SMART goals: how to create an emergency fund

An emergency fund is essential to protect yourself from unexpected problems where a lot of money needs to be spent. This article will show you how to create one step-by-step.

An emergency fund is essential to protect yourself from unexpected problems where a lot of money needs to be spent. This article will show you how to create one step-by-step.

We have covered why we need to set goals before investing in this post: Set a goal before looking for what to invest in.

This post uses the S.M.A.R.T framework to ensure that goals are set in the right way so that you can move on to the next steps of goal-based investing: I am now ready to do goal-based investing. What now?

The S.M.A.R.T framework has the following five components. We will discuss one by one:

If the goal is missing one or more of these attributes, you cannot invest for it meaningfully. In this post, we will apply the S.M.A.R.T framework to create an emergency fund.

You need a way to pay for expenses caused by an emergency. An emergency is defined as something that is unexpected, sudden and can cause a lot of money to be spent like:

An emergency fund prevents the requirement of new debt: both personal loans and worse credit cards have extremely high interest rates. If you already have loans, having an emergency will severely strain the monthly budget. People who earn and save well sometimes take their good fortune for granted and ignore having an adequate emergency fund. It is one of the axioms of personal finance?.

What is NOT an emergency:

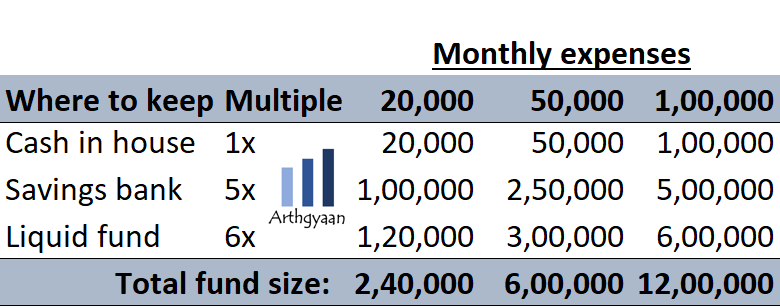

The size of the emergency fund is measured as multiples of monthly expenses like

The fund does not include discretionary items like entertainment, subscriptions and eating out.

There are three schools of thought on the size of the fund in multiples of monthly mandatory expenses and EMI:

If you are saving 6-12x home loan EMI as a part of your emergency fund, explore if an overdraft scheme, like SBI Maxgain, will be beneficial.

An emergency fund lets you sleep well at night.

This is like wearing a helmet or seatbelts. You will not need it every day but on the day it is needed, you will be extremely glad that you have that protection.

Emergency fund estimation varies between people:

If you specific guidance on paying off loans or budgeting with irregular income, refer to these resources:

monthly surplus = income in hand - mandatory expenses

You should aggressively start saving most of the surplus to build up the emergency fund until at least 3x is saved. Do not invest in long-term (>5 years) goals until at least 6x is saved.

Divert all bonuses, gifts etc., into building your emergency fund until you reach at least 6x. If your spouse does not have any income, please consider a slightly higher allocation to your emergency fund.

You can consider a psychological hack keeping one year of children’s school fees in a separate bank account as FD. This FD will give you peace of mind that your children’s schooling will not be interrupted due to any emergency.

There is no absolute time limit to creating your emergency fund. However, given the concept and purpose, the priority, once you start earning money, will be to reach the 3x expenses value as early as possible preferably within 6 months.

When an emergency fund is:

| Question | Answer |

|---|---|

| Specific: Why do you need the money? | To act as a cushion in case of emergencies |

| Measurable: How much money do you need? | 6 times mandatory expenses and EMI |

| Achievable: Can you do it? Do you need help? | Target 3 times expenses in 6 months, 6x in a year |

| Realistic: Can you reach this target based on where you are? | All investible surplus must be diverted for creating this fund |

| Time-bound: When do you need the money? Is the timing flexible? | Flexble but should be completed at the earliest |

We repeat our previous guide on where to keep your emergency fund below:

The emergency fund needs to be liquid, i.e. immediately available. Apart from household cash, bank accounts offer the next best place, followed by liquid mutual funds. Do not chase returns here and lock up this money in a way it is not available.

For banks, you can go with large banks like SBI, HDFC or ICICI (due to their SIFI status) and look for banks that offer sweep FDs. If your bank does not provide sweep FD, it is okay - keep some money in a savings account and some in FD. Make this a joint account with all adult family members and have multiple debit cards. At all times, look for good ATM coverage for your bank and have Netbanking via apps set up on your phone. Avoid banks that have been in the news lately for issues with their operations or have a recurring history of trouble.

After choosing a bank account, liquid mutual funds can be used (choose those liquid MF which invest in 91day T-Bills and cash only). If you cannot determine which funds have this feature, please stick to banks.

A high-limit credit card can be used as a part of an emergency fund if you have the money to pay it off and use it in an emergency. However, sometimes hospitals or medical stores may not accept credit cards, so this should not be your first choice.

Do not keep family gold, stock/equity MF etc., as an emergency fund - these are not liquid and can lead to losses if sold in a down market. These are for long-term emergencies like medical treatment etc., where everything needs to be spent.

Many people choose housing loans or overdraft accounts like SBI Maxgain etc., for an emergency fund. However, please don’t do this since the lender may change withdrawal terms, or it is difficult to take out the money in an emergency. Only the EMI part of the fund should be stored here.

Ultimately it would help if you wished that you never have to use your emergency fund but will be relieved to know it is there.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled SMART goals: how to create an emergency fund first appeared on 05 Oct 2022 at https://arthgyaan.com