How can grandparents invest for their grandchildren?

This article provides multiple options for grandparents to transfer family wealth to their grandchildren.

This article provides multiple options for grandparents to transfer family wealth to their grandchildren.

This article is a part of our detailed article series on the concept of building and transferring generational wealth. Ensure you have read the other parts here:

This article provides an alternative to the usual safe investments that retirees choose vs growing their wealth without taking market risk themselves.

This article explores using the NPS Vatsalya scheme for grandparents to transfer wealth to their grandchildren by gifting them a large corpus to be used to create a pension income stream.

This article discusses an alternative retirement portfolio construction method for generational wealth transfer.

There are multiple reasons, apart from love and affection, that justify investing for grandchildren:

Warning: Investment for family members should be made only when you have enough in your retirement portfolio to last your and your spouse’s expected lifetime.

We will now break these down and explain them in more detail.

Asset compartmentalization here refers to carving out a portion of their assets to be spent on a future date for a particular purpose. The benefit of this type of physical separation is that the investment can be then invested in high-risk investments, like equity mutual funds, and allowed to grow.

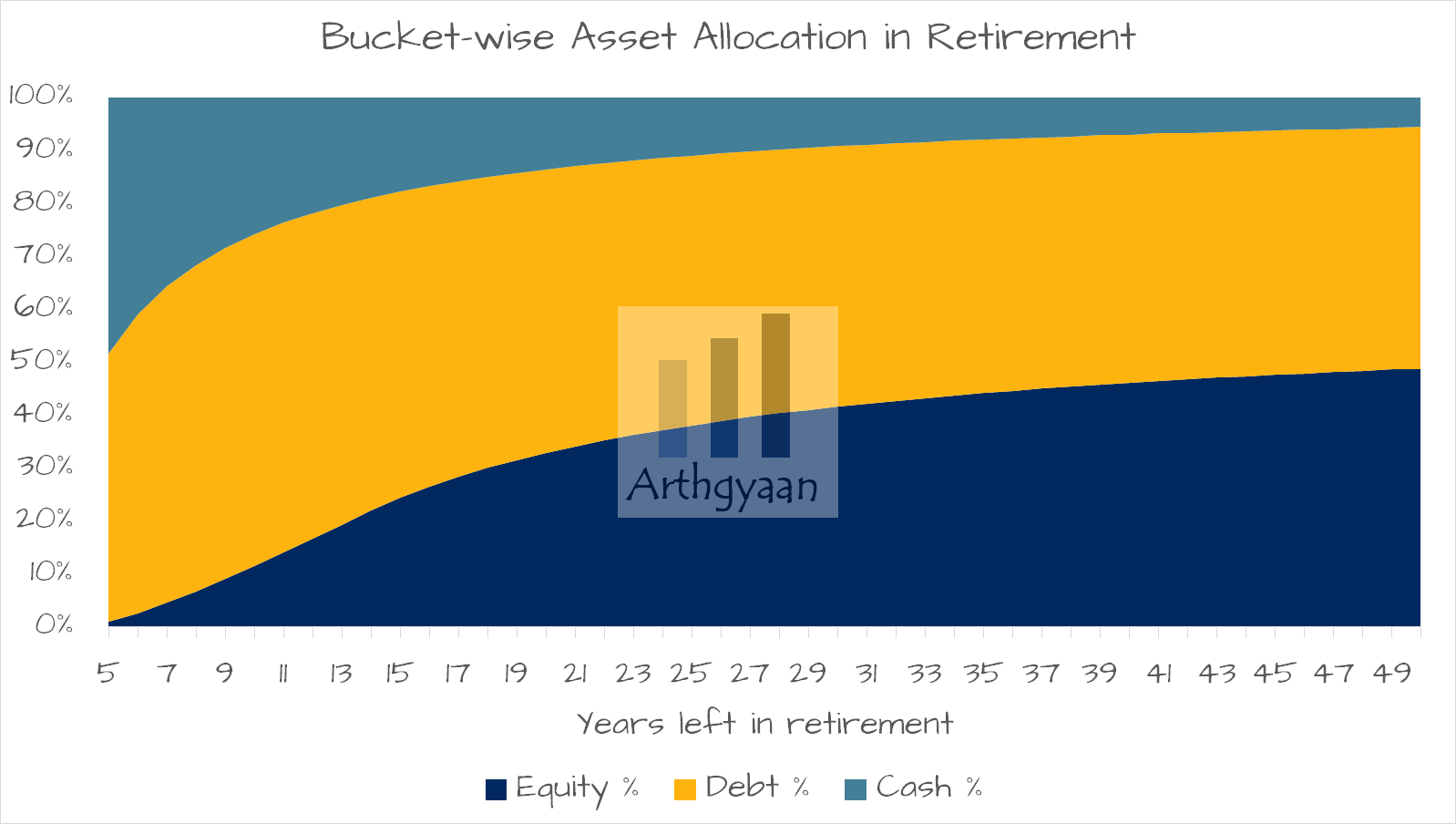

This slice of the portfolio, earmarked for the grandchildren, is now separate from the one used for day-to-day expenses which is likely to be more conservative as the chart above shows.

Generational wealth is how financial assets get transferred from one generation to the next. The alternative to creating generational wealth is that each generation starts its investment journey from scratch since the previous generation depleted all the corpus.

We have covered this concept before here: Building Generational Wealth through an Alternative Retirement Portfolio Planning Technique

By starting a separate investment for the grandchildren, by investing in inflation-beating assets, the grandparents are ensuring that their wealth gets transferred to the newest generation and gets used at the right time.

Grandchildren will be able to spend this corpus when:

Whatever the purpose, the grandparents here will have complete control over what the investment is to be used for and when.

Our main aim of investing is generally to grow the corpus at a suitable pace covering long-term inflation associated with the particular goal. For example, college education fees generally grow at 7-10% in India. If the college is abroad, the inflation in fees might be lower, but there is the impact of Rupee depreciation as well.

| Asset | Inflation | Ticker size | Regulations | Liquidity | Income | Taxation |

|---|---|---|---|---|---|---|

| Mutual funds | High | Low | High | High | SWP | Best |

| Shares | High | Low | High | High | Dividend | Best |

| Real estate | Low | Highest | None | Lowest | Rent | Medium |

| Gold | Medium | Low | Medium | High | None | Low |

| FD | Low | Low | High | High | Interest | Worst |

| Bonds | Low | Medium | Medium | Low | Coupon | Worst |

Overall, equity mutual funds, are a good investment option due to professional management, liquidity (you can take out the amount at any time) and inflation-beating characteristics. If you are uncomfortable with this asset class, consider taking professional guidance.

A case can be made about income-producing investments if the purpose is to pay college fees every semester or something equivalent. In such a case a government bond or SGB with regular 6-monthly coupon payment can be an option. The maturity value of that investment can be used for a lump sum goal like marriage or house purchase.

You can use this formula to calculate income from bond price and coupon rate:

Monthly income = 100 * Coupon * Investment / Price / 12 * (1 - TaxRate)

For example, if you buy a 2030, 7.28% coupon bond at a price of ₹105 by investing ₹50 lakhs then you get:

You can also get similar results from a portfolio of dividend-paying stocks: Understanding dividend investing: should you invest in stocks or mutual funds for dividend income?

There are two aspects here if you are thinking of investing a large amount in one go:

If you are confident that you can spare the amount by making a large one-time investment, then a lump sum investment makes the most sense.

An alternative case can be made if there is spare regular income (interest, rent, pension, dividend) etc. in the grandparent’s family that can be used to invest for the grandchild. A common investment option is regular investment in mutual funds (equity for the long term, hybrid for the medium term and debt for the short term).

A recurring deposit can be considered if the goal of the investment is due in the next few years.

You can even set up a gold-accumulation scheme via physical gold or SGB: What is the best way to accumulate gold for your child’s wedding?

Another popular option is investing in the Public Provident Fund (PPF) for both boys and girls and Sukanya Samridhhi Yojana (SSY) for only girls

To understand what is the best thing to do in these circumstances:

A demat-based mutual fund investment account is the best way of investing in mutual funds for grandchildren. We will explain how.

Continue investing in this account as per your wish and cash availability.

Before selling you have two options:

Related reading:

Investing for a grandchild where the amount will be used abroad has complexities around tax laws both abroad (e.g 529 plans in the US) as well as in India (LRS regulation for example - How the government has provided relief to travellers and international investors by tweaking the LRS and TCS rules from 1st Oct 2023?).

Also, there are additional complexities around holding PPF and SSY accounts for NRI children: How should NRIs handle investments and accounts in India before shifting?

In such cases, it is simplest to keep the investment in India in the name of the grandparent and explore the options when the money is to be used.

We are a big supporter of retaining control over investments until the point of usage. This stance takes care of issues if the recipient of the gifted corpus is either unable to manage the sum themselves or ends up spending it for any other purpose.

Investing this way allows you the flexibility to distribute the amount over time (e.g. college semester fees) or at one time (say house downpayment) while retaining control for using the amount only for the intended purpose.

An example will make this point clear.

You, as the grandparent, had accumulated 10 lakhs in the name of your son who is the father of your grandchild for college admission. When the child is 15, the family decides to spend that money on a trip to Disneyland.

Therefore all investments should be maintained in the name of the grandparent, either singly or jointly, with their child, i.e. the parent of the grandchild as the nominee. Nomination, ideally enforced via a will, ensures that once both grandparents are no more, the amount passes on to the parent of the grandchild.

There is no benefit to making the minor grandchild the nominee since their parents are anyway the legal guardian. If the grandchild is a major, they can be made the nominee directly.

There are two options at this point besides continuing the investment as is:

In every case, it is best from an income tax standpoint, to make a gift deed to record the gift.

Nominees are not legal heirs. To ensure that the investment passes to the correct recipient, a will must be created and this investment mentioned explicitly.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How can grandparents invest for their grandchildren? first appeared on 07 Jul 2024 at https://arthgyaan.com