Which are the best performing tax-saving ELSS mutual funds in March 2024?

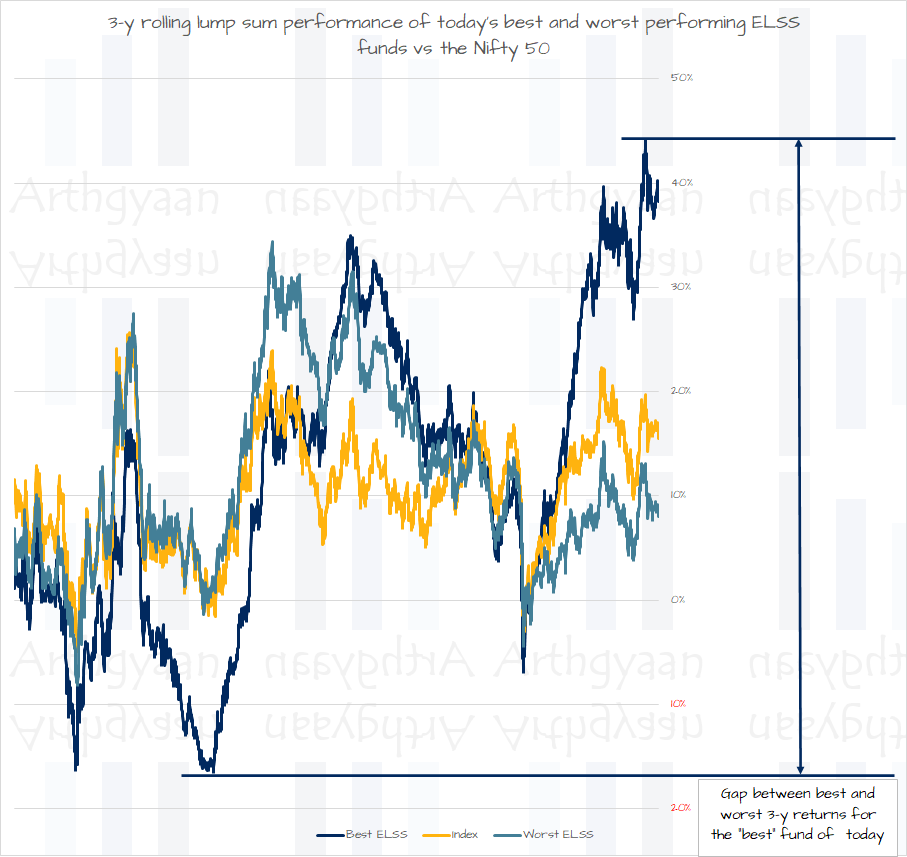

This post sifts through 43 options to find the best performing ELSS funds for the 3-year period ending before March 2024.

This post sifts through 43 options to find the best performing ELSS funds for the 3-year period ending before March 2024.

Disclaimer: The fund names mentioned in this article are not recommendations to invest/not invest in those funds. Please perform adequate due diligence before making any investments. Past performance does not give any indication about future performance. You can lose all or part of your capital in mutual funds.

This article is a part of our detailed article series on the concept of ELSS Tax savings mutual funds in India. Ensure you have read the other parts here:

This post sifts through 43 options to find the best performing ELSS funds for the 3-year period ending before Apr 2024.

This post sifts through 39 options to find the best ELSS funds for investing in 2024.

This post sifts through 38 options to find the best ELSS funds for investing in 2023.

This article discusses a new category of ELSS funds relaunched in India that are run as index funds. Should investors invest in ELSS index funds for tax-saving purposes?

This post sifts through 38 options to find the best ELSS funds for investing in 2022.

This article is frequently updated. The latest version is here.

Before we discuss ELSS investing, you need to note that ELSS is a part of 80C deduction which is no longer an allowed tax deduction in the new tax regime. You should always check first if you will save more tax in the new tax regime: Which is the best tax regime to choose from April?

That being said, many investors wish to know the best performing ELSS funds in the month of March and this article serves that purpose.

This article presents historical data only. Historical performance will likely not repeat in the future. We have taken ELSS NAV data from the AMFI website.

Investors should note that the each investment in ELSS funds is locked for 3 years and cannot be redeemed. If it is a lump sum then the amount can only be redeemed after 3 years. For a SIP, each instalment of the SIP is locked for 3 years.

All “Amount” and “Return” figures in the tables are pre-tax: Pay lower capital gains taxes for equity: understand how grandfathering works

The table below shows the 10 best performing ELSS funds in the last 3 years. The invested amount is ₹1.5 lakhs.

| Fund name | Lump sum return | Amount (₹) |

|---|---|---|

| Quant Tax Plan | 34.46% | 201,687 |

| Sbi Long Term Equity Fund | 27.44% | 191,157 |

| Hdfc Elss Tax Saver | 26.19% | 189,291 |

| Bank Of India Tax Advantage Fund | 25.49% | 188,230 |

| Parag Parikh Tax Saver Fund | 24.70% | 187,045 |

| Motilal Oswal Elss Tax Saver Fund | 24.16% | 186,234 |

| Bandhan Elss Tax Saver Fund | 23.96% | 185,941 |

| Franklin India Taxshield | 22.63% | 183,952 |

| Dsp Tax Saver Fund | 21.85% | 182,774 |

| Jm Elss Tax Saver Fund (Direct) | 21.57% | 182,358 |

The table below shows the 10 best performing ELSS funds in the last 3 years where ₹12,500/month has been invested in the last 36 months. The total invested amount is ₹4.5 lakhs.

| Fund name | SIP Return | Amount (₹ lakhs) |

|---|---|---|

| Sbi Long Term Equity Fund | 33.14% | 7.22 |

| Quant Tax Plan | 32.51% | 7.16 |

| Motilal Oswal Elss Tax Saver Fund | 29.12% | 6.84 |

| Hdfc Elss Tax Saver | 28.58% | 6.80 |

| Bank Of India Tax Advantage Fund | 28.39% | 6.78 |

| Iti Elss Tax Saver Fund | 26.77% | 6.63 |

| Franklin India Taxshield | 25.66% | 6.53 |

| Jm Elss Tax Saver Fund (Direct) | 25.15% | 6.49 |

| Taurus Elss Tax Saver Fund | 24.69% | 6.45 |

| Parag Parikh Tax Saver Fund | 24.42% | 6.42 |

We will now consider a step-up SIP since increasing your investment amount as per salary hikes has the potential to create more wealth. 80C deduction, if availed is applicable only up to the first ₹1.5 lakhs/year.

The table below shows the 10 best performing ELSS funds in the last 3 years where ₹12,500/month has been invested in the last 36 months. The amounts invested are:

The total invested amount is ₹472,875.

| Fund name | SIP Return | Amount (₹ lakhs) |

|---|---|---|

| Sbi Long Term Equity Fund | 33.47% | 7.55 |

| Quant Tax Plan | 32.77% | 7.48 |

| Motilal Oswal Elss Tax Saver Fund | 29.44% | 7.16 |

| Hdfc Elss Tax Saver | 28.79% | 7.10 |

| Bank Of India Tax Advantage Fund | 28.71% | 7.09 |

| Iti Elss Tax Saver Fund | 27.13% | 6.95 |

| Franklin India Taxshield | 25.90% | 6.83 |

| Jm Elss Tax Saver Fund (Direct) | 25.41% | 6.79 |

| Taurus Elss Tax Saver Fund | 24.94% | 6.75 |

| Parag Parikh Tax Saver Fund | 24.58% | 6.71 |

The table below shows the 10 best performing ELSS funds in the last 3 years where ₹12,500/month has been invested in the last 36 months. The amounts invested are:

The total invested amount is ₹496,500.

| Fund name | SIP Return | Amount (₹ lakhs) |

|---|---|---|

| Sbi Long Term Equity Fund | 33.79% | 7.89 |

| Quant Tax Plan | 33.04% | 7.81 |

| Motilal Oswal Elss Tax Saver Fund | 29.75% | 7.49 |

| Bank Of India Tax Advantage Fund | 29.03% | 7.42 |

| Hdfc Elss Tax Saver | 29.00% | 7.42 |

| Iti Elss Tax Saver Fund | 27.47% | 7.27 |

| Franklin India Taxshield | 26.14% | 7.15 |

| Jm Elss Tax Saver Fund (Direct) | 25.66% | 7.10 |

| Taurus Elss Tax Saver Fund | 25.18% | 7.06 |

| Parag Parikh Tax Saver Fund | 24.73% | 7.02 |

We have a detailed article on this topic here: What are the portfolio and tax related things that you must do in March?

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which are the best performing tax-saving ELSS mutual funds in March 2024? first appeared on 02 Mar 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.