, the lifetime return needed from their portfolios is bounded by their asset allocation and the rebalancing plan.

Note: The IRR calculation uses Google Sheets’ own IRR function. If you get strange numbers, as some users have reported, please copy range io!L3:L102 (from the hidden “io” sheet) to Excel and apply IRR in Excel.

We have already shown before that it is very difficult to beat inflation at a total portfolio level.

Our IRR calculation shows the same result. Depending on the goals you have, your portfolio return does not need to be very high. In such cases, there is no need to take an excessive amount of risk. For example, if you have planned it that way, a small amount of risk, via safe investments like PPF may be enough for your children’s goals:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much portfolio return do you need over your lifetime to meet all your goals? first appeared on 07 Apr 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.