What is the latest Employees Provident Fund (EPF) rate? What are the historical rates for EPF?

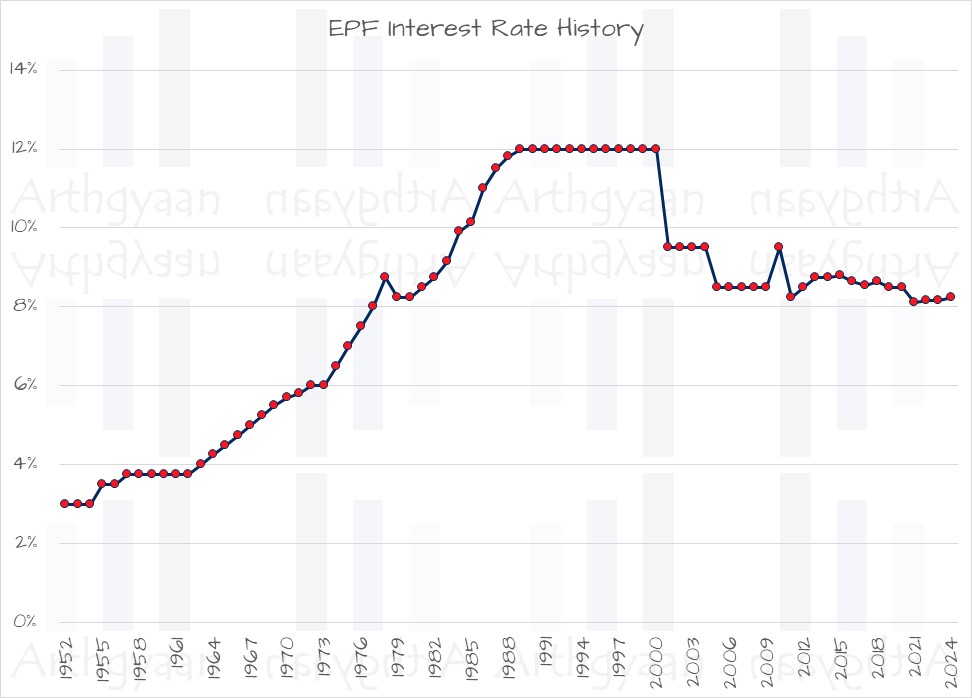

This article gives you the current and historical interest rates for EPF so that you can track how the rate has moved since the 1950s.

This article gives you the current and historical interest rates for EPF so that you can track how the rate has moved since the 1950s.

Originally published: 5-Jul-2023

Updated: 19-Feb-2024 - EPF rate updated to 8.25%

As per the EPFO website, Employees’ provident fund (EPF) is the world’s largest social security scheme offering a provident fund (retirement scheme), pension and death benefits. EPF investment is mandatory with an employer match for most salaried employees.

EPF allows you to save small sums of money, and offers a guaranteed interest rate and tax benefits that make it attractive for many conservative investors. EPF is an excellent debt instrument which has guaranteed return (though it has fallen over time as we show here) but it is still higher than the market rate in other options.

EPF is an EEE-class instrument which means that it is exempt from tax on investment up to 1.5 lakhs/year under 80C, exempt from taxation during growth and there is a full exemption on taxes at maturity. Currently, investments in EPF beyond 2.5L/year leads to taxes on the interest paid above ₹2.5L investment.

The latest EPF rate is 8.25%

Using data from the EPF India website, we plot the historical interest rates of EPF since 1952.

Some observations:

In the sections below we will cover a few commonly asked questions on EPF.

Our analysis using SENSEX data from 1979 shows that stock investing in SIP form over a 30-year horizon has given better returns than investing in the EPF.

Read more: EPF vs. mutual funds: which is better?

If your college admission date is 15 years or more away, then a EPF account can be used. However, the returns from EPF are below the usual college fee inflation of 10% (or more), you need equity mutual funds as well to ensure that you meet your goal.

Read more: What is the best way to invest for your child’s college education?

For long-term goals, EPF is a good option. For goals that are more than 15 years away, the typical asset allocation, i.e. mix of equity and debt in the portfolio, should be around 60:40. This means that your monthly investment should also follow the same 60:40 rule. As long as you are investing at least enough in equity as per the asset allocation, the rest can be in EPF and other debt investment options.

Read more: What should be my mix of MF, Stocks, Gold, NPS, FD, EPF and ELSS if I want to invest 50k per month?.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the latest Employees Provident Fund (EPF) rate? What are the historical rates for EPF? first appeared on 05 Jul 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.