Which ELSS funds have consistently doubled your money in three years?

This article gives you a list of ELSS funds that have consistently doubled their invested amount in three years.

This article gives you a list of ELSS funds that have consistently doubled their invested amount in three years.

Disclaimer: Fund names in this article do not constitute as recommendations to either enter or exit those funds.

Before we discuss ELSS investing, you need to note that ELSS is part of the 80C deduction, which is no longer an allowed tax deduction in the new tax regime. You should always check first if you will save more tax in the new tax regime: Which is the best tax regime to choose from April?.

That being said, many investors wish to know the best-performing ELSS funds in March, and this article discusses an observation about the return of ELSS funds vs. their holding period.

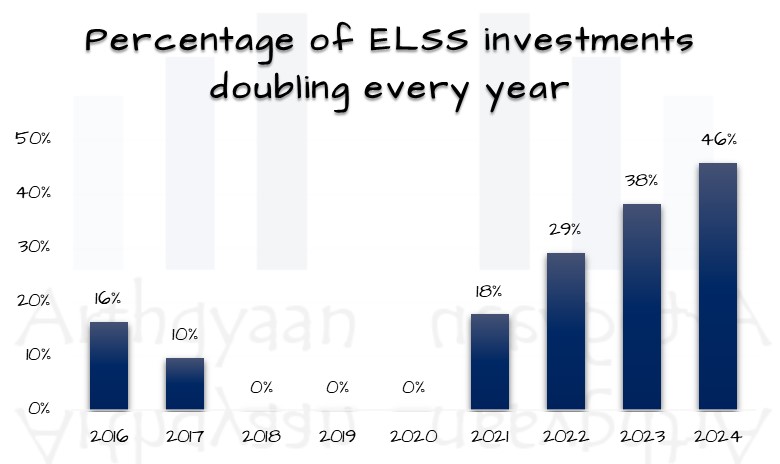

Given the current bull market in India, there are a lot of ELSS funds that have doubled after a 3-year holding period. We have chosen to analyse the 3-year holding period because once you invest in ELSS funds, each investment is locked in for 3 years.

We will try to see which funds have been able to do this continuously.

In this analysis, we have considered direct plans of ELSS funds active since 2013. The data comes from: What are the rolling returns of SIP and lump sum of direct mutual funds?.

No. Not really. That would be unrealistic.

As the chart shows, ELSS funds redeemed in 2018-2020 never doubled after holding for 3 years. Some amount of doubling was seen in 2016 and 2017, but the phenomenon becomes more pronounced after March 2020.

In this table, we have calculated, on a rolling basis, the total number of doublings divided by the total number of 3-year investment periods for 31 ELSS funds.

| AMC | Consistency Score |

|---|---|

| Quant | 54.8% |

| Parag Parikh | 17.7% |

| Nippon | 16.4% |

| Bank Of India | 15.2% |

| SBI | 13.7% |

| HDFC | 13.6% |

| Mahindra Manulife | 12.8% |

| Bandhan | 12.5% |

| Mirae | 11.8% |

| DSP | 11.7% |

We have provided only the AMC names instead of the fund names since, as per SEBI rules, each AMC is allowed to have only one ELSS fund. Of course, you should only invest in the Direct Plan only.

The stock market does not move like an FD. Using the rule of 72, doubling in 3 years implies a return of 72/3 = 24%. That return is extremely uncommon and will not happen often. We have data in the first chart showing that there are periods when doubling in three years did not happen.

If you have checked that the old tax regime is best for you, only then should you consider ELSS funds: How to choose the best ELSS funds?.

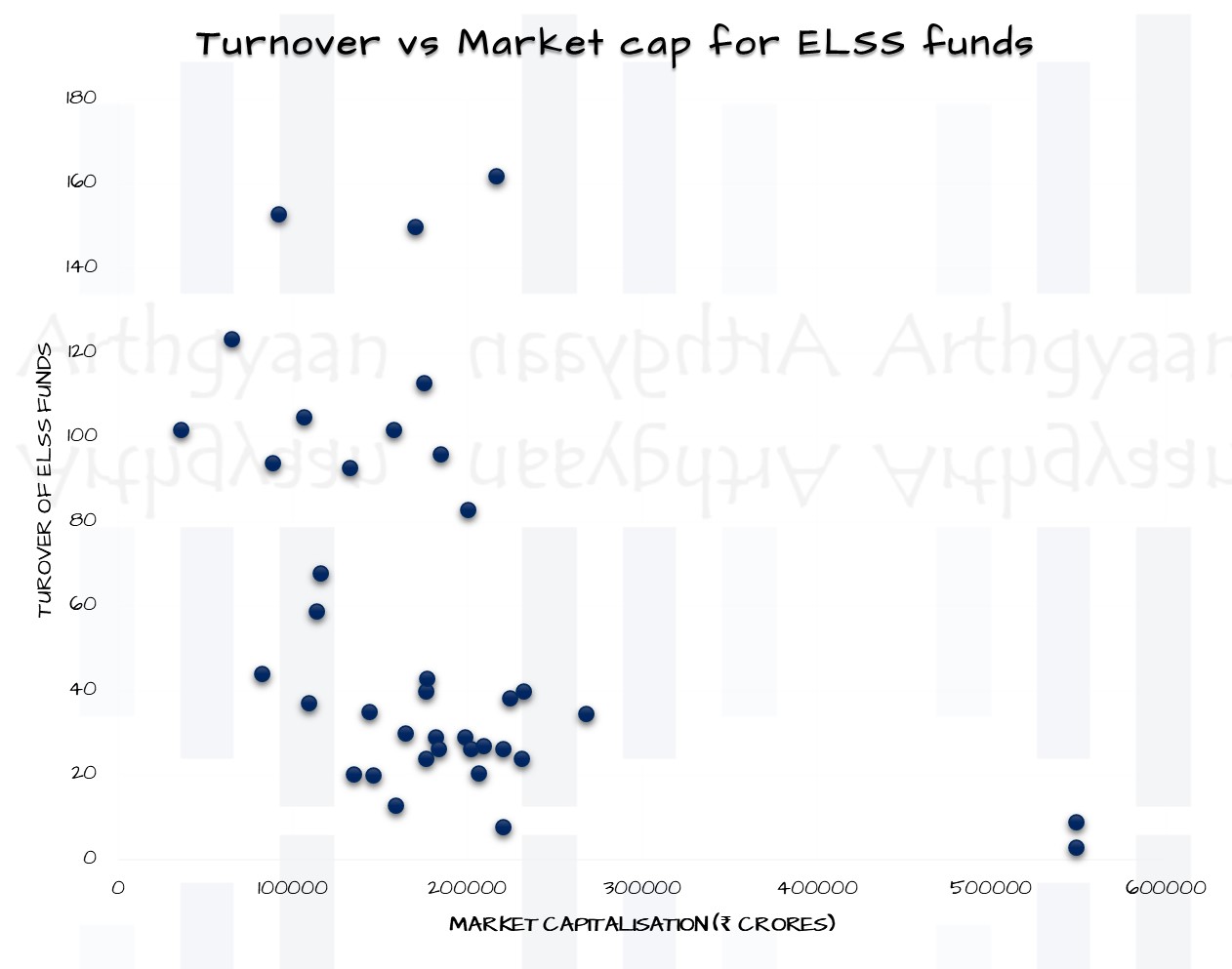

The relative outperformance of Quant ELSS deserves a comment here. ELSS funds are defined by SEBI like this:

At least 80% in stocks in accordance with Equity Linked Savings Scheme, 2005, notified by the Ministry of Finance

The mandate does not mention any large/mid/small cap tilt for these funds. Therefore, ELSS fund managers are free to explore any style (measured by market capitalisation of the portfolio) and strategy (measured by turnover as in how quickly they sell old stocks and buy new ones) as the chart above shows using data from Valueresearchonline. No strategy works consistently, and just because a fund has been able to double its investment after 3 years consistently does not mean that it will continuously keep doing so.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which ELSS funds have consistently doubled your money in three years? first appeared on 31 Jul 2024 at https://arthgyaan.com