What should you do if you have received the 80GGC SMS?

This article tells the next steps to take if you have received an SMS about your 80GGC tax deduction claim made in the past.

This article tells the next steps to take if you have received an SMS about your 80GGC tax deduction claim made in the past.

Disclaimer: You should take professional help from a practicing CA in case you are facing a taxation situation where doing-it-yourself might make things worse.

This article is a part of our detailed article series on various communications that the income tax department sends you. Ensure you have read the other parts here:

If you’re paying rent above ₹50,000/month and haven’t deducted TDS, you could face penalties and must act soon.

This guide explains why you might receive a notice under Section 148A, how to respond effectively, and the new time limits for reassessment along with Frequently Asked Questions (FAQs).

This article tells the next steps to take if you have received an SMS about your past income tax returns which you can amend using the ITR-U facility.

This article shows you what do do if you receive this cryptic SMS from the income tax department.

Multiple tax-payers have received a mysterious SMS from the income-tax department that looks like this:

It is observed that you have claimed deduction under section 80GGC of Rs xxxxxx in your ITR for A.Y. 20yy-zz. It is requested that the claim may be verified and mistake, if any, may be rectified by updating the ITR for A.Y. 20yy-zz by 31.03.2025.

Warm regards

Income Tax Department

If you have made a valid 80GGC donation as per the rules, then this article is for you.

As per the income-tax website,

It is important to understand the rules under which these deductions work to understand if the deduction that you have claimed is valid or not.

If you have followed all of the points above, then your 80GGC deduction claim is valid. However, donations made to Registered Unrecognised Political Parties (RUPP) are already under the Income Tax scanner might be problematic.

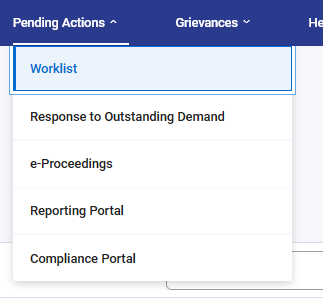

It is a good practice to check if there are any Pending Actions in the income-tax portal:

If there is no Pending Action, check back in a few days.

If there is a Pending Action, please follow the instructions to upload a copy of the 80GGC receipt. This will start the processing steps for the Pending Action.

There are two cases here on the status of the 80GGC claim:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What should you do if you have received the 80GGC SMS? first appeared on 28 Jan 2025 at https://arthgyaan.com