How to correctly calculate returns from an under construction flat?

This article gives an easy-to-use calculator for knowing the returns from buying and later selling an under-construction property.

This article gives an easy-to-use calculator for knowing the returns from buying and later selling an under-construction property.

Real estate investors who have invested in under-construction properties need a way to correctly calculate the return from their investments since

For this purpose we have created an easy-to-use calculator for calculating your overall returns when you sell the asset.

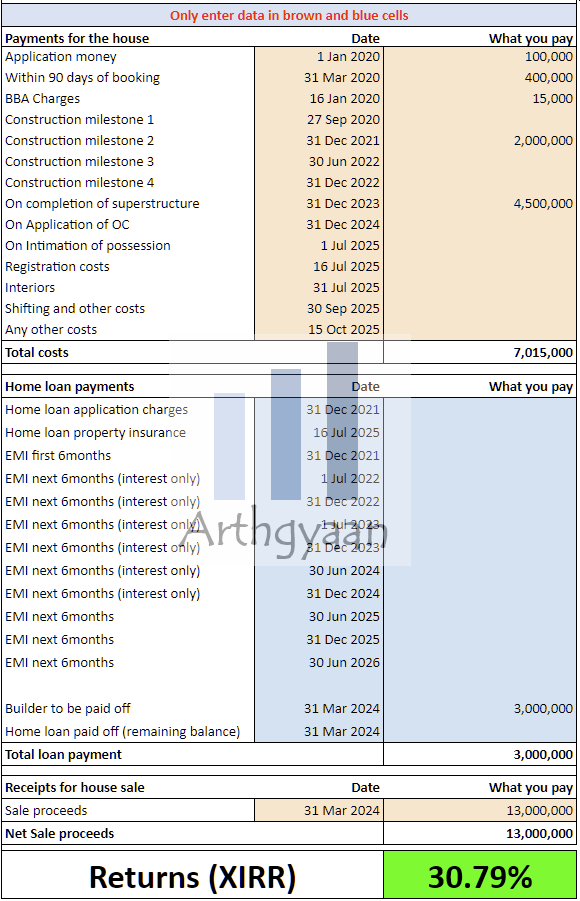

We have used the concept of Extended Internal Rate of Return (XIRR) to calculate the final returns since money is paid on different dates in an irregular fashion.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

This calculator is in the “house-sale-return” tab.

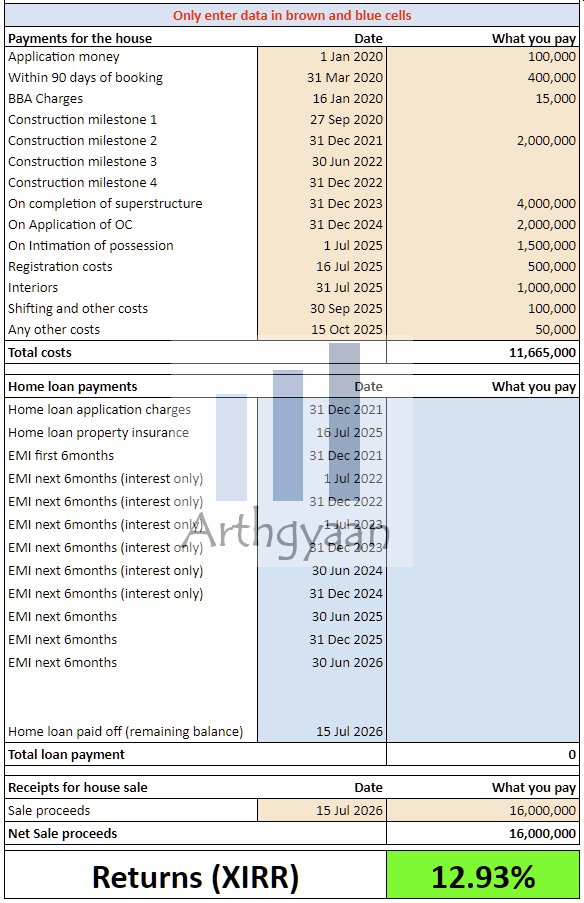

We will show a few cases below. In each case we will consider a house purchased for ₹1 crore where the construction takes place over multiple years.

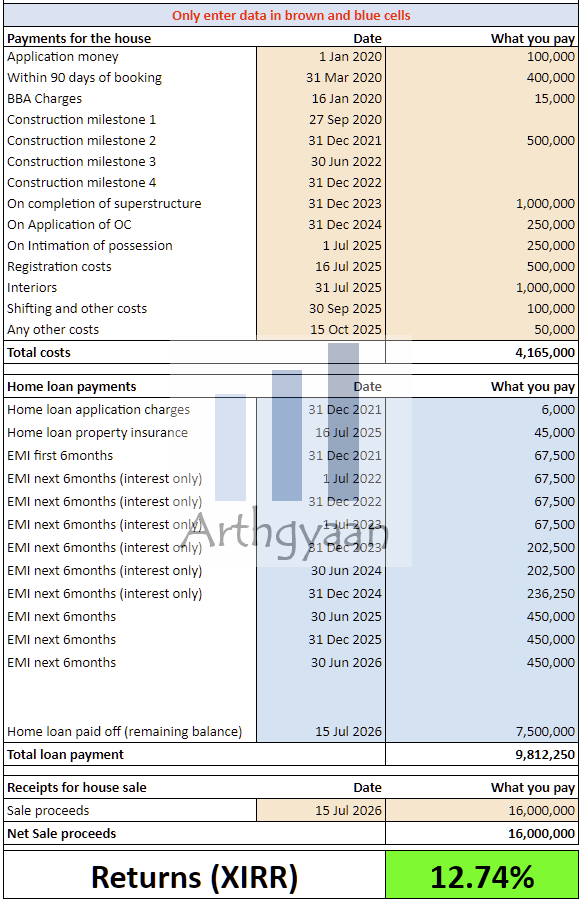

A home loan of 75% of the house value is taken, if applicable, for 15 years at 9%. The EMI for such a loan is 1%: EMI Calculator: know your EMI per lakh to easily know how much total EMI you have to pay.

For simplicity, we have assumed that the final sale price is post tax.

To understand how to calculate your returns from your real estate investment:

In this case, the investor makes payments to the builder out of their own funds, takes possession, pays for registration, interiors and other costs. The property is sold after some time.

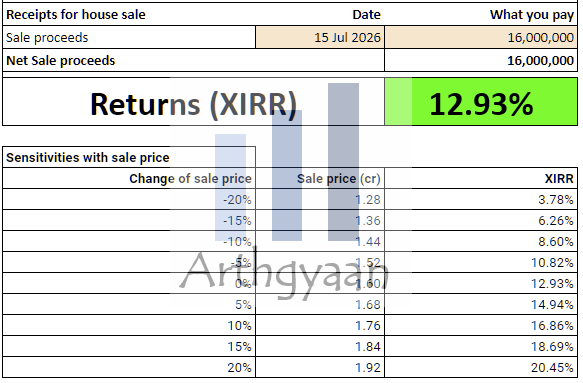

The final return is quite sensitive to the final sale price as we can see below:

This case is the same as the one above but 75% of the price is paid via home loan. For the period before registration, only interest is paid on the home loan. EMI starts once registration is done.

In this case, the investor sells off the property before hand-over and registration is complete. There are significant savings since registration, interiors etc. are not done. The house is sold at a 30% premium to the allotment price and the investor makes an excellent return.

.

.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to correctly calculate returns from an under construction flat? first appeared on 03 Mar 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.