What are the dangers of following financial advice from main-stream media?

This article discusses what kind of caution you should exercise in case you are using media outlets to learn about personal finance.

This article discusses what kind of caution you should exercise in case you are using media outlets to learn about personal finance.

This article, which came on print in December 2023, talks about how investing in NPS can create a corpus for retirement. The article says that if a 25-year old invests a small sum like ₹442/day in NPS for 35 years, then you will create a corpus of ₹5 crores at age 60 which will lead to an income of ₹2.5 lakhs in retirement.

Let us break this down why an article like this is extremely attractive to read:

One very good thing that the article does have, to give it credit, is the focus on starting investments early. However, as we will show below, there are fundamental problems in the article that we need to be mindful of and adjust.

you are likely to get an average interest of 10 per cent

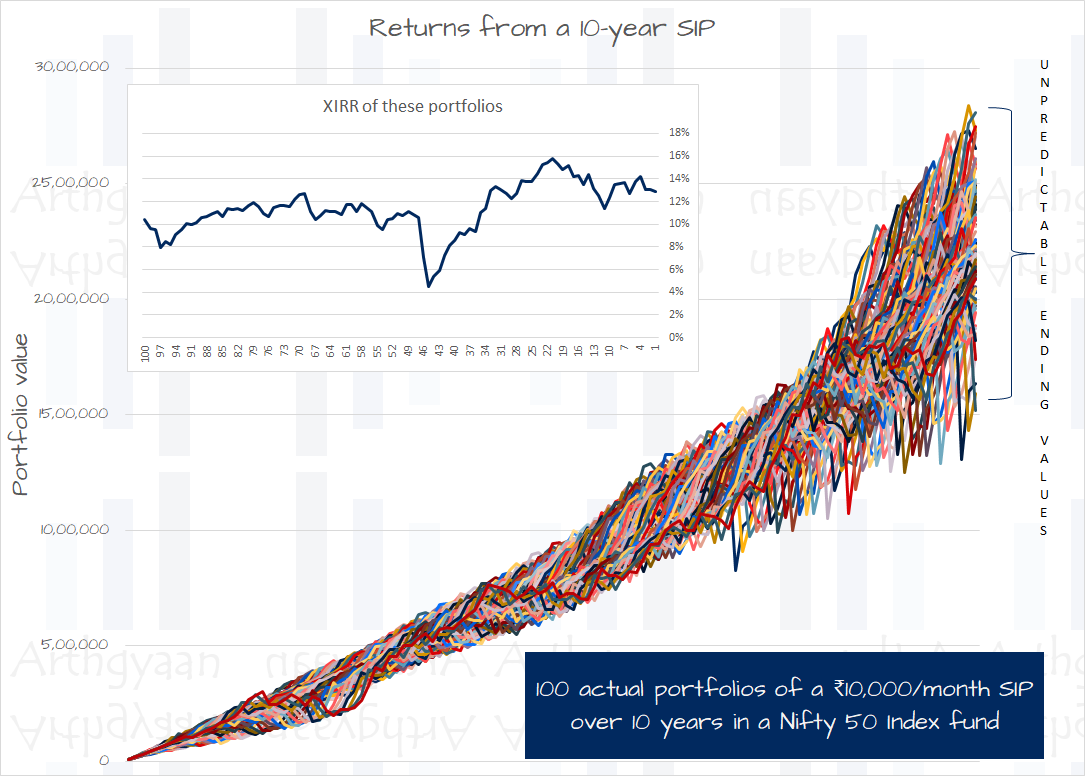

The article, thankfully, uses the word “average” here. As we have argued before in talking about the lie of wealth-creation via SIP in mutual funds, an average return assumption completely glosses over the fact that the stock market does not behave like an FD.

To reach a fixed target of ₹5 crore in 35 years is possible but not by running a blind SIP but by adjusting the asset allocation over time via rebalancing: What is the lifecycle of a goal?.

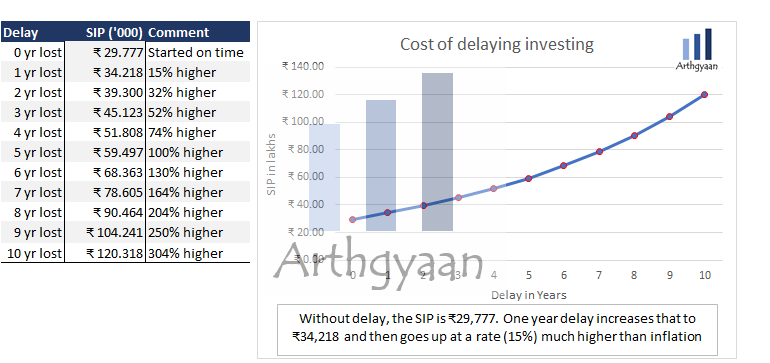

The article does not talk about increasing the SIP amount over time as and when income increases.

This is a rather surprising omission since investing more and more over time obviously increases the final corpus. In fact, increasing the SIP amount by 10%/year reaches a corpus of ₹15 crores which obviously makes the monthly income figure ₹7.5 lakhs/month in retirement

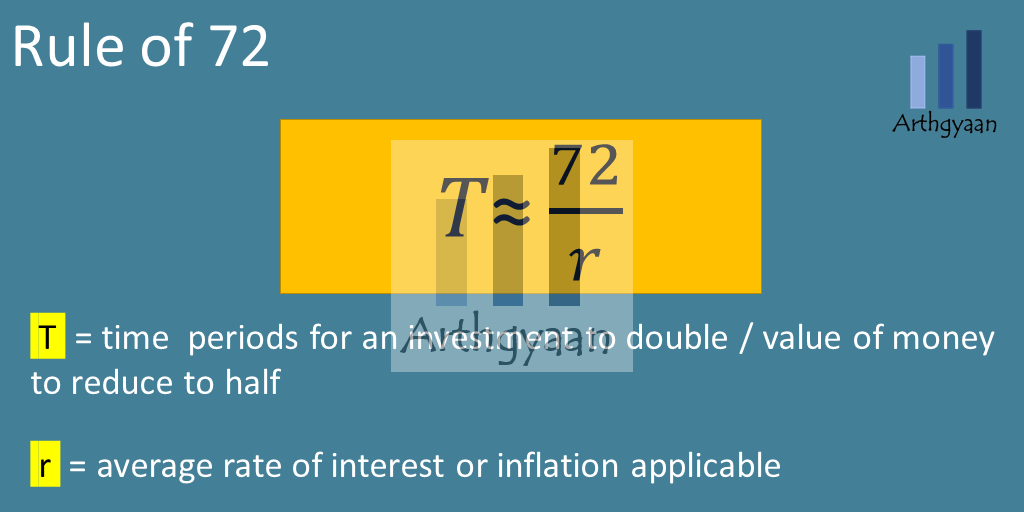

Unfortunately, the article completely omits any mention of inflation. We can use the rule of 72 to estimate the effect of inflation quickly. A modest 7.2% inflation of goods and services shows that the cost will double in 10 years, approximately or the purchasing power of money will be cut by half over this period.

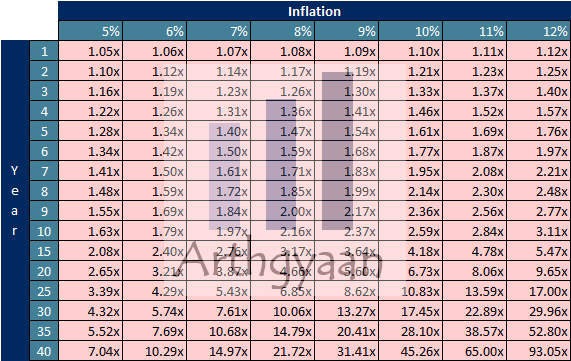

Since the corpus is accumulated after 35 years, let us now apply inflation and see the reality. Applying the same 7% inflation rate and applying the compounding table above, we can see that costs will become 10.68 times in 35 years. A product that costs ₹100 today will cost ₹1068 after 35 years. If this sounds unreasonable, please check with your parents or grandparents about the cost of milk (or gold) at the time they got married. The reality will be clear immediately.

If we adjust for inflation with a factor of 10.68,

We have covered pension plans in retirement here: Do you need a pension plan during retirement?

The article does not have any derivation for the ₹2.5 lakh/month income during retirement. We know that as per NPS rules, 40% of the corpus, at the minimum has to be invested in an annuity while the rest can be withdrawn tax-free and invested anywhere else.

To get to ₹2.5 lakhs/month, assuming a reasonable 6% returns, you need a corpus of 2.5 * 12 / 6% = ₹5 crore. If this is what the article has done then again there is no inflation adjustment. We have already said that at 7% inflation, prices double every 10 years. So 10 years into retirement, the ability of that ₹2.5 lakhs to buy things becomes half. If we adjust against today’s money, the ₹2.5 lakhs/month income in retirement in today’s money is worth

Therefore, the headline ₹2.5 lakhs/month becomes a much smaller number at the point of retirement after inflation-adjustment. That too shrinks rapidly, due to inflation again, once

We have covered a detailed step-by-step retirement planning process and calculation here:

The process above uses the right approach and adjusts correctly for inflation.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the dangers of following financial advice from main-stream media? first appeared on 27 Dec 2023 at https://arthgyaan.com