What are the portfolio and tax related things that you must do in March 2024?

This article gives you the list of things you must do in March regarding taxes and improving your portfolio returns.

This article gives you the list of things you must do in March regarding taxes and improving your portfolio returns.

🎉 Our third anniversary is in March 2024

The 2025 version of this article is here: March 2025 Tax Planning Checklist: Advance Tax, Portfolio Rebalancing & Tax Harvesting Strategies

If you have salary income, your company already deducts taxes every month and pays them to the government. However, you might have taxes incurred on income, like interest, dividends, rental income or capital gains (e.g. selling stocks and mutual funds or trading), that must be calculated and paid as per the schedule below to avoid penalties.

| Due date | Advance tax payable |

|---|---|

| 15th June | 15% |

| 15th September | 45% |

| 15th December | 75% |

| 15th March | 100% |

In each of the above cases, you need to subtract the advance tax already paid.

Resident individuals should use Challan Type 280, major head 0021 (Income Tax other than companies) and Minor Head (100-Advance Tax) from the TIN NSDL site to pay their advance tax. Delaying advance tax payments will lead to penalties.

If any income or capital gains occur after 15 March, you can pay the tax using the Minor Head (100-Advance Tax) code by 31st March. If any tax is to be paid after that, for example, while filing tax returns, that is to be paid using Minor Head (300-Self Assessment Tax). It is good to pay this tax as early as possible to avoid penalties.

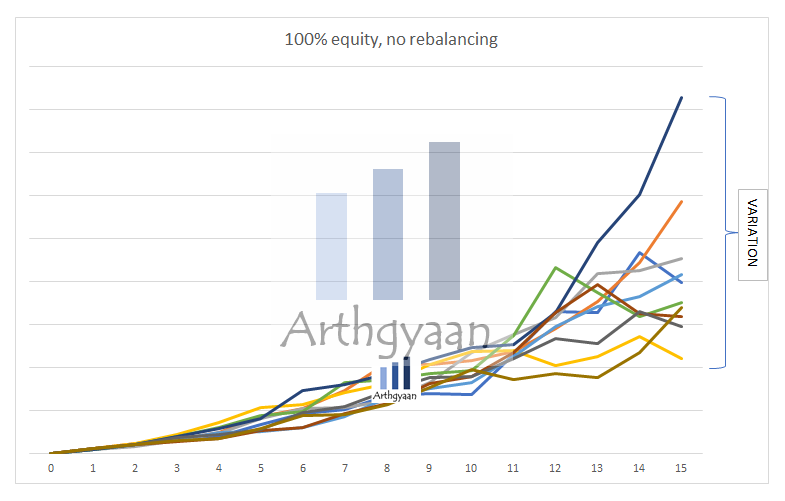

Rebalancing is the way to systematically buy low and sell high inside a portfolio. Since different asset classes, like equity, debt and gold do not all go up or down at the same time, rebalancing protects profits by moving the capital from those assets which have risen in value to those that have not risen that much or have fallen. If you have not done rebalancing yet in the current financial year, then March is the last chance to do it. Portfolio rebalancing can be performed using our Plan Excel-based tool tool very easily since the tool will show you the portfolio and goal-level equity and debt asset allocation.

Without rebalancing, periodic profit booking does not happen and the final portfolio value is unpredictable. There is no point in investing for 30 years and then ending up with a portfolio in retirement that you cannot predict will give you 10,000/month or 1lakh/month.

Of course, to effectively rebalance, you need to set your goals first by following this process: I am now ready to do goal-based investing. What now?. We have discussed the concept of portfolio rebalancing in detail in this post: Portfolio rebalancing during goal-based investing: why, when and how?.

To understand more on the tasks that you must do in March:

The profits obtained from the sale of some funds can be offset by deliberately selling other funds whose oldest units are at a loss.

| Date | Folio | Fund | Transaction | Units | Price | Comment |

|---|---|---|---|---|---|---|

| 1 | A | X | Buy | 100 | 10 | First buy |

| 2 | B | Y | Buy | 100 | 12 | First buy |

| 3 | A | X | Sell | 50 | 12 | 50*2=100 profit |

| 4 | B | Y | Sell | 25 | 8 | 25*(12-8)=100 loss |

For example, we sell 25 units of fund Y to offset the profit from selling 50 units of fund X.

Suppose you are planning to keep investing in fund Y. In that case, selling units from Y now lowers the average purchase price of the remaining units. This leads to higher taxes in the future and needs to be weighed vs. saving taxes today.

Some investors prefer to segregate portfolios using different folio numbers and tag them to varying goals as described here. This leads to a logical separation of goals and allows the booking of capital gains as per requirement.

If you are investing in mutual funds that lost their indexation benefits from 1st April 2023, please use the same different folio rule: How to invest in mutual funds which are taxed at slab rates from 1st April 2023.

Currently, long-term capital gain in equity is tax-free for the first one lakh per year. If units sold in different funds are sold at a price higher than the purchase price, and the total profit is:

So if the LTCG is ₹ 120,000, then the tax payable is ₹20,000 * 10% = ₹2,000 + cess + surcharge.

This feature of the tax code allows booking ₹100,000 profit every year in equity funds or stocks to save ₹10,000 in taxes. This feature is calculated on ₹ 1 lakh of profits and not sale consideration.

For more details, here is a detailed case study on equity LTCG harvesting.

For this section, we need to distinguish between mutual funds that primarily invest in equities vs debt and mutual funds considered equity or debt funds based on taxation rules.

We will use this article as a base for tax calculation of shares and mutual funds: How is tax calculated on selling shares/MFs and how do to do tax harvesting?.

If you opened your PPF account between 1st Apr 2008 and 31st Mar 2009, then your PPF account will mature on 1st April 2024.

This post explains what you should do next with your PPF account: Should you renew your PPF account or invest in mutual funds?.

31st March is the deadline for tax saving investments under Section 80C (PPF, ELSS, NPS etc), Section 80CCD i.e. NPS, which is not very useful, and other eligible deductions as described in this post on How to plan tax deductions for salaried income?.

Here you need to note that ELSS is a part of 80C deduction which is no longer an allowed tax deduction in the new tax regime. You should always check first if you will save more tax in the new tax regime: Which is the best tax regime to choose from April?

If you are looking for an ELSS fund for 80C investment, this article shows a way to shortlist one.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the portfolio and tax related things that you must do in March 2024? first appeared on 06 Mar 2024 at https://arthgyaan.com