How to include your property with a home loan in your portfolio?

This article shows the right way of valuing your property with a home loan for your investment portfolio.

This article shows the right way of valuing your property with a home loan for your investment portfolio.

This article is the second part of valuing real-estate relative to your investment portfolio. You can read the first part here: How much real estate should you hold in your portfolio?.

The property that I own is worth 60 lakhs. And the outstanding home loan amount is 20 lakhs. How to include this in my portfolio?

To answer this reader question, we must first understand how paying down a home loan builds an asset, i.e. equity in your home.

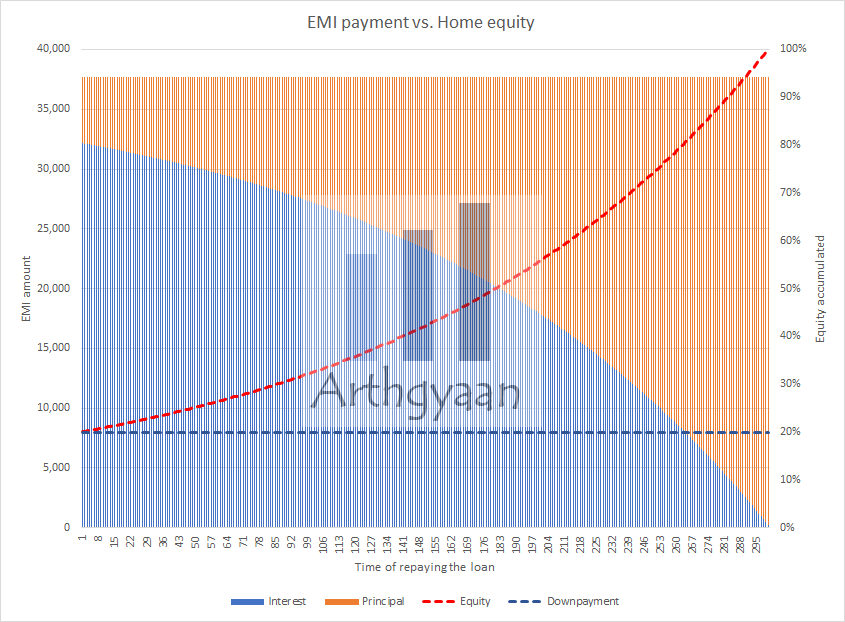

The bank gives a home loan to own the property while you use it until you pay back the loan via EMIs. An Equated Monthly Instalment plan (EMI) is a standard way to pay off a loan by making a fixed payment monthly that includes both interest and principal in the same amount.

EMI = Principal + Interest

In each EMI, the split of the interest and principal changes since the interest is based on the outstanding loan balance at that point and the rest of the EMI is principal. As the chart shows, the interest part drops off with time, and the rest is the principal. The actual numbers in the chart relate to a ₹50 lakhs home loan taken at 8% for 25 years. The EMI is ₹38,591. The down payment amount is ₹12.5 lakhs.

You can test the numbers using this calculator:

As you pay back the loan, your ownership share in the house will increase in the same way. At the point of taking the loan, you own 20% of the house (12.5 out of 62.5, of which 50 is the loan). The bank owns 80%. As the loan is repaid, you own more and more of the house as the principal is paid off. This is the concept of building equity in an asset. Equity is the part of the asset you own after subtracting the part that the bank owns.

Home equity value = Current home value - Outstanding loan balance

Once you build equity in your home, that has additional benefits:

Let’s recap the question:

The property that I own is worth 60 lakhs. And the outstanding home loan amount is 20 lakhs. How to include this in my portfolio?

We can follow one of two approaches here:

We use the Arthgyaan Goal-based investing calculator to formulate the investment model with all the above assumptions and goals. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Once you get your sheet, you can access video tutorials in the howto tab.

Home equity value = Current home value - Outstanding loan balance

In this example, we will enter the house value minus any outstanding loan amount in the assets table. Here, the investor owns a loan-free plot worth ₹20 lakhs and has ₹40 lakhs equity in the house.

Assets tab:

Goals tab:

We will do two things:

In our example, we will assume that the house is worth ₹60 lakhs and the outstanding loan is ₹20 lakhs at 9.05% for 10 years. The EMI for this loan is ₹25,000/month or ₹3 lakhs/year.

We will cover two cases:

Goals tab:

Home loan tab:

We have followed the instructions in the red cell to set the home loan values here per this framework: Goal-based investing: how to purchase your dream home.

Assets tab:

Goals tab:

The SIP value is ₹113,078/month, of which the ₹45,231 debt SIP includes the EMI of ₹25,000. The assets total is ₹130.44 lakhs, and the term insurance coverage is ₹3.74 crores. Interestingly, the asset allocation uncovers a problem with the portfolio: insufficient equity allocation. The solution here is to divert the entire ₹113,078 (minus the EMI) into equity until the asset allocation corrects itself.

We summarize the results below:

There is a caveat, though, on the asset allocation. We need to ensure that the asset allocation is correct for all the goals in the portfolio. A quick test to ensure this is to check if the target equity allocation of the portfolio is very close to the current one. A too-low current equity allocation carries the risk of long-term goals not being met.

Every investor needs to calculate their home loan and asset exposure for all the three cases described above and choose the approach where:

If your property does not have a home loan, there are two ways of dealing with the situation:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to include your property with a home loan in your portfolio? first appeared on 09 Aug 2023 at https://arthgyaan.com