What to do if you get the transactions reported by you in Form 60/61 relating to FY 2022-23 SMS from the Income Tax department?

This article shows you what do do if you receive this cryptic SMS from the income tax department.

This article shows you what do do if you receive this cryptic SMS from the income tax department.

Disclaimer: You should take professional help from a practicing CA in case you are facing a taxation situation where doing-it-yourself might make things worse.

This article is a part of our detailed article series on various communications that the income tax department sends you. Ensure you have read the other parts here:

This article outlines the next steps for taxpayers who receive an email or SMS regarding missed or incomplete Schedule FA, based on FATCA/CRS data-sharing agreements.

This article outlines the next steps for taxpayers who receive an SMS regarding significant mismatches in their income tax filing and IT records.

If you’re paying rent above ₹50,000/month and haven’t deducted TDS, you could face penalties and must act soon.

This guide explains why you might receive a notice under Section 148A, how to respond effectively, and the new time limits for reassessment along with Frequently Asked Questions (FAQs).

This article tells the next steps to take if you have received an SMS about your past income tax returns which you can amend using the ITR-U facility.

This article tells the next steps to take if you have received an SMS about your 80GGC tax deduction claim made in the past.

A lot of tax-payers have been getting this SMS from a short-code like “CP-CMCPCI” that looks like this:

Attention «Tax Payer Name», Income Tax Department has received information about certain transactions reported by you in Form 60/61 relating to FY 2022-23. It is requested that if you are not in occupation of a PAN Number, the same may be applied in Form 49A immediately or else, the PAN Number should be submitted to the Reporting Entity within 15 days from the campaign execution date. - Income Tax Department

There are two questions here that the message receivers have that need to be answered:

We will discuss the answers to both questions one by one.

The list published by the Economic Times here, shows that the message is from a legitimate source.

The tax payer just needs to check that their SMS application shows the sender name as “XY-CMCPCI” or a similar valid id from the ET list.

After establishing the genuineness of the message, let us break down the contents.

We will now look at the message in parts.

about certain transactions reported by you in Form 60/61 relating to FY 2022-23

This means that the SMS receiver reported some of their transaction in FY 2022-23 which is the period 1st April, 2022 to 31st March, 2023 using Form 60/61. Such an individual can do one of two things:

the same may be applied in Form 49A immediately

If the receiver does not have a PAN number, a new PAN card application may be done using Form 49A as soon as possible or,

PAN Number should be submitted to the Reporting Entity within 15 days

if PAN number is already there, the receiver should submit the same to the reporting entity within 15 days of receiving the SMS.

We will further break this down.

If an individual does certain financial / high-value transactions, they must have a valid PAN number which must be quoted along with the transaction. A classic example is buying mutual funds, property, FD etc. above certain thresholds.

This list is compiled from the official income tax website:

If PAN number is not present, then either Form 60 or Form 61 is to be filled and submitted instead of the PAN number under rule 114B of the Income Tax act:

The SMS therefore says that:

The confusion here could be because many receivers have not performed any such transaction where they have submitted Form 60/61 in the period FY 2022-23.

If the SMS is applicable to you, the next steps are clear: apply for PAN number or update the PAN where you did the transaction.

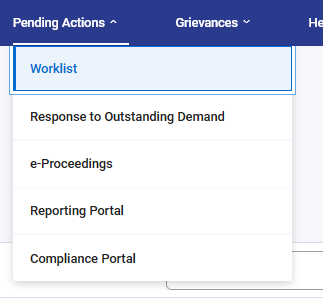

This is a likely glitch since social media is flooded with many such messages from confused tax payers. One option could be checking the Pending Actions section in the Income Tax website. If there is nothing there, please check bank statements and speak to family about easily overlooked transactions like FD, jewellery purchase, cash deposit etc.

If still nothing is found, wait a while longer for further clarification from the Income Tax department.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What to do if you get the transactions reported by you in Form 60/61 relating to FY 2022-23 SMS from the Income Tax department? first appeared on 10 Aug 2023 at https://arthgyaan.com