What are the best tax-saving ELSS Mutual Funds in 2022?

This post sifts through 38 options to find the best ELSS funds for investing in 2022.

This post sifts through 38 options to find the best ELSS funds for investing in 2022.

This article is a part of our detailed article series on the concept of ELSS Tax savings mutual funds in India. Ensure you have read the other parts here:

This post sifts through 43 options to find the best performing ELSS funds for the 3-year period ending before Apr 2024.

This post sifts through 43 options to find the best performing ELSS funds for the 3-year period ending before March 2024.

This post sifts through 39 options to find the best ELSS funds for investing in 2024.

This post sifts through 38 options to find the best ELSS funds for investing in 2023.

This article discusses a new category of ELSS funds relaunched in India that are run as index funds. Should investors invest in ELSS index funds for tax-saving purposes?

Note: This article has been superseded by our latest guide on ELSS funds here: What are the best tax-saving ELSS mutual funds?

Equity Linked Savings Scheme (ELSS) funds are mutual funds that are an eligible scheme to get tax deductions under Section 80C of the Income Tax act. 80C allows you to get a deduction of ₹150,000 per financial year if they are in the old tax regime, which leads to a saving of ₹46,800 tax per year in the highest tax bracket.

ELSS funds have a mandatory 3-year lock-in for every purchase. So, if you are investing in SIP form, then keep in mind that every SIP installment is locked for three years from the date of purchase.

Many investors use the 1-lakh equity LTCG tax exemption to roll their ELSS funds every year. This form of tax harvesting involves selling the oldest ELSS units (more than three years old) and reinvesting them immediately in the same or another fund.

Instead of going through a mad last-minute rush to invest in ELSS due to the tax-proof submission deadline, this post will help investors to shortlist funds for review.

Investments in ELSS funds should be only to fill any remaining 80C limit and should be as per the equity allocation of your goals. If your 80C is already full with ₹1.5 lakhs of investments, ignore ELSS funds. This recommendation for avoiding ELSS comes from the fact that these are active funds and leads to portfolio clutter if not reviewed properly. Related: Are you checking the performance of your funds regularly?.

We will use a waterfall approach to fill the 80C limit (see this for details on 80C investing) by moving to the next step only if anything is left within the 150,000 limits:

ELSS should be considered as a part of investing for long term goals as per the right asset allocation. This article talks about asset allocation for goals where equity allocation can be appropriate: What should be the Asset Allocation for your goals?.

All ELSS funds are currently available only as active funds. Only having active funds, and that too 38 funds, leads to a “which is the best ELSS fund” confusion amongst investors. The thumb rule to choose active funds is

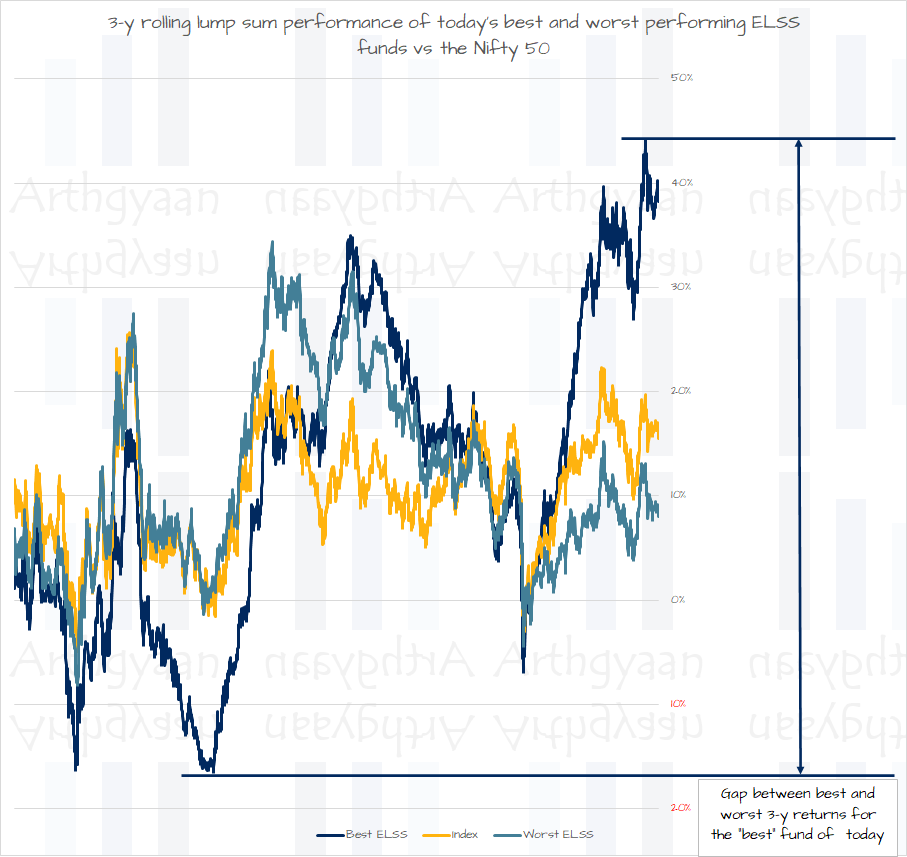

Warning and disclaimer: Choosing the best fund is an attempt to predict the future by looking at what things were in the past. You cannot predict the future is one of the axioms of personal finance. Therefore, investors should not spend too much time trying or believing in future predictions.

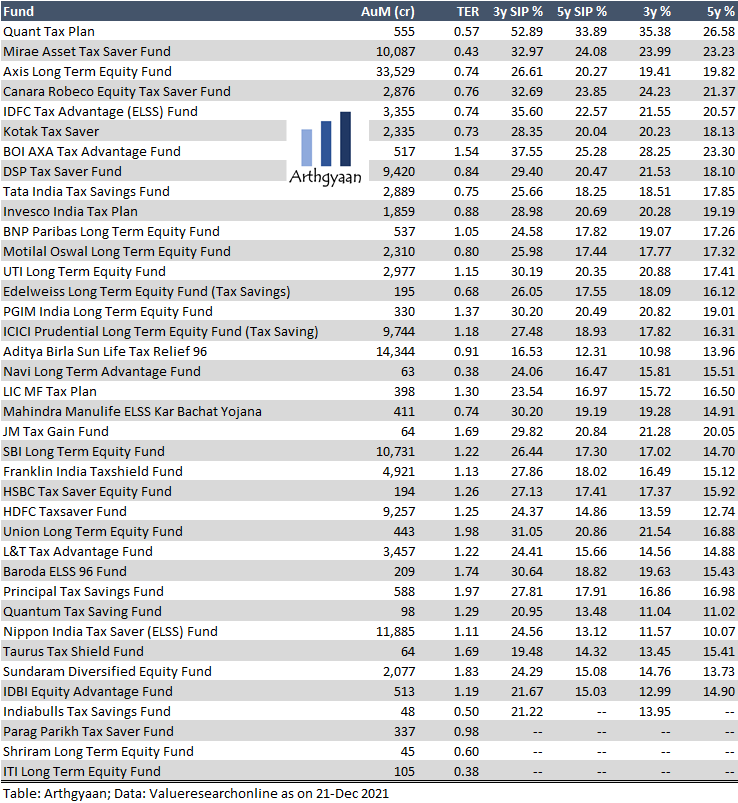

That being said, we have created a simple ranking scheme based on AuM, TER, SIP returns (3 and 5 years) and the last five calendar year absolute returns to generate a ranking of ELSS funds. It should be evident that funds without five years of history will appear at the bottom of the ranking table. We believe this to be fair since an active fund manager needs to prove their ability to beat their peers and the benchmark for a minimum amount of time.

This table shows the ELSS funds’ relative ranking based on the previous paragraph’s criteria.

If your current ELSS fund is in the top 3, you can consider keeping it. If not, consider reviewing if you are happy with the performance or not. If your current ELSS fund has a high TER (above 1%), re-consider continuing at such a high expense ratio. If you are invested currently in Regular funds, this is how you switch to Direct: How to switch from regular to direct funds?.

If you are considering investing in a new ELSS fund, look at the top 3-5 to understand the fund’s investment objective and the risks. Always consult with an investment advisor before making any investments.

Operationally speaking, if you have the cash available, perform a single lumpsum investment unless the amount is very large compared to your existing portfolio. In such a case, break it over a few months. The AMC will send an account statement by email that will suffice for investment proof submission.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the best tax-saving ELSS Mutual Funds in 2022? first appeared on 01 Jan 2022 at https://arthgyaan.com