Top Mutual Funds with High Returns & Low Risk for Bottom Fishing

This article highlights the best-performing equity and hybrid funds, based on their historical performance compared to the Nifty 50 index.

This article highlights the best-performing equity and hybrid funds, based on their historical performance compared to the Nifty 50 index.

Disclaimer: The Fund names in this article are not recommendations to buy/hold/sell. Mutual funds are subject to market risks. Do not invest real money without adequate research.

The ultimate investment goal for mutual fund investors is high returns at low risk. The stock market always offers opportunities to pick up funds that have the potential to give stable returns with lower fluctuations.

Identifying funds that have done well in the past vs. the Nifty 50 index fund can be tricky since getting and analysing the data might be tricky.

This article shows a list of mutual funds based on their historical returns.

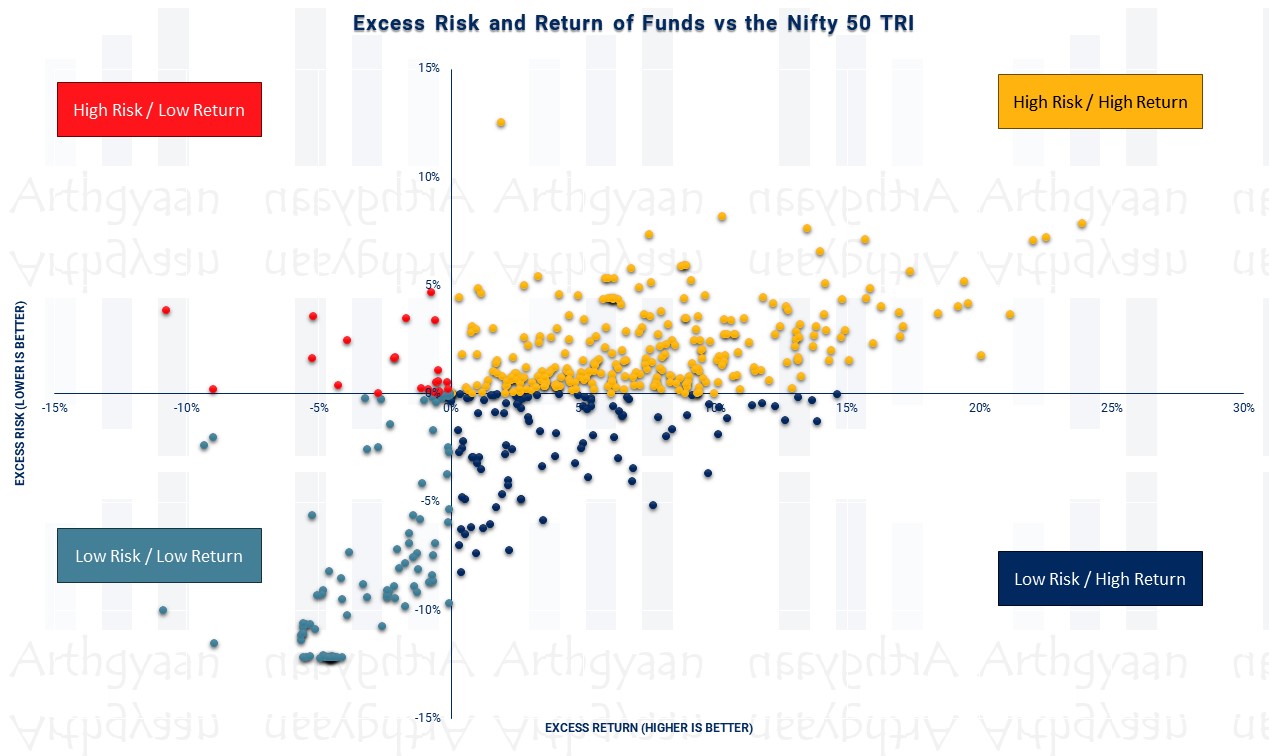

If we split the list of all equity mutual funds then we will end up with four categories:

Incidentally, users of the free Arthgyaan mutual fund portfolio review service will get the above chart created for all funds in their portfolio.

In this article, we will look at the latest list of equity mutual funds, including index funds tracking indices other than the Nifty 50, to check if they are in the best category of higher returns and lower risk.

In the analysis below, we have chosen equity and hybrid mutual funds with higher returns at lower risk using the last three years of market data from AMFI for the period ending 12-Dec-2025. The funds that have fallen the most from their 52-week high levels are presented first.

Note: This chart represents point-to-point data. The funds in the list will change over time as the future performance of any particular fund is random and cannot be predicted in advance.

| Fund | Change (%) | NAV (52w high) | Latest NAV |

|---|---|---|---|

| UTI India Consumer | 12.91 | 70.2329 | 61.1642 |

| Tata Ethical | 12.12 | 493.1378 | 433.3853 |

| Fund | Change (%) | NAV (52w high) | Latest NAV |

|---|---|---|---|

| Motilal Oswal Focused 25 | 14.33 | 59.9011 | 51.3187 |

| Fund | Change (%) | NAV (52w high) | Latest NAV |

|---|---|---|---|

| Samco Flexi Cap | 17.23 | 13.2300 | 10.9500 |

| Shriram Flexi Cap | 12.87 | 26.1322 | 22.7680 |

| Fund | Change (%) | NAV (52w high) | Latest NAV |

|---|---|---|---|

| Shriram ELSS Tax Saver | 12.42 | 27.0346 | 23.6777 |

| Fund | Change (%) | NAV (52w high) | Latest NAV |

|---|---|---|---|

| Mirae AssetHang Seng TECH ETF | 13.36 | 13.7100 | 11.8780 |

| Axis Multi Factor Passive FoF | 11.96 | 17.0468 | 15.0072 |

| Fund | Change (%) | NAV (52w high) | Latest NAV |

|---|---|---|---|

| ICICI Prudential Nifty IT Index | 21.48 | 15.8208 | 12.4223 |

There are three key takeaways from this data:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Top Mutual Funds with High Returns & Low Risk for Bottom Fishing first appeared on 26 Jan 2025 at https://arthgyaan.com