What are the rolling returns of SIP and lump sum of direct mutual funds? (July 2024 edition)

This article provides a list of fund and category-wise statistics of rolling return of SIP and lump sum investments for various mutual funds.

This article provides a list of fund and category-wise statistics of rolling return of SIP and lump sum investments for various mutual funds.

Rolling returns are all of the returns that the fund gave for a particular investment period. If, for example, we wish to understand how much returns the fund usually gave for a 10Y lump sum investment, we can list down in a table or chart returns like this:

and so on. This sequence of returns [X,Y,Z] is a time series like this:

| Ending date | Type | Return |

|---|---|---|

| 01-Jan-16 | 10Y lump sum | X% |

| 02-Jan-16 | 10Y lump sum | Y% |

| 03-Jan-16 | 10Y lump sum | Z% |

With this time-series, you can plot a graph, calculate metrics like average, max, min, median etc.

For example, we have calculated metrics like

The statistical terms used in this article are explained here: Which are the common statistical terms used in Investing?

In this article, we will show the rolling metrics of various mutual funds:

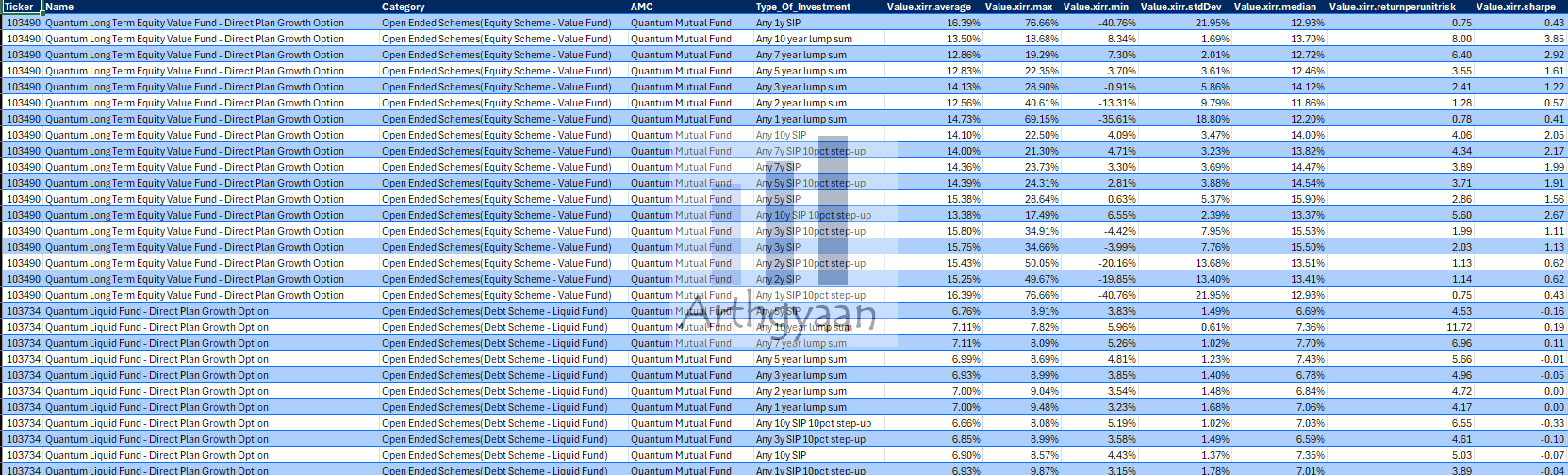

These are the column headers of in the file:

| Field | Meaning |

|---|---|

| Ticker | Fund id from www.amfiindia.com |

| Name | Name of fund |

| Category | AMFI category of the fund |

| AMC | AMC which runs the fund |

| Type_Of_Investment | Investment type |

| Value.xirr.average | Average of the XIRR numbers |

| Value.xirr.max | Max |

| Value.xirr.min | Min |

| Value.xirr.stdDev | Standard Deviation |

| Value.xirr.median | Median |

| Value.xirr.returnperunitrisk | Average/StdDev |

| Value.xirr.sharpe | Sharpe Ratio |

| bv | Investment amount |

| Value.mv.average | Average of the final pre-tax amount |

| Value.mv.max | Max |

| Value.mv.min | Min |

| Value.mv.stdDev | Standard Deviation |

| Value.mv.median | Median |

There are no charges for downloading this data. You can download the full data-set here

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the rolling returns of SIP and lump sum of direct mutual funds? (July 2024 edition) first appeared on 03 Jul 2024 at https://arthgyaan.com