Should you invest in ELSS Index Funds like the 360 ONE ELSS fund?

This article discusses a new category of ELSS funds relaunched in India that are run as index funds. Should investors invest in ELSS index funds for tax-saving purposes?

This article discusses a new category of ELSS funds relaunched in India that are run as index funds. Should investors invest in ELSS index funds for tax-saving purposes?

Disclaimer: The fund names mentioned in this article are not recommendations to invest/not invest in those funds. Please perform adequate due diligence before making any investments. Past performance does not give any indication about future performance. You can lose all or part of your capital in mutual funds.

This article is a part of our detailed article series on the concept of ELSS Tax savings mutual funds in India. Ensure you have read the other parts here:

This post sifts through 43 options to find the best performing ELSS funds for the 3-year period ending before Apr 2024.

This post sifts through 43 options to find the best performing ELSS funds for the 3-year period ending before March 2024.

This post sifts through 39 options to find the best ELSS funds for investing in 2024.

This post sifts through 38 options to find the best ELSS funds for investing in 2023.

This post sifts through 38 options to find the best ELSS funds for investing in 2022.

This article is a result of the 360 ONE (formerly IIFL) Nifty 50 ELSS fund that got launched in December 2022. This fund will be investing in the same stocks as the Nifty 50 index, like every other Nifty 50 passive fund but with an extra feature. This fund will be an ELSS fund where:

There used to be a “Franklin India Index Tax Fund” that was closed way back in 2011 due to a lack of interest. The fund was merged with the Nifty 50 fund of the same AMC.

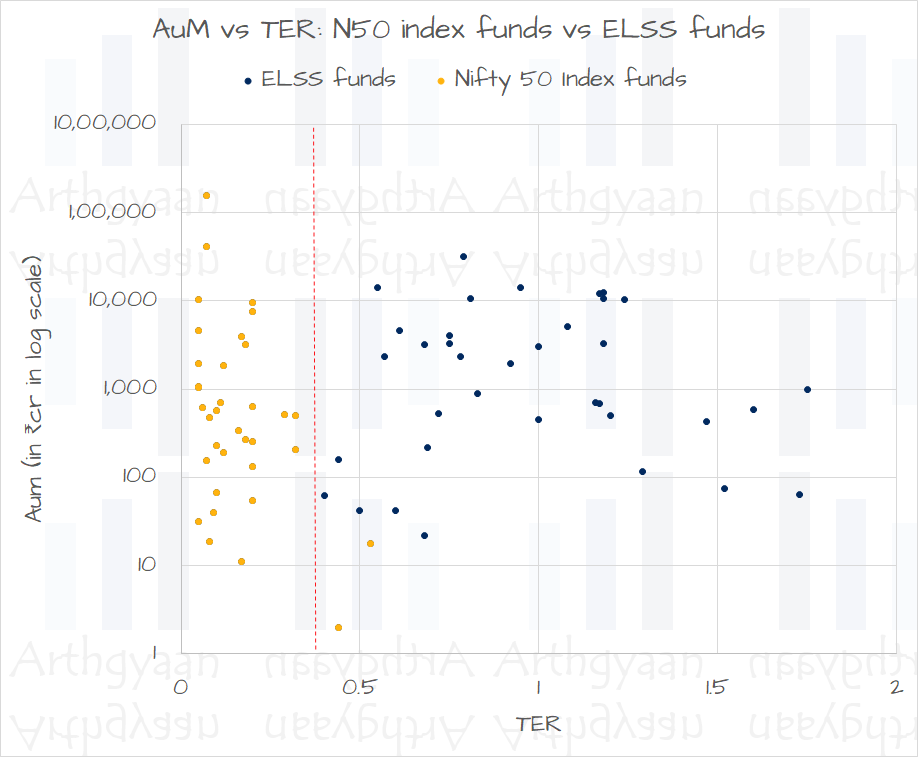

This is the current status of Nifty 50 index funds and ELSS funds in India. There is a good amount of spread in terms of the assets managed by both categories of funds but the distinction in terms of fund expense (TER) is very clear. Index funds charge lower expenses while active funds, like ELSS in this example, charge more. The question to ask here is “does more fees necessarily lead to better returns?”. We examine this question in detail below.

It is our opinion that the ideal duration for investing in ELSS funds is three years. We are not advocating that equity investing is only for a short-term horizon like three years. Instead, we are saying that as soon as the 3-year lock-in period is over:

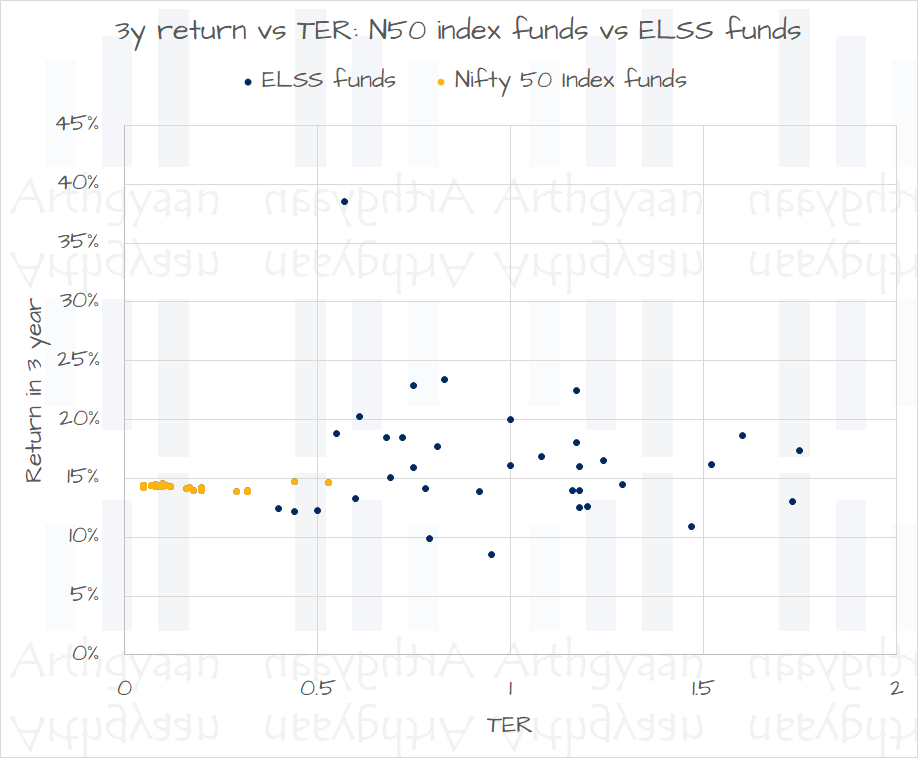

We have chosen index funds benchmarked against the Nifty 50 since the new 360 ONE fund is a Nifty 50 fund as well. In the sections below, we will show how ELSS funds have fared, as a point-to-point return estimate, vs the Nifty 50 index funds for 3-year investment periods. In each case, we will show how the performance vs. the expenses (TER) for the mutual fund. It should be noted that for equity funds, there is no guarantee of returns but the higher the expense, the lower the expected returns for two funds with the same investment philosophy.

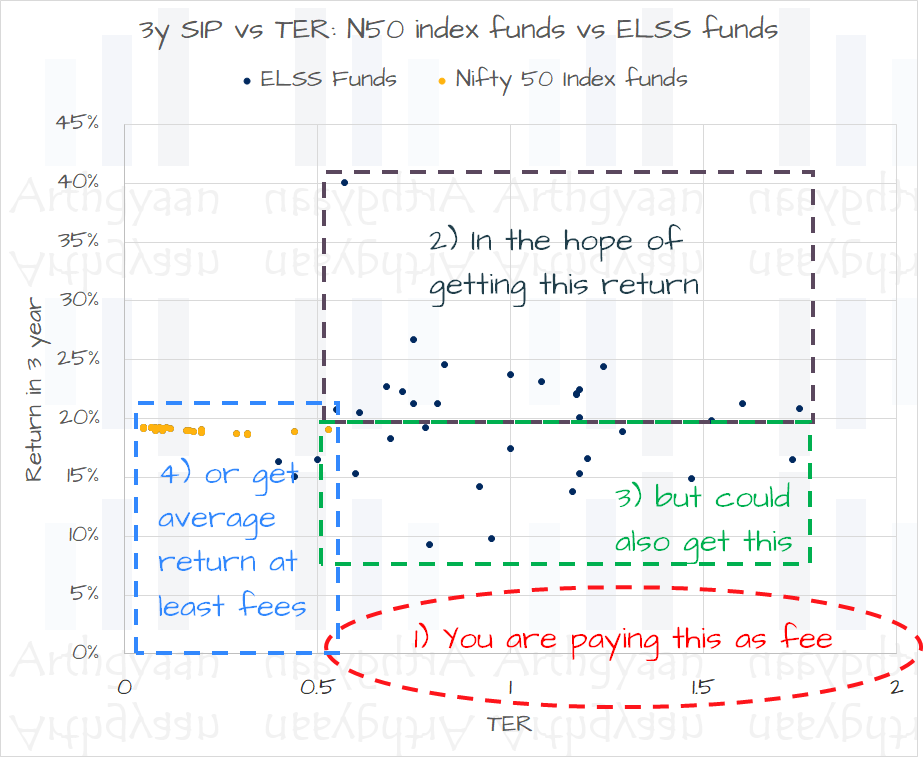

We are plotting the TER of the funds vs the 3-year SIP returns of the funds, for the 3-year period ending 21-Dec-22. However, for the active ELSS funds the returns are all over the place. There is no guarantee that even by paying the higher expenses, about half of the funds have given returns lower than the index funds.

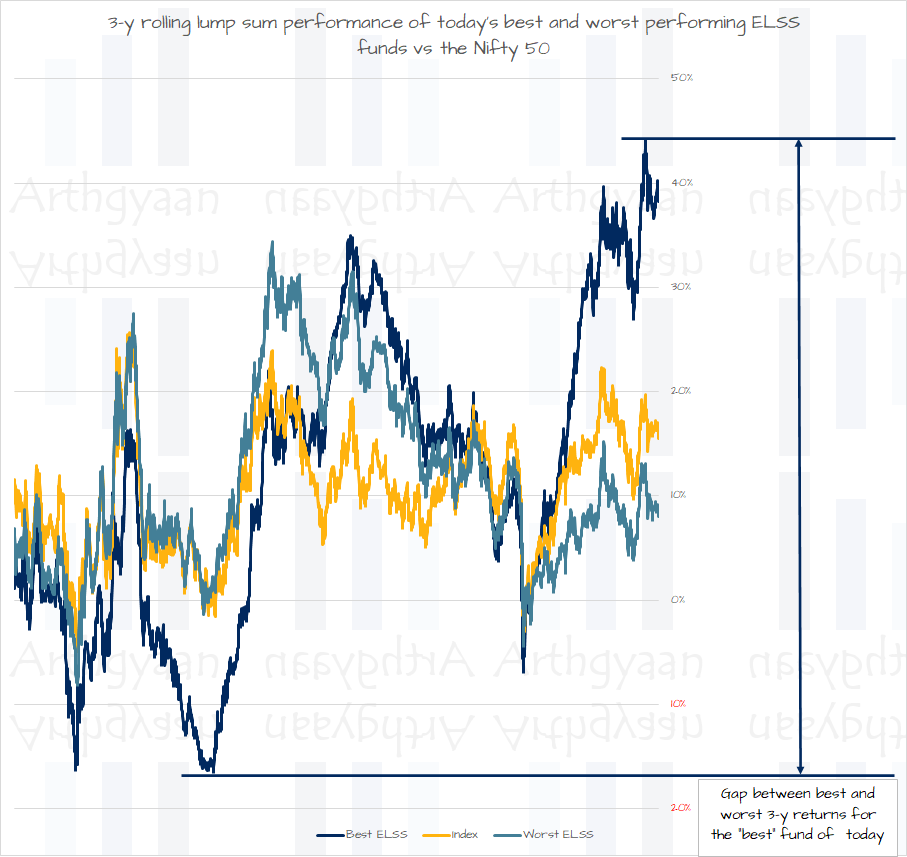

We see the same result for a lump sum investment. Since these returns are point-to-point, here is the same chart for rolling 3-y lump sum returns.

The chart shows that today’s “best” performing ELSS fund has fluctuated around the returns of the index fund over a 3-year period using the previous 13 years’ worth of historical data. Today’s “worst” performing fund has also performed in the same way. This proves that there is no guarantee that either choice of today’s best or worst-performing ELSS will beat the Nifty 50 index fund over the next three years.

If there is no need for an 80C tax deduction, there is no need to invest in ELSS mutual funds. Basically, there are two questions to ask here:

This is an article that will help you decide: How to plan tax deductions for salaried income?.

If you are convinced that you do not wish to chase returns by investing in active funds, then index funds are suitable. The 360 ONE fund is a step in that direction.

If you are willing to take a punt with active funds, please refer to our guide on choosing ELSS funds: What are the best tax-saving ELSS Mutual Funds?.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you invest in ELSS Index Funds like the 360 ONE ELSS fund? first appeared on 28 Dec 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.