The 2021 Arthgyaan Year in Review

This blog completes its first year with 100+ posts in 10 months. Here’s looking back.

This blog completes its first year with 100+ posts in 10 months. Here’s looking back.

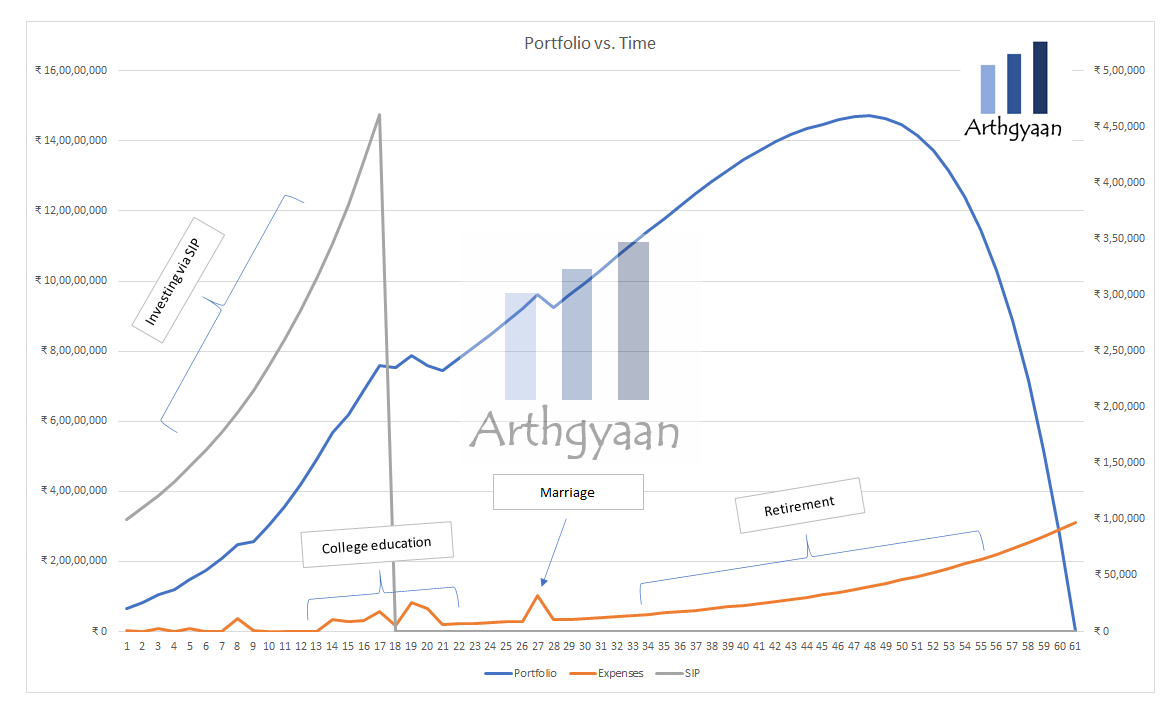

Arthgyaan was started in March 2021 to simplify goal-based investing and personal finance. The blog helps you create a system for reaching your financial goals by sharing simple, actionable advice backed by research and analysis. Our tag-line is “Supporting everyone’s personal finance journey”.

This blog is a single-person effort. You can find more details on the About page. Our readers are located worldwide.

You can start reading here: Start here.

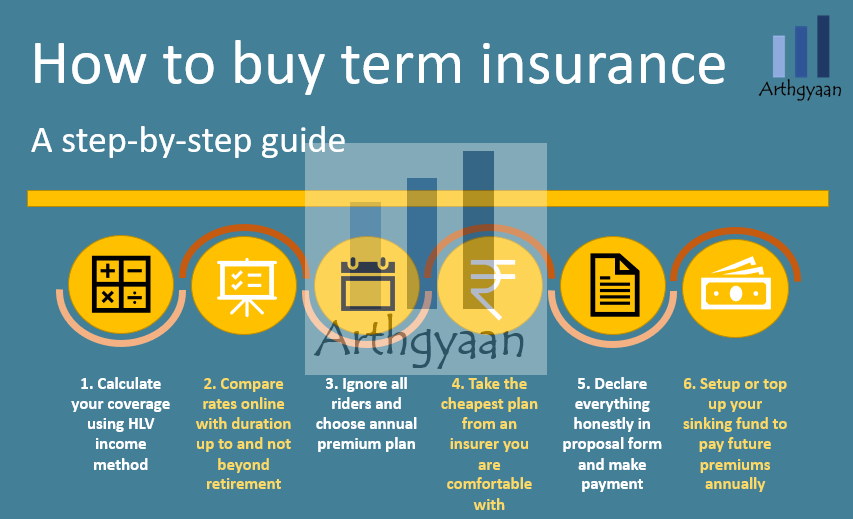

Over 10 months, more than 100 articles have been published that cover various topics. Some of the popular ones are:

These are the five most popular posts according to page views:

There are multiple popular and useful tools and calculators available:

2022 is expected to be a more significant year, focusing more on choosing investments, portfolio construction, and dealing with case studies from readers and questions. Here’s wishing you all happy holidays and a happy new year. 2022 will be great!

Now that 2022 is over, here is the next year in review: 2022 year in review.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled The 2021 Arthgyaan Year in Review first appeared on 29 Dec 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.